Exness is a Forex and CFD broker offering CFDs on forex, precious metals, energies, indices, stocks and cryptocurrencies for both individual and institutional traders.

Exness was founded in 2008 and regulated in Kenya and have a local branch office in Nairobi. As a regulated Forex broker, Exness is authorised by Multiple Top-Tier Financial Regulators to provide services for trading Forex & CFDs on financial instruments. Their website provides access to real-time charts for all instruments.

In this Exness Kenya review, we have looked at what you should know about Exness account types, platforms, deposit and withdrawal, customer service, execution policies, and regulations.

| Exness Review Summary | |

|---|---|

| 🏢 Broker Name | Tadenex Limited |

| 📅 Establishment Date | 2008 |

| 🌐 Website | www.exness.ke |

| 🏢 Address | Tadenex Limited, Courtyard, 2nd Floor, General Mathenge Road, Westlands, Nairobi |

| 🏦 Minimum Deposit | $10 |

| ⚙️ Maximum Leverage | 1:2,000 |

| 📋 Regulation | CMA, FCA, CySEC, FSCA, FSC |

| 💻 Trading Platforms | MT4 & MT5 for PC, Mac, Web, Android, iOS and Exness Trader for Web, iOS and Android |

| Start Trading with Exness | |

Exness Pros

- Regulated by the CMA

- Offers commission-free trading

- Has KES account currency

- Accepts deposits/withdrawals to Kenyan banks

- Has negative balance protection

- No inactive account fees

- Available on multiple trading platforms

- 24/7 live chat support

Exness Cons

- Slow email support

- Limited payment methods

Is Exness Safe in Kenya?

Exness is considered a safe broker in Kenya. This is because this broker is regulated by the Capital Market Authority of Kenya, and is also regulated by other top tier regulatory bodies in other jurisdictions.

Here are the regulation of Exness:

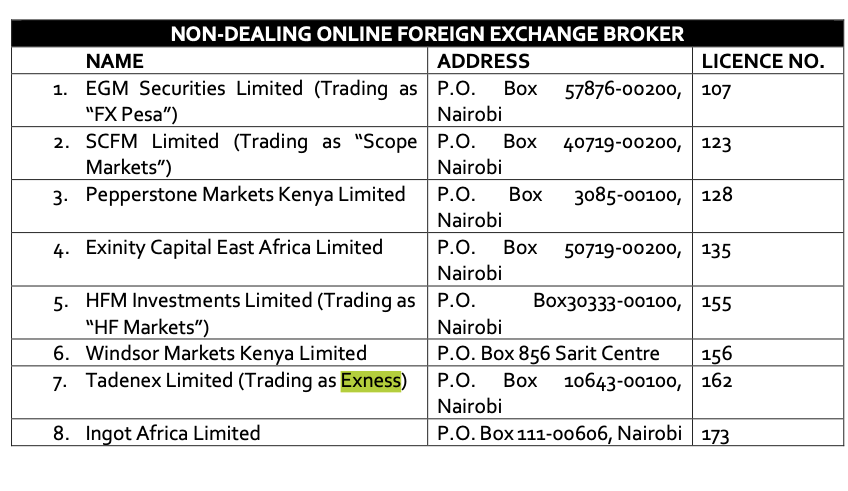

1) Capital Markets Authority (CMA), Kenya: Exness is licensed under by CMA as Tadenex Limited with the license number 162 as a non-dealing online foreign exchange broker.

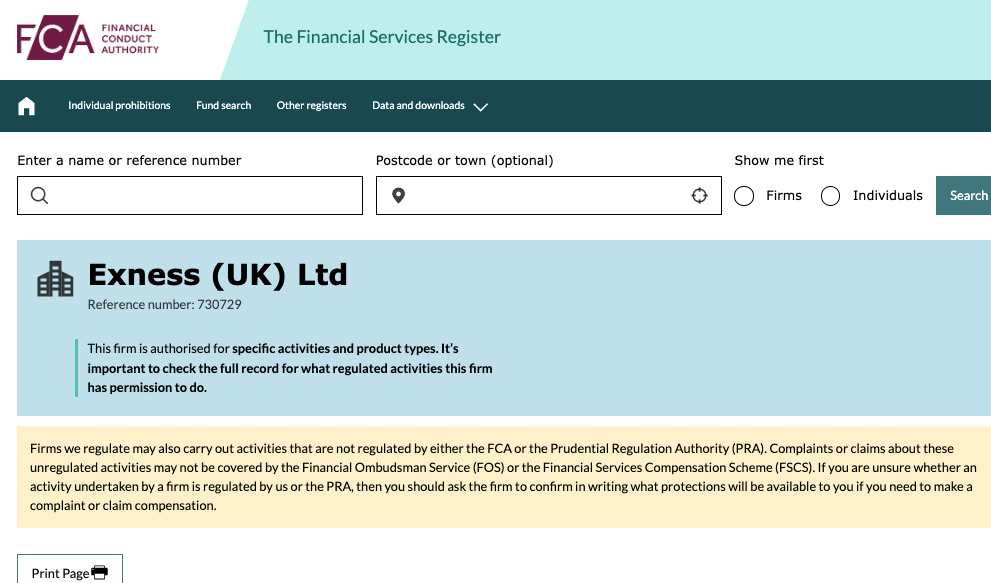

2) Financial Conduct Authority (FCA), United Kingdom: Exness is licensed by FCA, a Tier 1 regulator, in the United Kingdom of Great Britain (UK) as Exness (UK) Ltd, which is registered as an Investment firm with Financial Services Register number 730729. The Exness UK website is www.exness.uk.

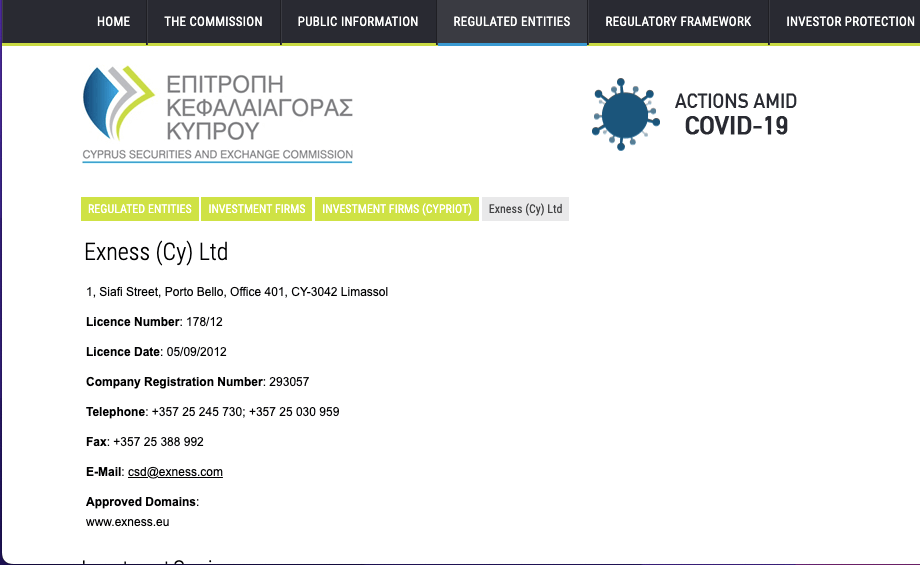

3) Cyprus Securities and Exchange Commission (CySEC): Exness is authorised by CySEC, a Tier 2 regulator, in Cyprus as an Investment Firm with license number 178/12. Registered as Exness (Cy) Ltd, and their website of operations is www.exness.eu.

