FXPesa is a Forex and CFDs broker that provides a platform for trading foreign exchange currency pairs, and CFDs (Contract for Differences) on metals, indices, oil, and shares.

FXPesa was established in 2018 and is regulated in Kenya by the Capital Markets Authority as well as in the UK by the Financial Conduct Authority, which is a Tier-1 financial regulator.

Our review of FXPesa gives an overview of the trading conditions, trading/non-trading fees, deposit/withdrawal options, regulations, trading platforms, and customer support of the broker.

| FxPesa Review Summary | |

|---|---|

| Broker Name | EGM Securities Limited (Trading name is FXPesa) |

| Establishment Date | 2018 |

| Website | www.fxpesa.com |

| Address | EGM Securities Limited, 12th floor, Tower 1, Delta Corner Towers, Waiyaki Way, Westlands, Nairobi, Kenya |

| Minimum Deposit | $0 |

| Maximum Leverage | 1:400 |

| Regulation | CMA, FCA |

| Trading Platforms | MT4, MT5, Equiti Trader |

| Visit FxPesa | |

FXPesa Pros

- Regulated by CMA in Kenya

- Offers commission-free account

- Free deposit for all payment methods

- Does not charge dormant account fees

- Accepts deposit/withdrawal to Kenyan bank account

- Has negative balance protection

- KES Account is available

FXPesa Cons

- Customer support is not available 24/7

- Relatively few tradable instruments

Is FXPesa regulated?

FXPesa is regulated in Kenya and by a Top-Tier regulator in the UK, which means they are compliant with the relevant authorities to protect clients’ funds. Find the regulations of FXPesa below:

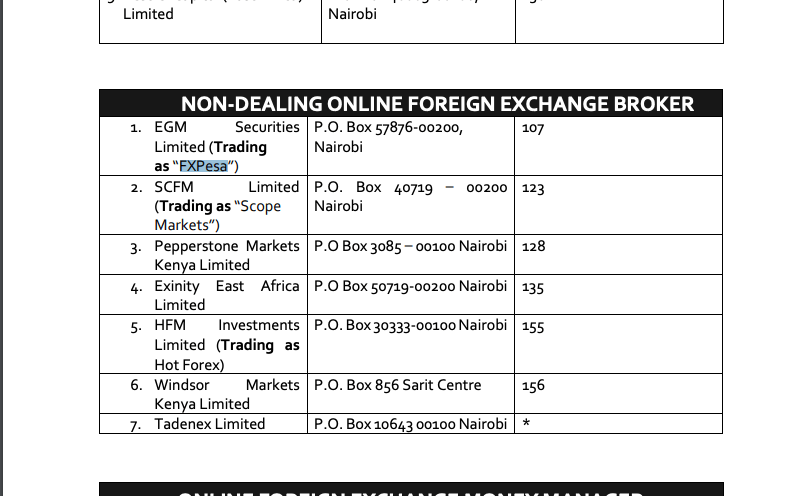

1) Capital Markets Authority (CMA), Kenya: FXPesa is the trading name of EGM Securities Limited, which is licensed by the CMA in Kenya as a non-dealing online foreign exchange broker, with registration number 107.

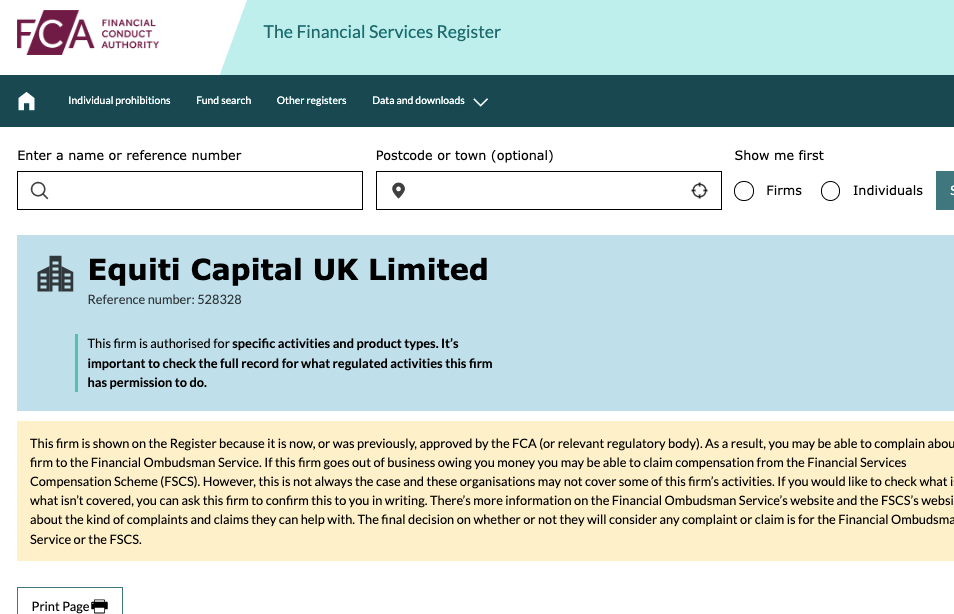

2) Financial Conduct Authority (FCA): FXPesa is regulated in the UK by the FCA as ‘Equiti Capital UK Limited’ and authorized to offer financial services, with reference number 528328.

FxPesa Leverage

With a fixed leverage system for trade positions, the maximum leverage on FXPesa is 1:400. This means that with a deposit of $100, you can open a trade position worth up to $40,000.

The maximum leverage of 1:400 applies to major forex pairs, other instruments have maximum leverages of 1:200 for CFDs and 1:20 for Equities.

Note that trading leveraged products involves risk and you can lose all your money. It is best to avoid trading them if you do not understand them or have experience. It is important that you do not use all the leverage available to you, as this would increase the risk of losing your money.