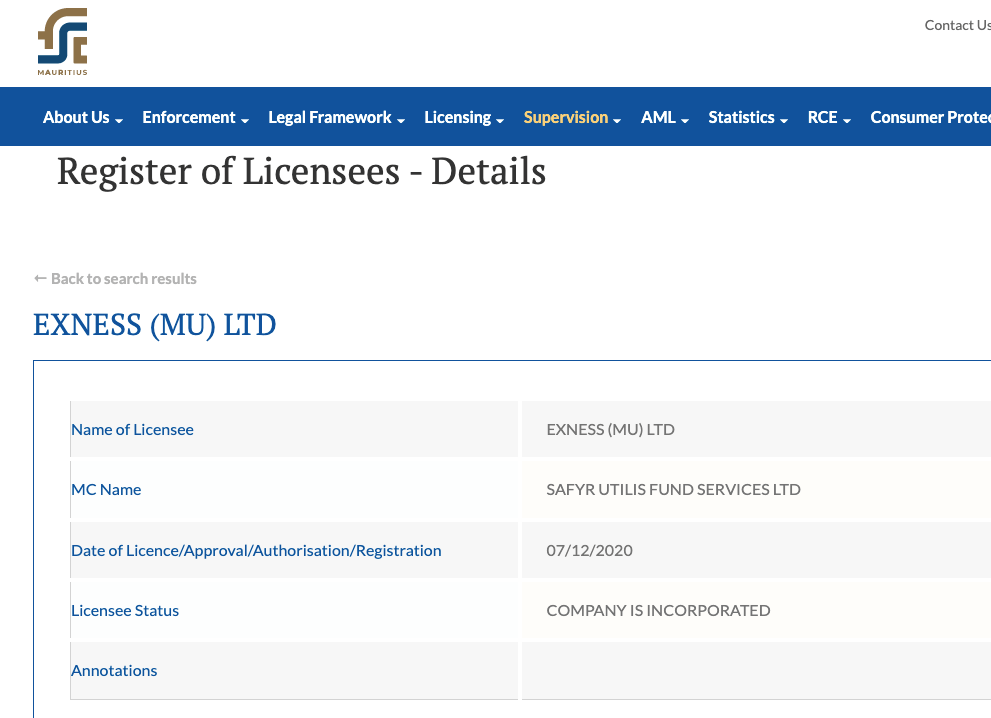

4) Financial Services Commission (FSC), Mauritius: Exness is regulated by FSC in Mauritius as Exness (MU) Ltd, an investment dealer.

Exness Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Kenya | Ksh 50,000 | Capital Markets Authority | Tadenex Limited |

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | Exness (UK) Ltd |

| Cyprus (EU) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Exness (Cy) Ltd |

| Other countries | No Protection | Financial Services Commission (FSC), Mauritius | Exness (MU) Ltd |

Exness Leverage

Exness leverage depends on the instrument you are trading the trade size. The maximum leverage on Exness Kenya is 1:400. This means that you can open a trade position worth 400 times or more than your deposit.

For example, with a deposit of Ksh1,000, you can open a trade position worth Ksh400,000. Depending on your risk appetite and the amount of leverage you want to use, higher leverage means that the chances of loss are higher too.

However, some instruments have preset leverage, which is fixed and you cannot change it. The maximum leverage of 1:400 applies to forex majors, other instruments have lower leverage limits.

Note: All instruments on Exness trade at a maximum leverage of 1:200 during weekends and holidays.

Exness Account Types

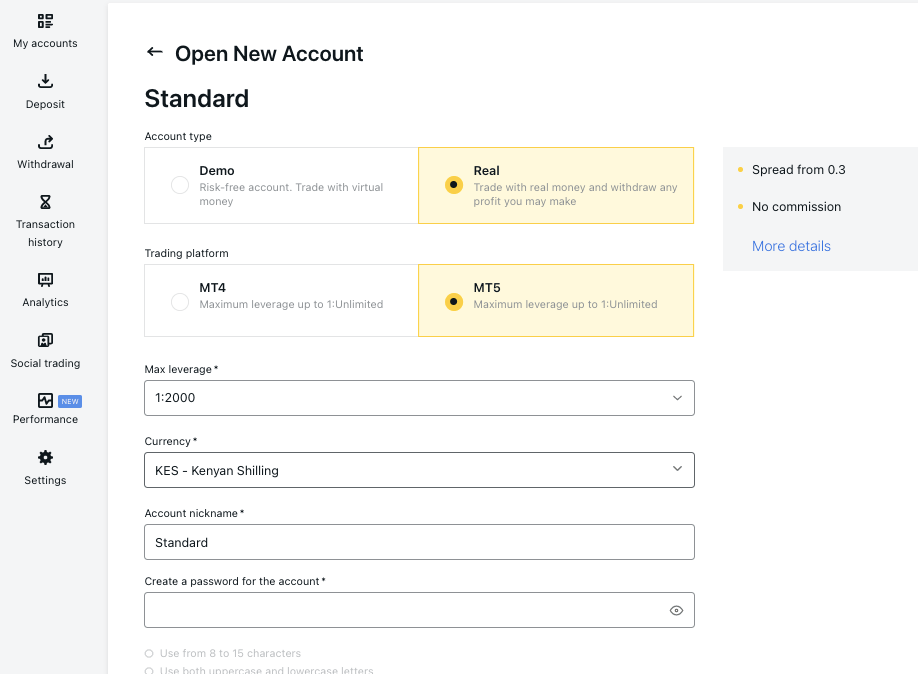

Exness trading account types are categorised into 2; Standard and Professional Accounts, accessible with the MT4, MT5, and Exness Trader trading applications.

Your account type on Exness determines the tradeable instruments available to you and the fees you will pay. Both the Standard and Professional Accounts have sub-categories of accounts. Details of the different account types offered by Exness are described below:

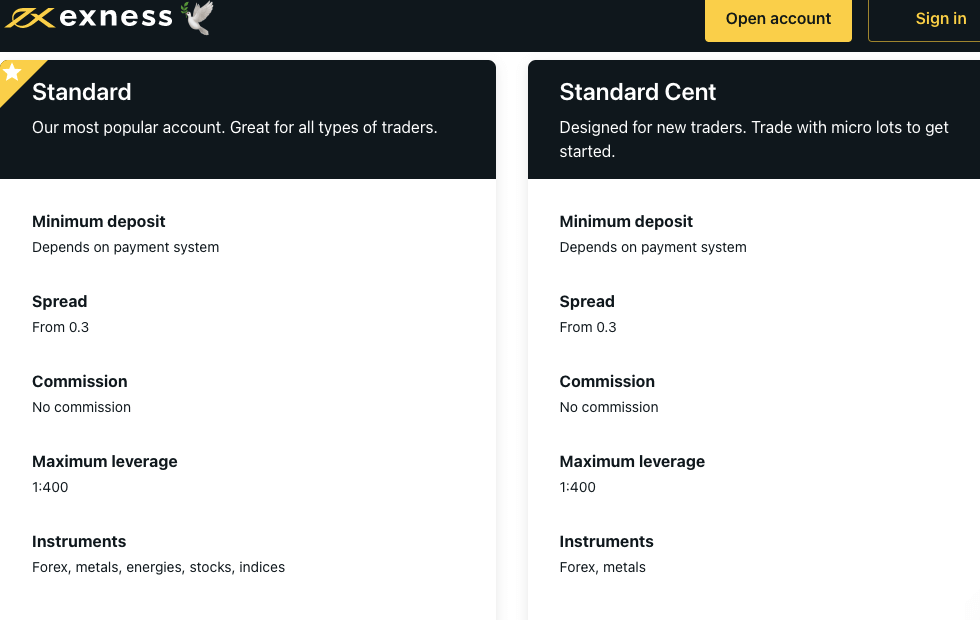

Exness Standard Accounts

Exness offers 2 Standard Account types, the Standard Account and Standard Cent account.

1) Standard Account: This account type is designed for all types of traders, and the tradeable instruments on Standard Accounts are Forex, metals, energies, stocks, indices, and cryptocurrencies, accessible on the MT5 platform.

There are no commission charges with this account, spreads start at 1 pip for majors like EURUSD, and you pay swap fees whenever you keep a trade position open past the market closing time.

You can trade maximum leverage of 1:400, a maximum lot size of 200 and a minimum lot size of 0.01. The minimum deposit on this type of account is $10.

This account has negative balance protection which means you cannot lose more than the money deposited. If you suffer a loss on a trade position and your account balance goes negative, the negative balance will be reset to zero.

2) Standard Cent Account: The Exness Standard Cent Account is a subcategory of the Exness Standard Account, designed to suit new traders. This account allows you to trade only Forex and metals and is accessible only on the MT4 platform.

Standard Cent Account is also commission-free, spreads start at 1 pip for majors like EURUSD, and you pay swap fees if your open trade rolls over to the next trading day before you close it.

The account has maximum leverage of 1:400. The minimum trade lot size is 0.01 and the maximum is 200 with 1,000 maximum open orders.

The required minimum deposit is $10 and the account also has negative balance protection.