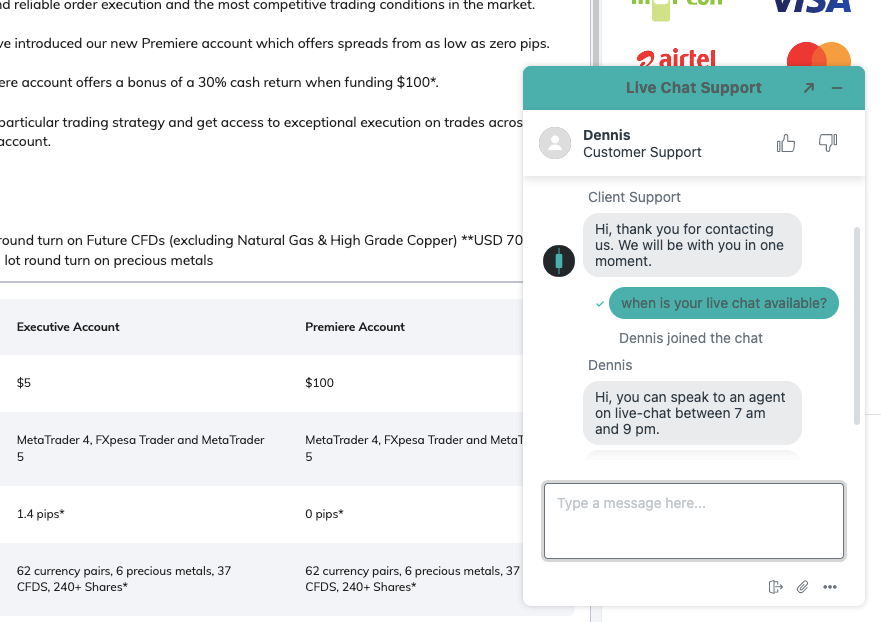

FxPesa Account Types

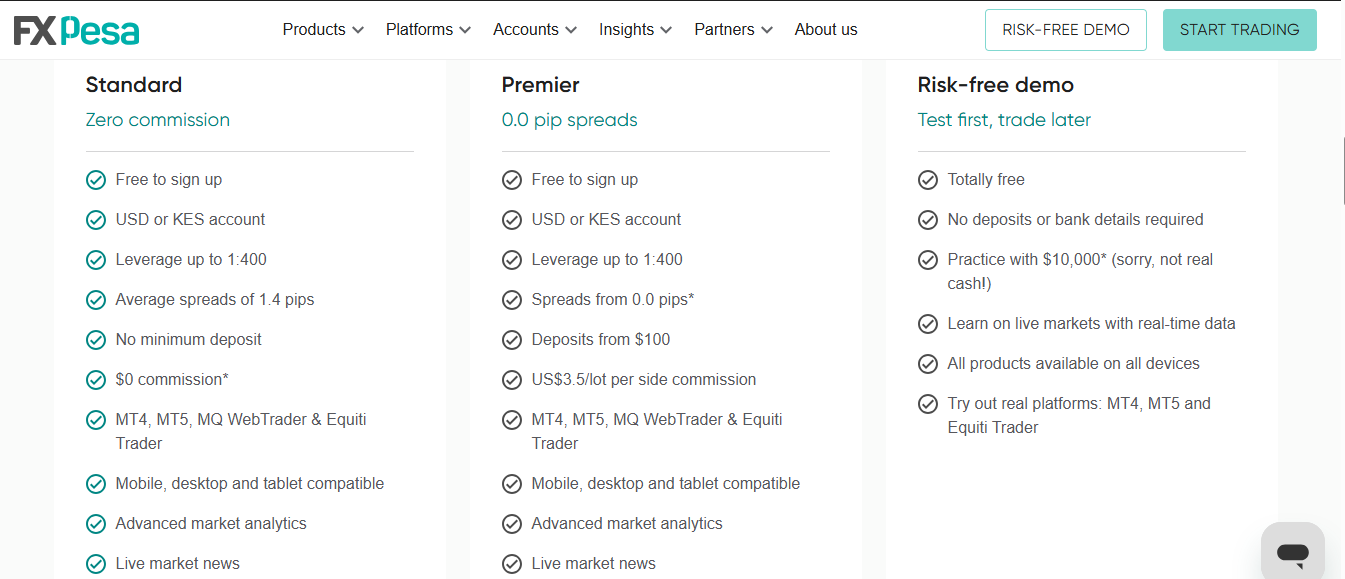

FXPesa offers 2 main account types to customers; Standard and Premiere Accounts. You can also get a swap-free account on FXPesa or open a demo account and use virtual money to practice trading before you put your real money.

Find the different features of the account types on FXPesa below:

1) Standard Account: The FXPesa Standard Account allows you to trade forex pairs and CFDs on shares, indices, and commodities of oil and precious metals. You can access the account on MT4, MT5, and Equiti Trader.

With this account, you do not pay any commission fees, and spreads start from 1.4 pips for major FX pairs like EURUSD. Whenever you keep a trade position open past market closing time, you pay swap fees.

The minimum deposit for this account is $0 with a maximum number of open trades of 500 and maximum leverage of 1:400.

FXPesa offers negative balance protection with this account which prevents you from losing more money than you deposited. If a trade position is unsuccessful and you lose all your money, any negative balance on your account will be reset to zero.

2) Premiere Account: The FXPesa Premiere Account allows you to trade forex pairs and CFDs on shares, indices, and commodities of oil and precious metals. You can also access the account via MT4, MT5, and Equiti Trader.

With this account, you pay commission fees when you open a trade position and another fee when you close the position. Commission fees on FXPesa Premiere Account can be up to $7 for a round turn (which is $3.5 per lot side, that is open and close).

Spreads on this account start from 0.0 pips for major FX pairs like EURUSD, and whenever you keep a trade position open past market closing time, you pay swap fees.

The minimum deposit for this account is $100 with a maximum number of open trades of 500 and maximum leverage of 1:400.

This account also has negative balance protection.

3) Islamic Account: FXPesa offers Swap-free Islamic Accounts to Muslim traders, which is in line with the sharia law tenet of no-riba. This means that you will not pay any interest fees or swap fees for keeping a position open past the market closing time on selected instruments.

To get a swap-free account on FXPesa, you can check the swap-free account box during registration. You can also send a message to the support team to convert your regular Executive or Premiere Accounts to swap-free account status.

Note that swap-free status does not apply to all tradable instruments.

FxPesa Account Currency

FXPesa offers 2 account base currency, the USD (United States Dollar) and KES (Kenyan Shilling). All your trades, profits or losses are measured in your account’s base currency.

FxPesa Fees

The fees on FXPesa depend on your account type and the instrument you are trading. We have a summary of FXPesa trading and non-trading fees below for you.

Trading fees

1) Spreads: Anytime you trade a financial instrument on FXPesa you pay spreads fee, which is markup the broker adds to the ask(sell) price of the instrument. The difference between the ask (sell) and bid (buy) price is called spread, measured in pips. Find the typical spreads on FXPesa for major pairs below:

| Currency Pair | Standard Account | Premiere Account |

|---|---|---|

| EUR/USD | 1.4 pips | 0.0 pips |

| GBP/USD | 2.2 pip | 0.2 pips |

| EUR/GBP | 2 pips | 0.2 pips |

| XAUUSD (Gold vs US Dollar) |

0.32 pips | 0.18 pips |

2) Commission fees: Whenever you open a trade position on FXPesa with the Premiere Account, you pay a commission fee of $3.5, when you close the position, you pay another commission fee of $3.5 which makes it $7 round turn. This fee is for major forex pairs and may differ for other instruments.