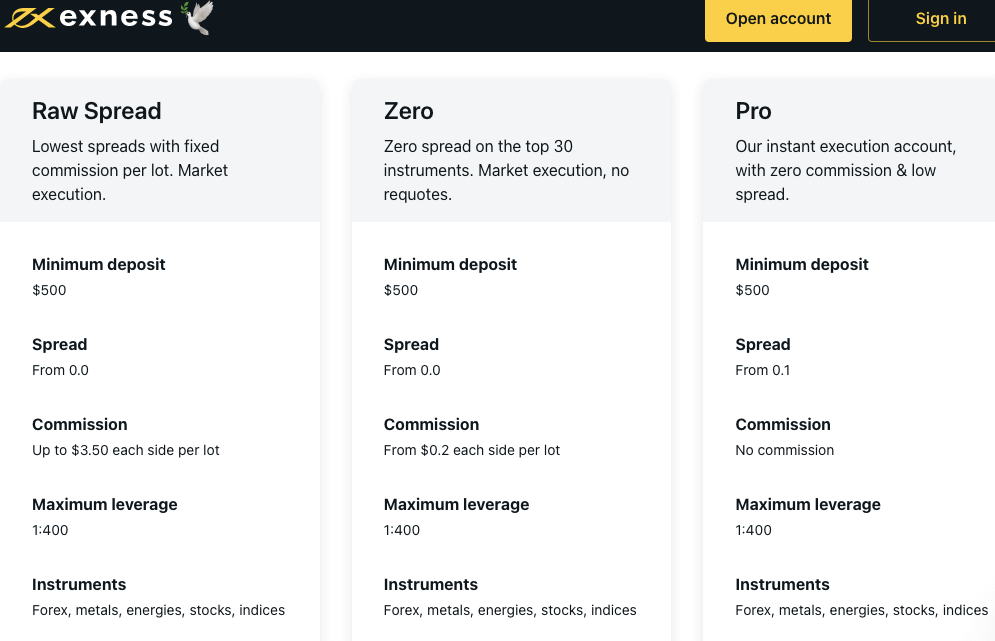

Exness Professional Accounts

The Exness Professional Accounts are designed for experienced traders, this account type has 3 subcategories. The features of Exness Professional Account types are shown below:

3) Raw Spread Account: The Exness Raw Spread Account can be accessed on all trading platforms. Tradeable instruments on this account are Forex, cryptoсurrencies, energies, metals, stocks, and indices.

Spreads start at 0.0, and commission charges are about $3.5 per side lot (which makes it $7 for a round turn) for major pairs like EURUSD. You also pay swap fees for overnight positions.

The account features maximum leverage of 1:400, and an unlimited number of open positions, with minimum and maximum lot sizes of 0.01 and 200 respectively and requires a minimum deposit of $500.

This account also has negative balance protection on Exness.

4) Zero Account: The Exness Zero Account can be accessed on all trading platforms and features zero spreads for the 30 major instruments. Tradeable instruments on this account are Forex, cryptoсurrencies, energies, metals, stocks, and indices.

Commission charges on Exness Zero Account are from $0.2 per side lot and up to $3.5 per side ($7 per round turn) for major pairs like EURUSD. Spreads start from 0.0 pips, and you pay swap fees for keeping a position open past the market closing time.

The maximum leverage on this account is 1:400 and no limit to the number of open orders. You need to trade a minimum lot size of 0.01 lot and a maximum of 200, with a minimum deposit of $500 and you have negative balance protection as well.

5) Pro Account: The Exness Pro Account can also be accessed on all trading platforms. Tradeable instruments on this account are Forex, cryptoсurrencies, energies, metals, stocks, and indices.

This is a spreads-only account, with no commission charges for opening or closing trade positions. Spreads start from 0.1 pips for major and you will be charged overnight funding costs if you keep a trade position open overnight into a new trading day.

The maximum lot size is 200 with a minimum of 0.1, with maximum leverage of 1:400 and a required minimum deposit from traders of $500.

This account offers unlimited open positions and negative balance protection.

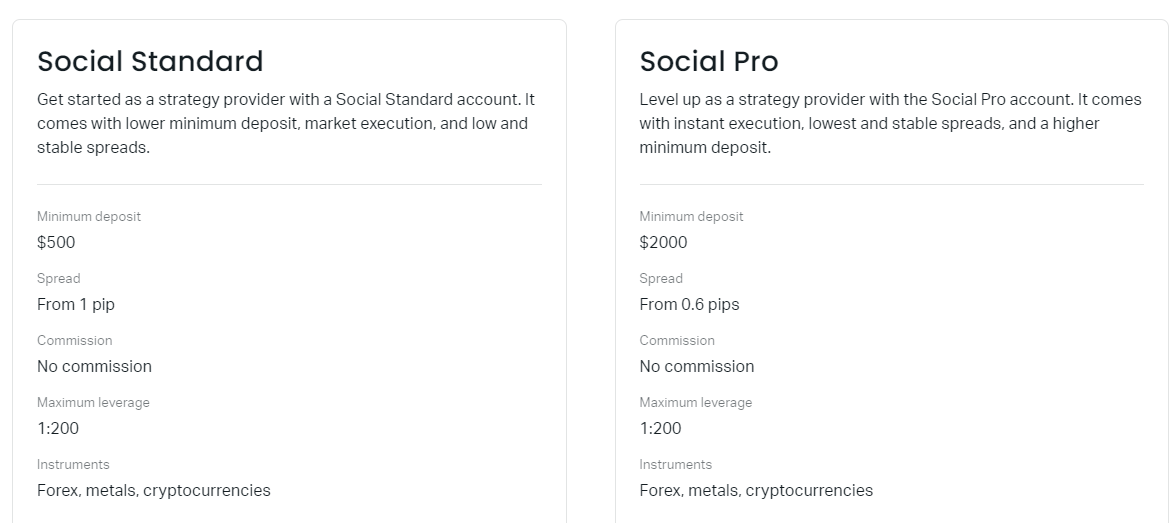

Exness Social Trading Accounts

Exness supports two social trading accounts. Thus trading account is useful if you want to share your trading strategies on Exness social trading app.

6) Social Standard Account: This account has a $500 minimum deposit with spreads beginning from 1 pip. Forex, metals, and cryptocurrencies are the instruments offered.

7) Social Pro Account: The Social Pro Account has the same conditions as the Social Standard. However, the minimum deposit is higher at $2000 with spreads starting from 0.6 pips.

Exness charge no commission on their social trading accounts

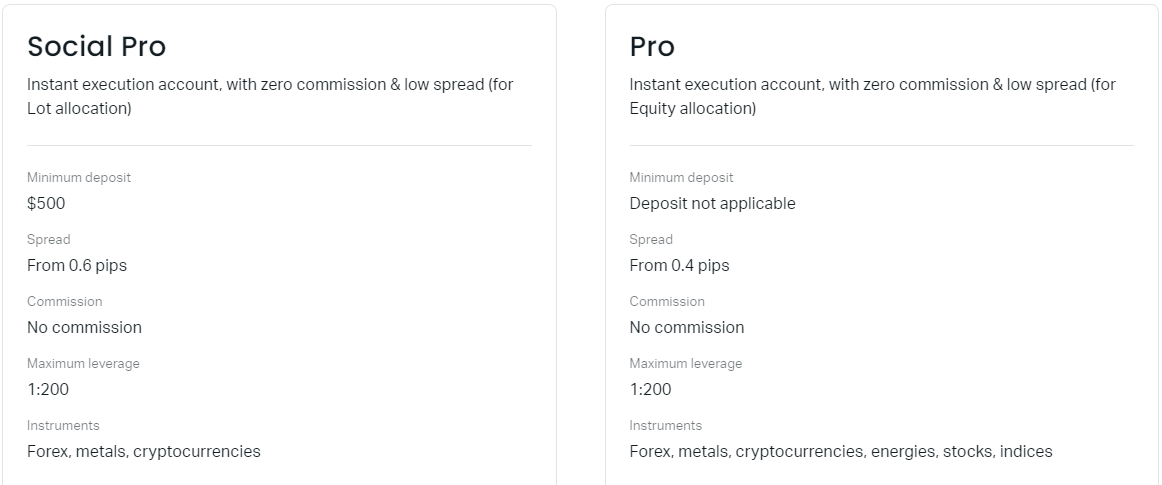

Exness Portfolio Management Accounts

Exness has a portfolio management feature. You can use either of the two accounts below to manage the funds in this feature.

8) Social Pro Account: You need $500 to open this account. The spreads begin from 0.6 pips with no commission charged. Forex metals, and cryptos are the only CFDs available.

9) Pro Account: The Pro account for portfolio managers have no minimum deposit. Spreads are lower, beginning from 0.4 pips and zero commission. The CFDs market is deeper with forex, metals, cryptoсurrencies, energies, stocks, and indices on offer.