Standard Accounts do not pay commission fees on trades, they operate as a spread-only accounts.

3) Swap fees: If you keep a trade position open past 11:59 PM platform time which is the closing time of the market, the trade rolls over to the next trading day, and you incur rollover cost (overnight funding costs) also called swap fee.

Swap fees on FXPesa are dependent on the instrument you are trading, the spread, leverage, trade volume and whether your position is a long swap (buy) or short swap (sell). Swap-free Islamic Accounts do not pay swap fees.

Non-trading fees

1) Deposit and Withdrawal fees: FXPesa charges zero deposit fees for all payment methods, while withdrawals via mobile payments and local bank transfers are free of charge, withdrawals via e-wallets (Skrill & Neteller) attract a fee of 1% of transaction value capped at $30 and international wire transfers have a withdrawal fee of $15.

2) Account Inactivity charges: FXPesa does not charge any inactive account fees. If you do not login into your account or perform any trade on it, any money in it will not be charged.

How to Open FXPesa Account in Kenya?

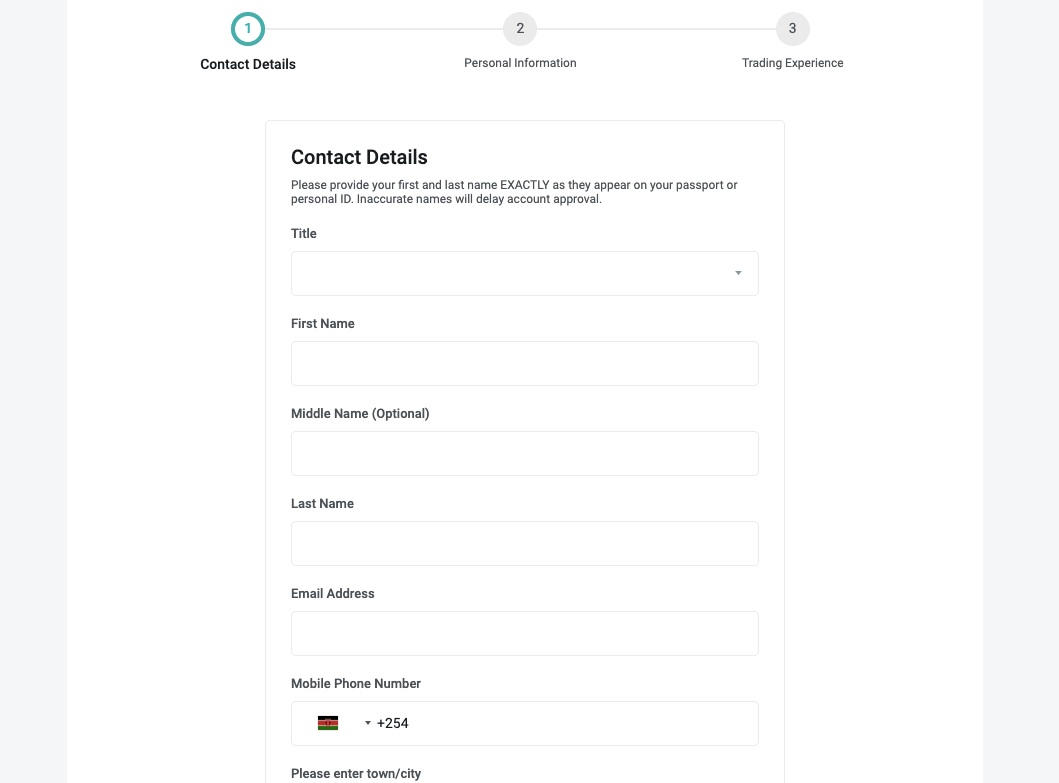

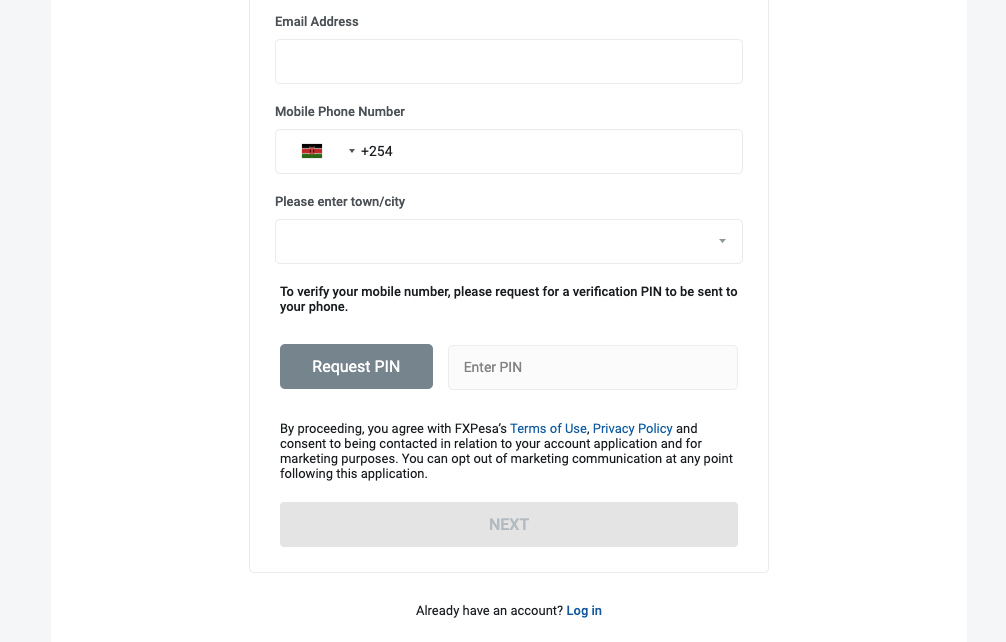

Follow these steps to open a trading account on FXPesa.

Step 1) You need to first apply for an account by going to the FXPesa website at www.fxpesa.com and clicking on the ‘Real Account’ button at the top of the page.

Step 2) Fill out your name, and email, verify your phone number and click ‘NEXT’.

Step 3) Provide your personal details like date of birth, home address, and educational and financial background.

Step 4) Answer some questions about your trading experience and create a password for your account.

Step 5) Click the confirmation link sent to your email, which will log you into your FXPesa dashboard (client portal), where you will be required to upload verification documents like a Passport or any other ID card for identity and utility bill for your address.

Step 6) Once your account application is approved, you will receive an email with your login details, and then you can make deposits and start trading.

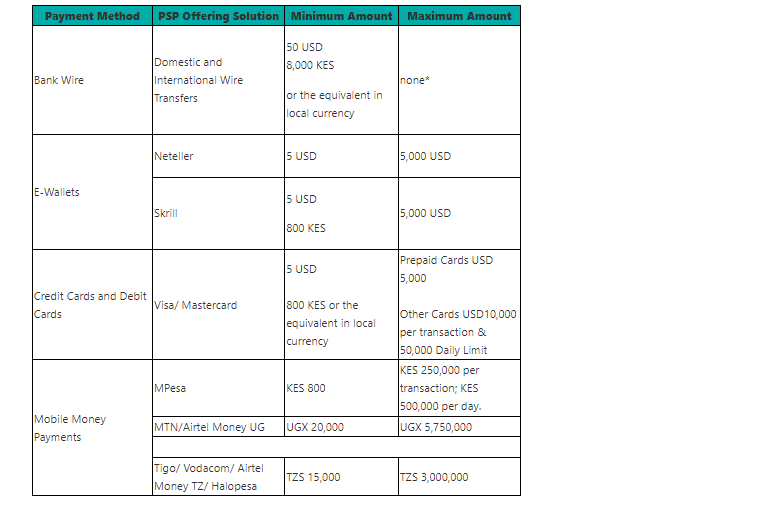

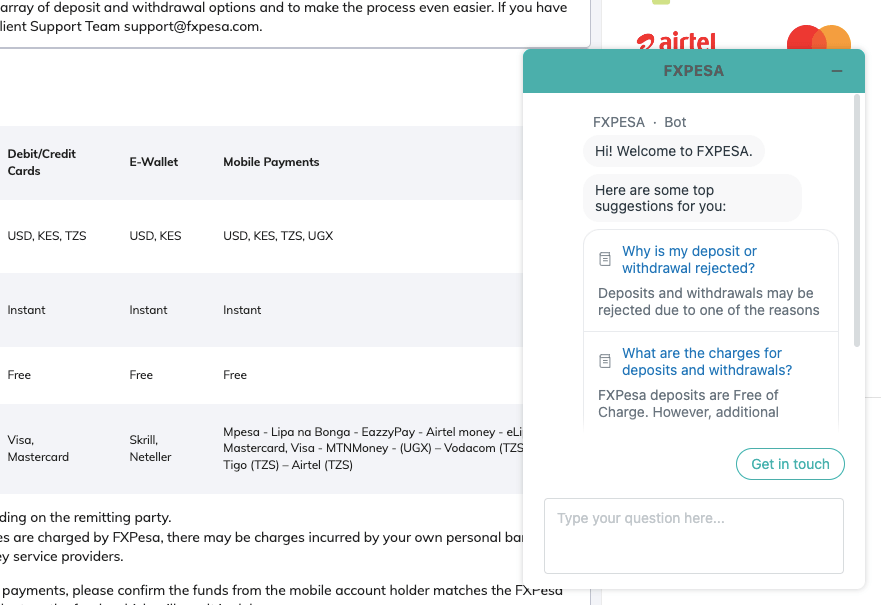

FXPesa Deposits & Withdrawals

Payment methods supported by FXPesa for deposits and withdrawals are bank transfers and cards. Here is the summary of the deposits and withdrawal options on FXPesa in Kenya.

FXPesa Deposit Methods

Here is a summary of payment methods accepted by FXPesa for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Online Bank Transfer | Yes (KES) | Free | 1-5 business days |

| Cards | Yes (Visa & Mastercard) | Free | Instant |

| E-wallet | Yes (Skrill & Neteller) | Free | Instant |

| Mobile Money Payment | Yes (Mpesa, Airtel Money, and others) | Free | Instant |

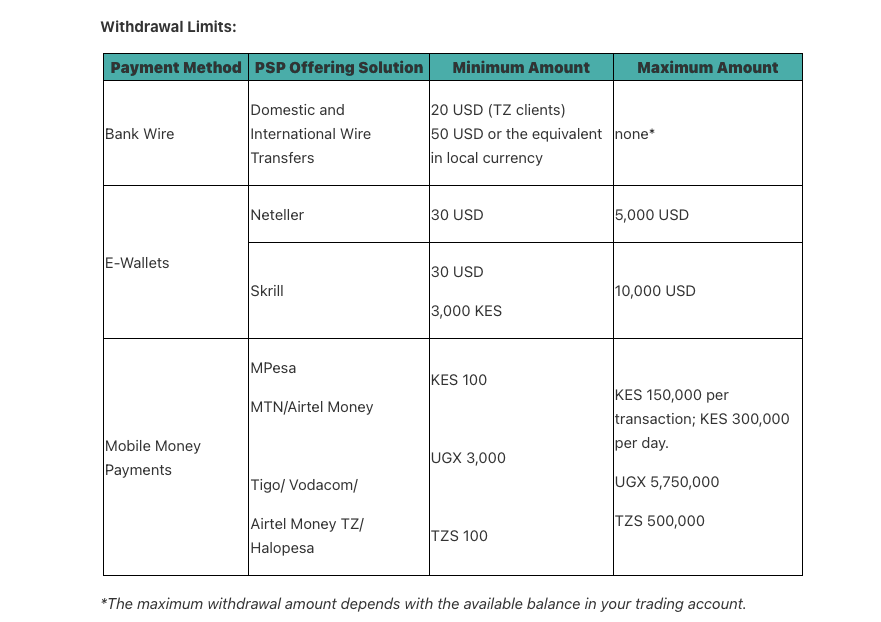

FXPesa Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on FXPesa.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Online Bank Transfer | Yes (KES) | Free | 1-2 business days |

| Cards | Yes | Free | 1-2 business days (can be up to 15 business days) |

| E-wallets | Yes (Neteller & Skrill) | 1% (capped at $30) | 1-2 business days |

| Mobile Money Payments | Yes (Mpesa, Lipa na Bonga, and others) | Free | Instant or within 24 hours |

What is the minimum deposit for FXPesa?

The FXPesa minimum deposit is $5 or 800 KES. This is for deposits via cards. Deposits via local bank transfer require a minimum deposit of $50 or Ksh 8,000, e-wallets are $5 or Ksh 800 while mobile payments require a minimum deposit of Ksh 800.

How do I deposit money into FXPesa?

Log in to your MyFXPesa client portal via www.portal.fxpesa.com, then click on deposits, select your preferred payment method, and follow the on-screen instructions to complete your deposit.

What is FxPesa Minimum withdrawal?

The minimum withdrawal amount on FXPesa is $50 for bank transfers, Ksh 100 for e-wallets, and mobile payments like MPesa.