Note: Though Exness offers Social and Portfolio Management Accounts, these accounts are not available in Kenya at the time of this writing. You cannot open them in Kenya.

10) Swap-free Account: Exness offers Interest-free Islamic Accounts to Muslim traders for all account types. With this account, you do not pay any swap fees for keeping a trade position open overnight.

If you want a swap-free Islamic Account on Exness, first open a standard or professional account, then contact customer support to change the status of your account to Islamic Account.

Note that for countries that have Islam as the predominant religion, swap-free status is applied automatically.

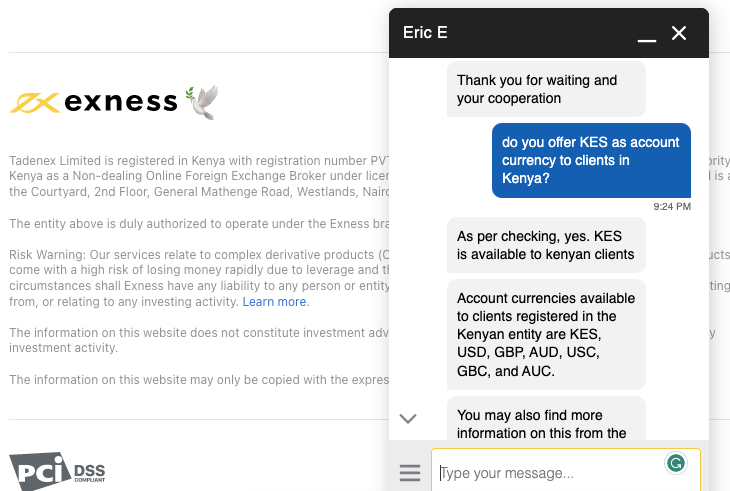

Exness Base Account Currency

Exness supports many base account currencies, depending on the account type. The Standard Cent account has the lowest number of supported currencies.

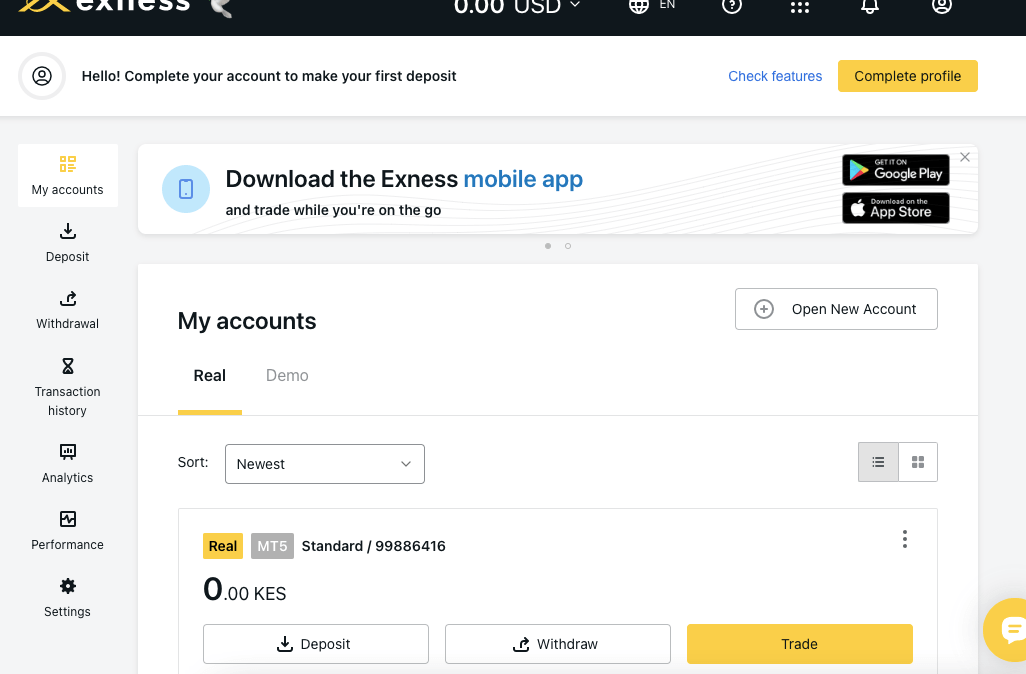

Exness has KES (Kenyan Shilling) as account base currency for all account types except the Standard Cent Account. Kenyan traders can open Exness KES accounts, make deposits in KES, and withdraw in KES to their Kenyan bank cards or MPesa.

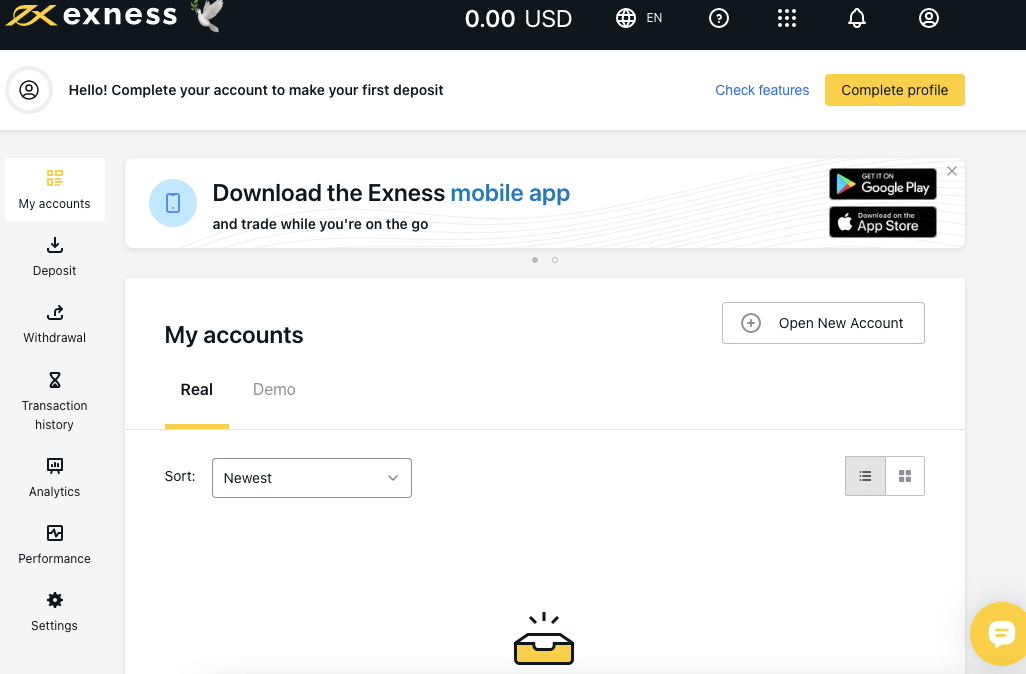

It is important to note that when you first open an Exness account, you are assigned a general account that has United States Dollar (USD) as base account currency, you will have to click on ‘Create New Account’ on your dashboard, to open a specific type of standard or Professional Account, and then select KES as your base currency. See a screenshot of this below:

Exness Overall Fees

Fees on Exness depend on the account type, although there are some general fee rules. Details of the trading and non-trading of Exness are shown below:

Trading fees

1) Spreads: Typical spread starts from 0.0 pips for the Professional Account types and 0.3 for the Standard Account types. The typical average spread for majors like EURUSD on the Standard Account is 1 pip. Note that the spreads on Exness are dependent on the account type of the trader and the instrument you are trading.

Find the average spreads for majors on Exness on the table below:

2) Commission fees: Most account types on Exness charge no commission on trades. Only the Professional Account (Raw Spread and Zero) have commission charges starting from $0.2 and up to $3.50 for each side lot for major pairs like EURUSD, which makes it $0.4 to $7 for a round turn. Other pairs have higher commissions on the Zero Account while Raw Spread has a fixed commission per side lot of $3.50.

Commission fees are charged whenever you open and close a trade position with the Raw Spread and Zero Accounts.

Exness Trading fees Table

Here is a summary of the average fees Exness charges on some instruments:

| CFD instrument | Spread (Standard Account) | Commission (Zero Account) |

|---|---|---|

| EUR/USD | 1 pip | $3.5 per lot |

| GBP/USD | 1.2 pips | $4.5 per lot |

| EUR/GBP | 1.6 pips | $9 per lot |

| XAU/USD (Gold) | 20 pips | $8 per lot |

| Crude oil | $0.03 over market | $3.5 per lot |

| UK100 | 57.8 pips | $1.25 per lot |

| SPX500 | 16.5 pips | $0.5 per lot |

3) Swap fees: Anytime you keep a trade position open past the closing time of the market closing time (10 PM GMT +0), you are charged swap fees which are added to your profit or loss at the time you close the trade.

The swap fee is calculated based on the size of the instrument you are trading, the spread, the number of days you keep the position open, and whether your position is a long swap (buy) or short swap (sell).

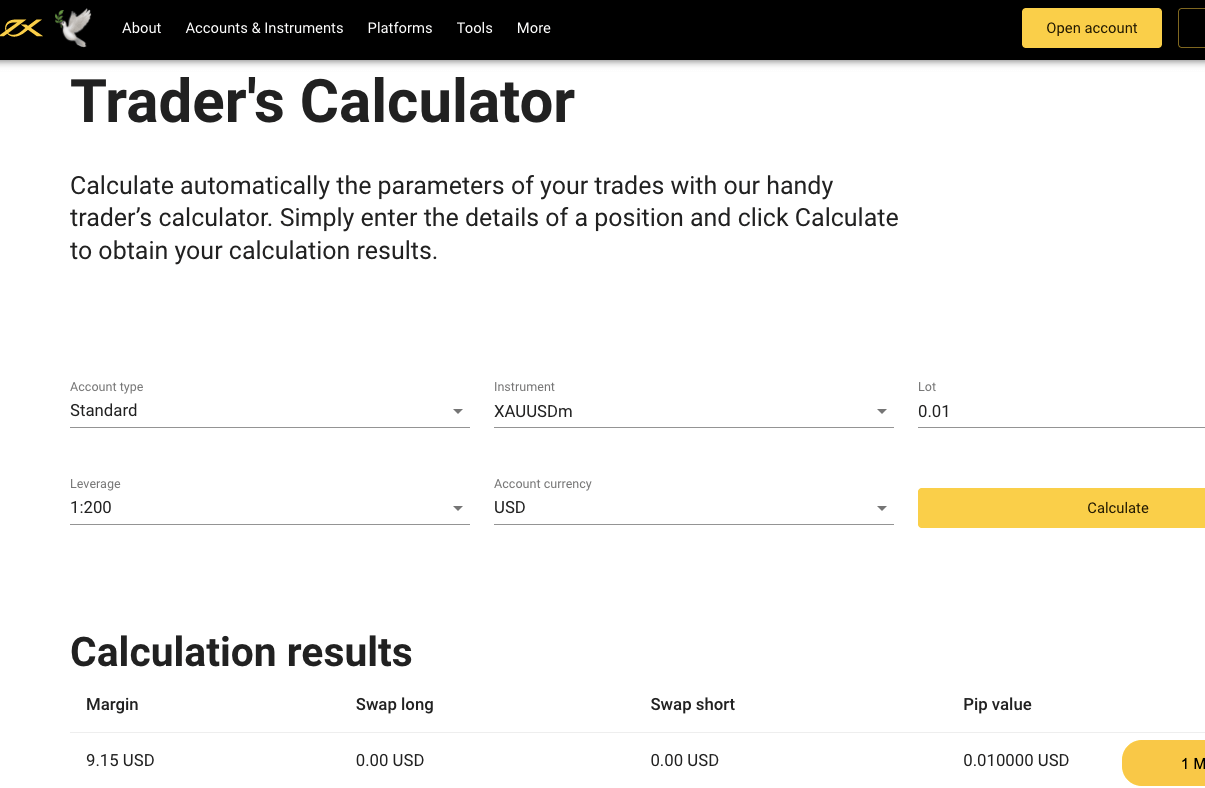

If your position is a buy (long swap), you may get interests added to your profit instead of a fee. You can estimate the fees you will pay by using the calculator on the Exness website.

Note that Islamic Accounts do not pay swap fees, and some instruments like cryptocurrencies, stocks, indices, and XAUUSD (Gold) are not charged swap fees for all account types.

Non-trading fees

1) Deposit and Withdrawal fees: Exness charges zero deposit fees and zero fees for withdrawals from the platform. This applies to all account types. Exness also covers any third part fees by your payment processor, with the exception of cryptocurrency miners’ fees or deposits via Perfect Money and Skrill.

2) Account Inactivity charges: No inactivity fees are charged on Exness accounts that have been inactive or dormant for any period of time.

Exness Non-trading fees

| Fee | Amount |

|---|---|

| Inactivity fee | None |

| Deposit fee | Free* |

| Withdrawal fee | Free* |

*Note that your payment processing company may charge some independent transaction fee.

How to Open Exness Account in Kenya

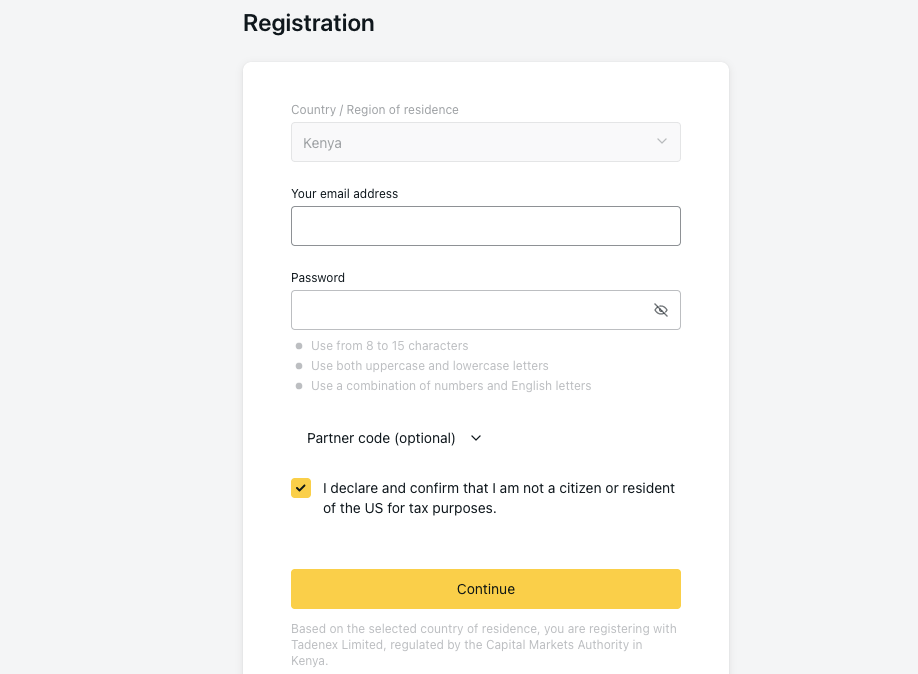

To start trading on the Exness platform, you need to open a live account. Follow these steps to open an account on Exness:

Step 1) Go to the Exness website home page at www.exness.ke and click on the ‘Open Account’ button, highlighted at the middle of the page or the golden colour button at the top right side of the home page.

Step 2) Fill in your email address and create a password for your account, check the box below the form fields to confirm you are not a US citizen or resident, then click ‘Continue’ to proceed.

Step 3) You will be redirected to your dashboard/personal area page. Click on ‘Complete’ to proceed.

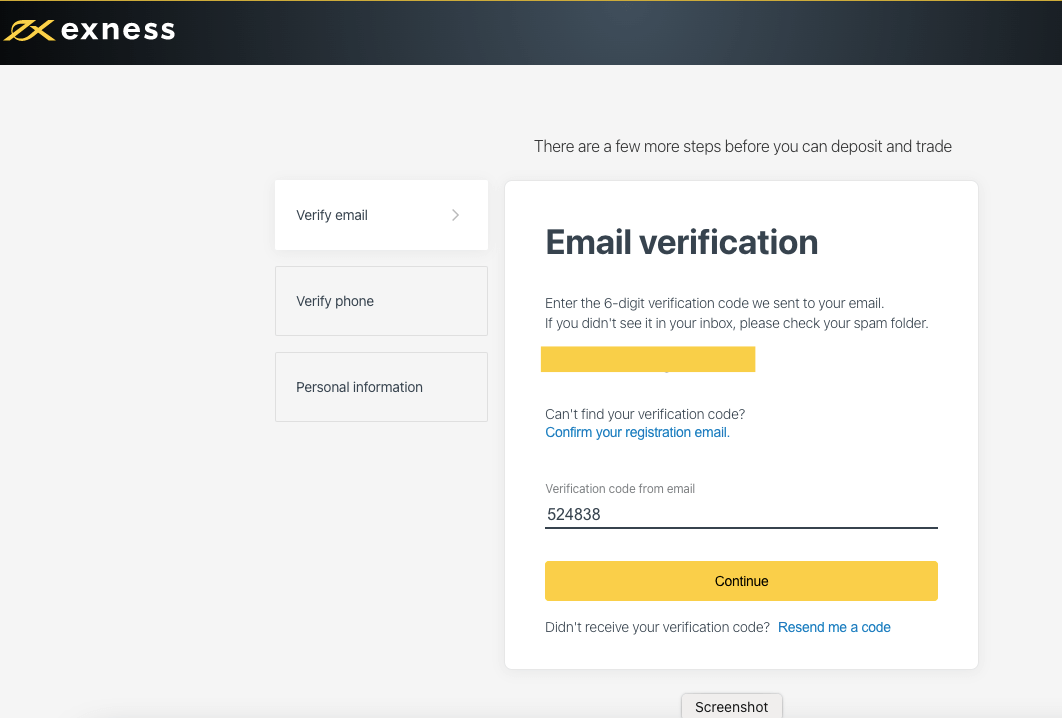

Step 4) Verify your email address and phone number, click on send me code, type the code in the field provided, and click on ‘Continue’ to proceed.