How do I withdraw money from FXPesa?

Log in to your MyFXPesa client portal via www.portal.fxpesa.com, then click on withdraw, select your preferred payment method, and follow the on-screen instructions to request a withdrawal.

FxPesa Trading Instruments

You can trade the following financial instruments on FxPesa.

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 59 currency pairs FXPesa (12 majors, 16 minors, and 30 exotics) |

| Commodities CFDs | Yes | 18 commodities on FXPesa (Including Gold, Silver, Platinum, Oil, energies, and agriculture commodities) |

| CFDs on Indices | Yes | 30 Indices on FXPesa (16 rolling and 14 futures indices, including US Wall Street 30, France 40, US Tech 100, UK 100, and others) |

| Shares CFDs | Yes | 240 shares on FXPesa (US, EU and UK shares) |

| Crptocurrencies | Yes | 60 cryptos on FXPesa (BTC, ETH, Shiba, and others) |

| ETFs | Yes | 46 ETFs on FXPesa (Vanguard Utilities, SaudiETF, US Global Jets, and others) |

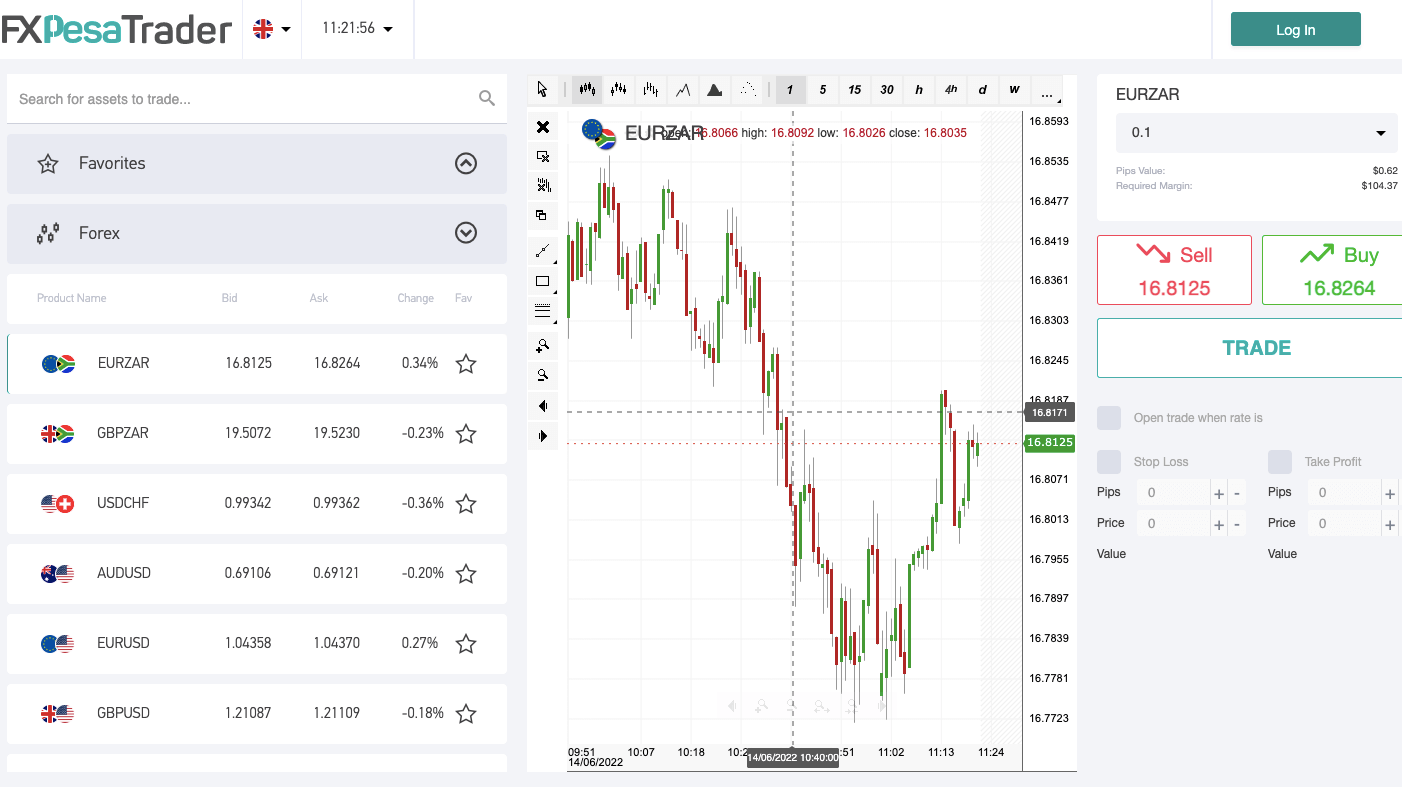

FXPesa Trading Platforms

Trading platforms supported by FxPesa are:

1) MetaTrader 4 and MetaTrader 5: FXPesa supports the MT4 and MT5 trading applications for accessing the financial market. You can access the platform via the web or download it to your desktop (macOS or Windows) or on mobile devices (Android & iOS).