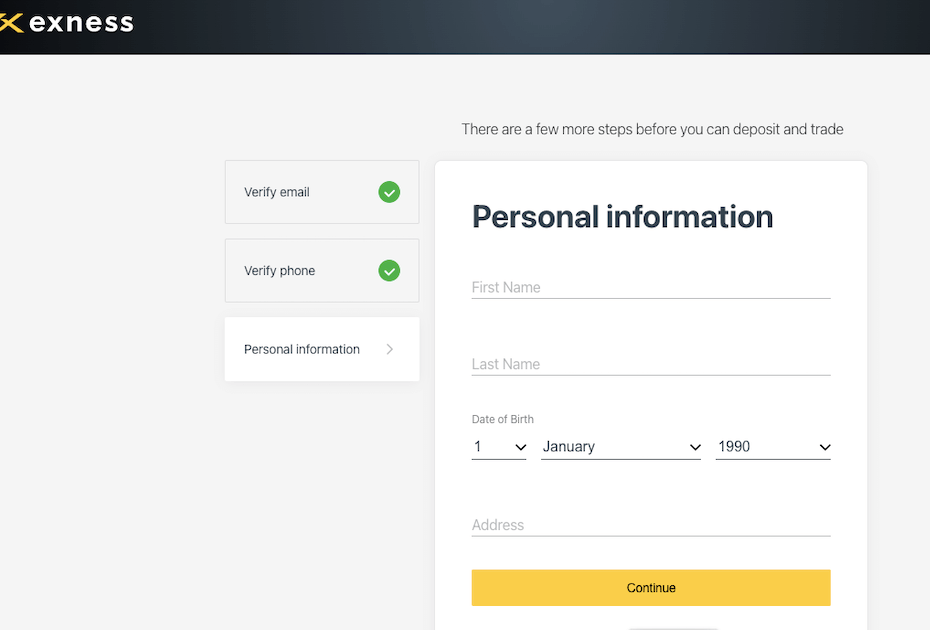

Step 5) Provide personal information like name, date of birth, and address, then click continue to complete your registration.

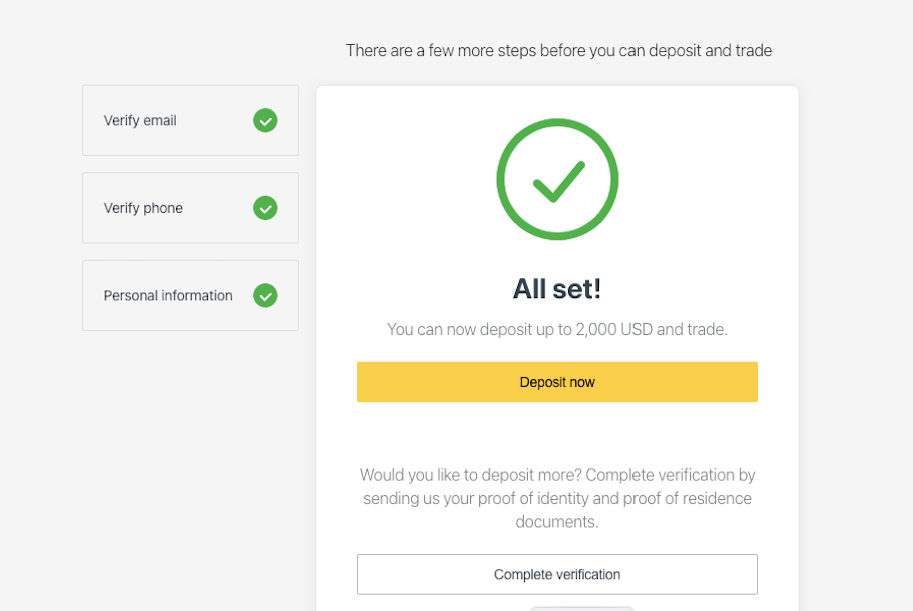

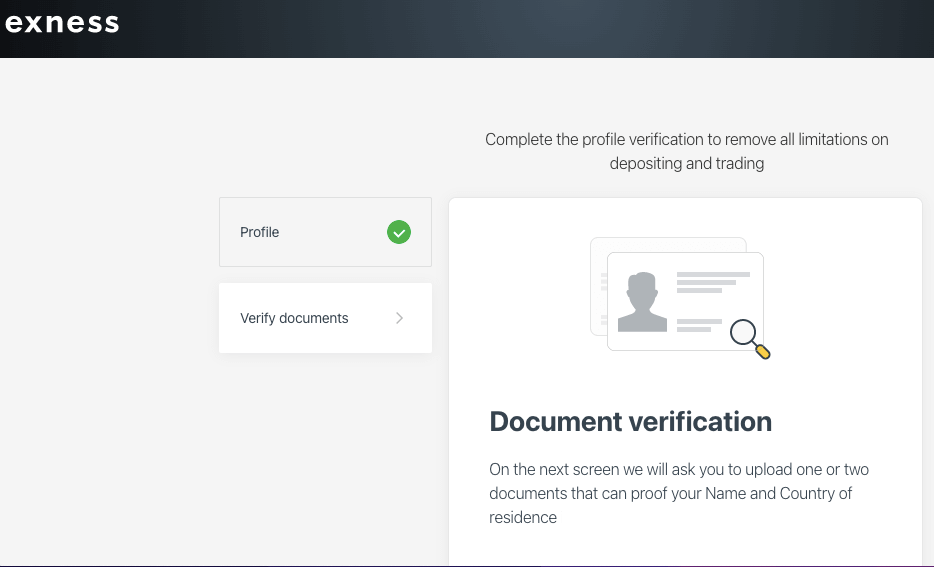

Step 6) After the registration is complete, you can choose to make a deposit immediately, this will take you to your Exness personal area or you can choose to complete verification by uploading some identity documents.

If you proceed to deposit without completing verification, you have a maximum deposit limit of $2,000. You need to verify your identity to access the full features of the platform.

Exness Deposits & Withdrawals

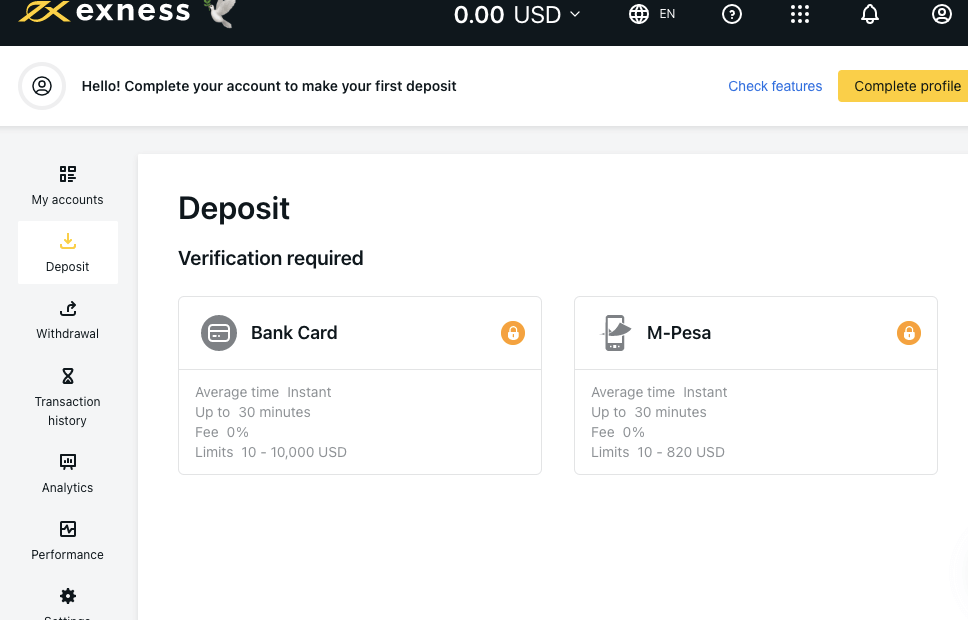

Payment methods supported by Exness for deposits and withdrawals are bank transfers and cards. Here is the summary of the deposits and withdrawal options on Exness in Kenya.

Exness Deposit Methods

Here is a summary of payment methods accepted by Exness for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Cards (KES) | Yes | Free | Within 30 minutes |

| E-wallet | Yes (MPesa) | Free | within 30 minutes |

Exness Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on Exness.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Cards (KES) | Yes | Free | Within 24 hours |

| E-wallets | Yes (MPesa) | Free | Within 24 hours |

What is the minimum deposit for Exness?

The minimum deposit on Exness is $10 for MPesa and Kenyan bank cards.

How do I Deposit Funds?

Follow the steps below to deposit funds into your Exness Account:

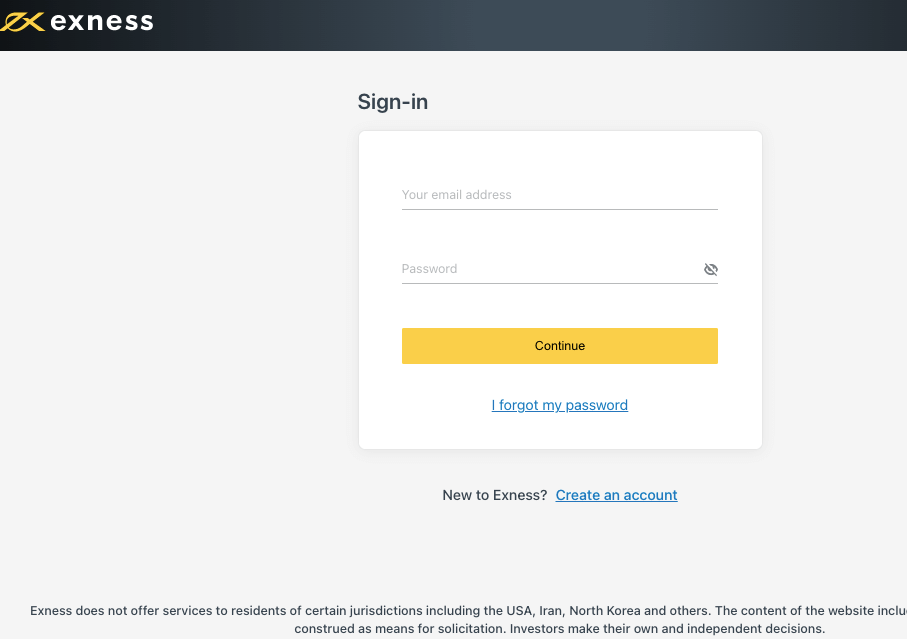

Step 1) Log in to your Exness Personal Area by visiting www.exness.com and clicking ‘Sign In’ on the top right side to log in or go to my.exness.ke/accounts/sign.

Step 2) Once you’re logged into your personal area (dashboard), click on ‘Deposit’, and select your preferred payment method.

Step 3) Next, select your preferred payment method, then follow the on-screen instructions to complete your deposit.

What is Exness Minimum withdrawal?

The minimum withdrawal amount on Exness is $10.

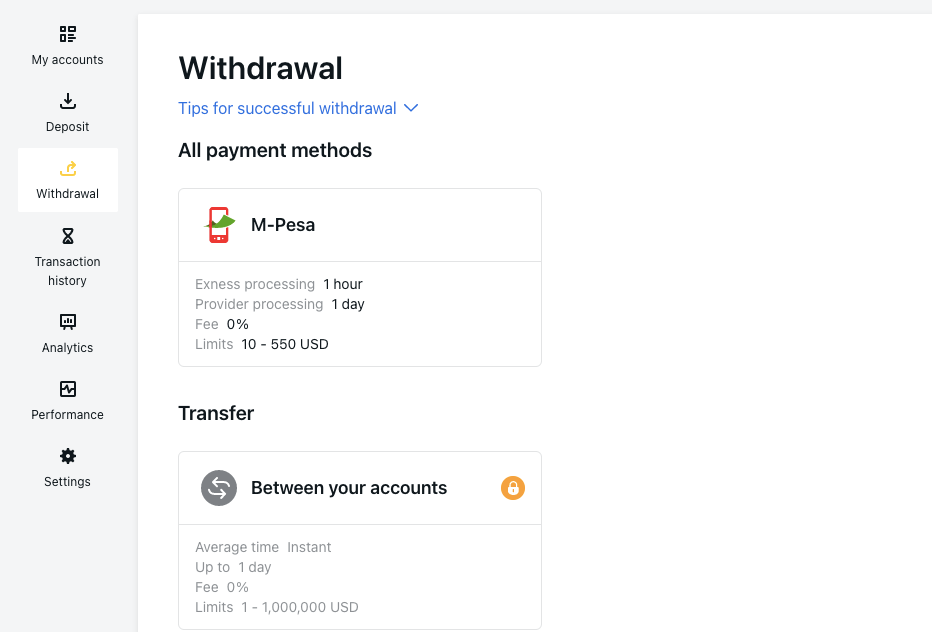

How to Withdraw Funds from Exness in Kenya?

Follow the steps below to withdraw money from your Exness Account:

Step 1) Log in to your Exness Account dashboard.

Step 2) Click on ‘Withdrawal’, which is on the left side column menu, and select the method you want to use.

Step 3) Select the trading account you would like to withdraw funds from, then enter the amount of money you want to withdraw in the field provided and follow the on-screen instructions to complete your withdrawal.

Exness Trading Instruments

You can trade any of the following instruments with Exness.

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 99 currency pairs (8 majors, 26 minors, and 65 exotics) |

| Energies CFDs | Yes | 3 Energies on Exness (Brent, Crude Oil, and NatGas) |

| Metals CFDs | Yes | 10 pairs of Metals on Exness (including pairs Gold, Silver, Platinum, and Palladium to USD and EUR) |

| Indices CFDs | Yes | 10 Indices on Exness (Dow Jones, S&P 500, US Wall Street, France 40, EU Stocks, and others) |

| Stocks CFDs | Yes | 98 Stocks on Exness (including, Google, Apple, AliBaba, Adobe, Cisco Systems, Amazon, etc) |

| Cryptocurrencies CFDs | Yes | 35 pairs of Cryptocurrencies on Exness (including ETH, Litecoin, Dogecoin, Ripple, Houbi, BTC, etc.) |

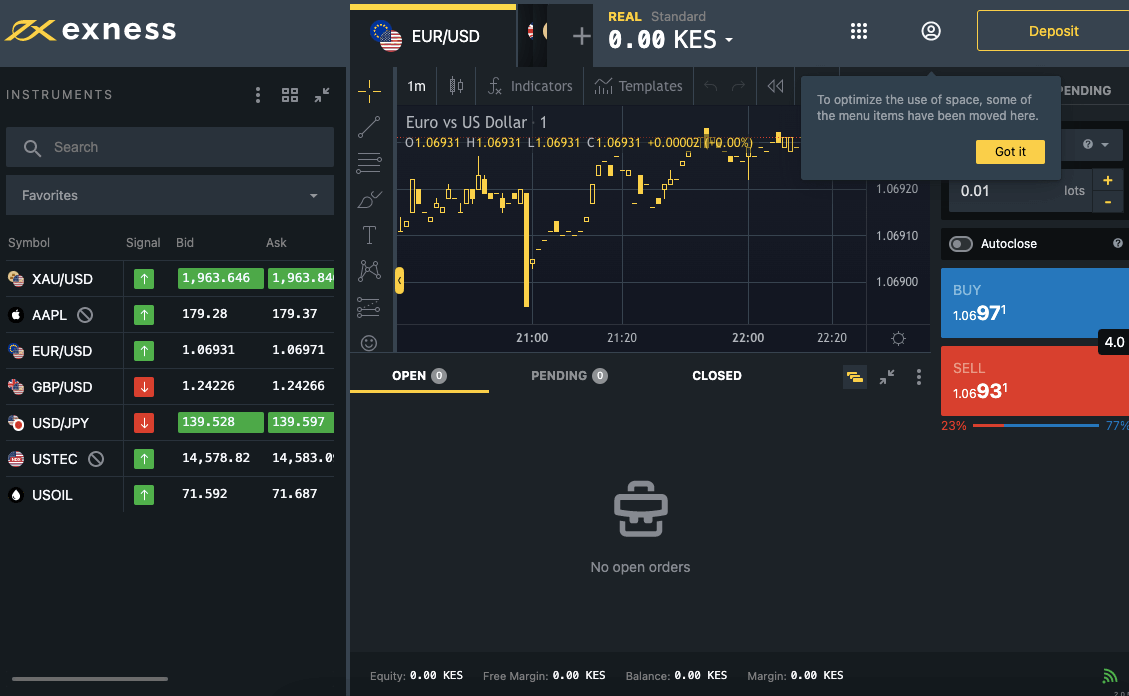

Exness Trading Platforms

Exness supports the following trading platforms:

- MetaTrader 4 & MetaTrader 5: Exness supports the MT4 and MT5 trading applications for trading financial markets. You can access the applications on the web, desktop and mobile devices (Android & iOS).

- Exness Trader: This is the proprietary Exness trading platform, developed by Exness. You can access it via the Exness Terminal on the web and mobile Exness Trader App for Android and iOS devices.

Exness Trading Tools

Exness has some tools that traders can use to improve their experience. You can use the following tools on the Exness Platform in Nigeria to analyze markets, plan trades, and manage risk effectively:

Analytic Tools on Exness

1) Trading Central Signals: You can use this tool to receive actionable trading signals generated by professional analysts on Trading Central platform. This is designed to help you stay informed and potentially spot favorable entry and exit points.

2) Market news by FXStreet: Exness has integrated the FXStreet forex news into their platform and you can access news about the latest updates and trends in the market.

3) Economic Calendar: The Exness Economic Calendar is designed to show upcoming economic events in various countries and regions that can impact currency movements. This tool is designed to help you anticipate and adjust your trading strategies accordingly.

4) VPS Hosting: If you open an Exness trading account with at least $500, you get a free VPS service. VPS means Virtual Private Server. It is a remote terminal solution that ensures trading continues even if trading terminal is closed. Even if there is computer crashes or power cuts, VPS is not affected.

5) Podcast: Exness podcast is called the born-to-trade podcast. You can listen to deep conversations with traders and industry experts. You can pick a thing or two from what they say and apply it to your trading.

Investment Calculator

The investor calculator on Exness is designed to help you do the following things:

1) Estimate Margin: The tool allow you to estimate the margin requirement for your desired trade size, which will help you ensure you have sufficient funds to avoid margin calls.

2) Calculate Pip Value: The tool also helps you calculate the potential profit or loss per pip movement for a specific trade, helping you assess risk and reward potential.

3) Calculate Profit: The Exness investor calculator can you estimate the potential profit or loss for a given trade you are considering to enter, based on entry and exit price, leverage, and commission fees.

Exness Partners Program

Exness partners program is divided into two: Introducing Broker Program and Affiliate Program. With the Introducing Broker Program, you earn up to 40% of Exness’ revenue on all active traders you introduce. As long as they are trading, you will be earning.

For the Affiliates Program, you get to earn commissions. The plans under this program are diverse so you can pick what works for you. You can earn up to $1850 in commissions per trader.

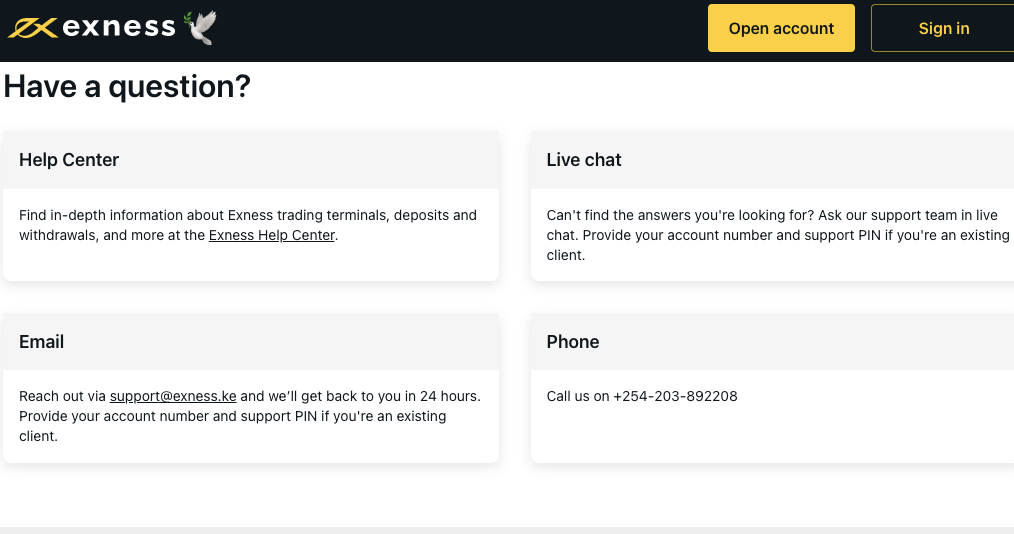

Exness Kenya Customer Service

Exness offers customer service to clients via the following channels:

1) Live chat support: Exness has a live chat that is available 24/7, sometimes they have long waiting queues. When you first click the live chat button, the Exness Virtual Assistant bot starts by sending you quick messages about account types and other Exness related info, you can then type ‘chat agent’, to be transferred to a chat agent.

Note that the Exness Assistant will request your email address before transferring you to a live chat agent. If left idle for a while, the chat closes automatically. When our team tested, the wait time was under 2 minutes.

2) Email support: The email support is relatively slow, compared to the email support of other brokers. When our team sent them an email, it was replied to after several hours. We sent a follow-up email and it also took hours to get a response.

The answer provided was relevant and they recommended live chat for faster response in the mail, with a link to it. The Exness email address is [email protected].

3) Phone support: Exness does offers phone support for traders in Kenya via a local phone number. . The Exness phone number in Kenya is +254-203-892208.

Does Exness support a demo account?

Yes, Exness provides demo account for their traders. They demo account is free and available on all Exness account types except the Standard Cent Account. You can access the demo account on trading platforms with $10,000 in virtual currency.

Does Exness protect my data?

Yes, Exness has a standard security system that protects your data. With their SSL encryption, they protect your data, personal, and financial information from falling into wrong hands.

Is Exness PCI DSS certified?

Yes, Exness complies with the Payment Card Industry Data Security Standard to make sure that your card transactions are secured.

How does Exness keep my fund safe?

Exness keep your fund safe by segregating your funds from their own funds. Furthermore, Exness funds is always larger. This ensures they can meet your withdrawal needs when you demand for it.

Do we Recommend Exness?

Exness is regulated by the Capital Market Authority (CMA) in Kenya, they are also regulated by top tier regulatory bodies in other jurisdictions. This broker offers several trading platforms and account types for you to choose from.

Exness offers competitive prices and does not charge inactivity Fee, rather your inactive account will be archived. The broker also offers negative balance protection which makes the platform safer for trading as you cannot lose more than your deposit.

The fees on Exness are moderate low when compared to some brokers, but are not the lowest. You can choose from the different account types depending on whether you prefer to pay more spreads or commissions.

The customer support of Exness is is available 24/7 via live chat and supports different languages including Swahili. Exness website is easy to navigate with lots of information and the account creation process was fast.

We recommend that you visit the broker website and probably chat with live agents to answer your questions to help you decide if the broker is right for you and the account type you prefer.

Exness Kenya FAQs

Does Exness Work In Kenya?

Yes, Exness works in Kenya. Exness is regulated in Kenya by the Capital Market Authority CMA in Kenya. They also provide you with gave choice to choose Kenyan Shillings as a base account currency.

How legit is Exness?

Exness is considered a reliable broker in Kenya. Aside from being regulated by the CMA, they are also regulated by Tier 1 regulatory bodies like the FCA in UK. Exness also has an office in Nairobi.

Which Exness account is best?

The best Exness account would be the Standard account, which has no commission fees, allows you trade multiple instruments and has competitive spreads. If you prefer to pay commissions with lower spreads, then the Exness Zero or Raw spread account will be best for you.

Thus the best Exness Account depends on your preference of the fees to pay and the instruments to trade..

How long does Exness withdrawal take?

Exness withdrawals take about 24 hours for you to receive your money in Kenya via bank cards or MPesa.

What is the minimum deposit of Exness?

The minimum deposit for Exness is $10 or the equivalent in KES.

Note: Your capital is at risk