2) Equiti Trader: This is a proprietary trading application developed by FXPesa through which you can trade the financial market via the web. You can download the FXPesa Mobile trader from Google Play Store for Android or Apple App Store for iOS.

FXPesa Kenya Customer Service

FxPesa Kenya offers 6 days of online customer support to traders via the following channels:

1) Live chat support: FXPesa offers live chat support to traders via the website, which is available from 7 AM to 9 PM, Sunday to Friday. When you first click on the support button on the website, you get suggested articles from the FXPesa chatbot, and you can transfer to a live agent by selecting ‘Get in touch’, then live chat.

When our team tested the FXPesa live chat, we got responses in under 5 minutes, although the chat was slow, the answers were relevant. Note that you will need to submit your email and name before you are transferred to a live agent.

2) Email support: FXPesa also offers email support for clients and is available too from 7 AM to 9 PM, Sunday to Friday. When we sent an inquiry to the FXPesa email support, we got an autogenerated response acknowledging our email and a live agent sent a reply after 3 hours. The FXPesa email address for support is [email protected].

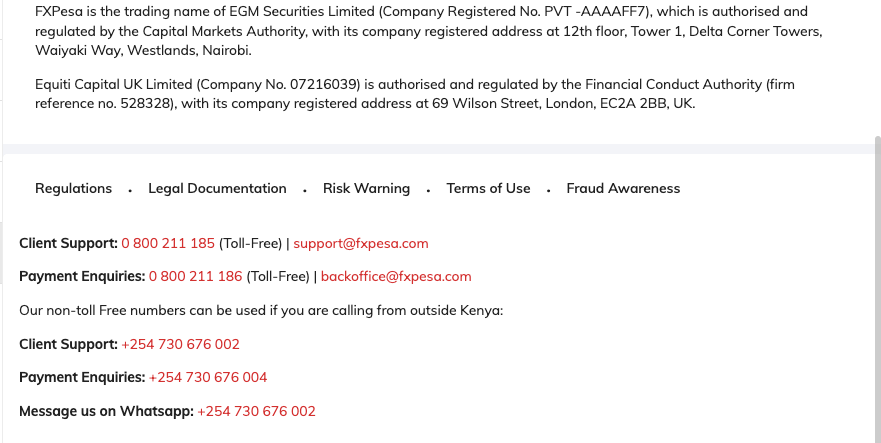

3) Phone support: You can also reach FXPesa customer service through a phone call. It is available from Sunday to Friday from 7 AM to 9 PM. The phone number to call is 0 800 211 185, which is toll-free. For other inquiries, you can call +254 730 676 002 or send a WhatsApp message to it.

How to Deposit Money to FXPesa using Mpesa?

Here is a step-by-step guide on how to deposit to FxPesa using Mpesa

After completing the transaction, wait till the money is deposited into your account. If you have issues with this mode of deposit, you can speak to FXPesa customer support.

Do we Recommend FXPesa?

FXPesa is regulated in Kenya by the CMA and by the FCA in the UK, which is a Tier-1 financial regulator. These regulations mean the broker is mandated by law to protect your funds, and in the event of a default, you can be protected by the CMA consumer protection rules in Kenya.

The fees on the platform are moderate, as you can operate a commission-free account with competitive spreads or pay commissions and trade with lower spreads. The broker does not charge dormant account and deposit fees, they also offer negative balance protection, which serves to minimise your loss to invested capital. Although withdrawal fees apply to some payment methods, you can escape this by using methods that do not have any fees.

The FXPesa is easy to navigate and user-friendly, the account opening process is simple and the minimum deposit is relatively low. The broker supports multiple trading platforms and their customer support is responsive, especially the live chat, although it is not available 24/7.

You can visit the broker’s website and probably chat with customer support and ask any questions you might have to help you determine if the broker matches your trading requirement.

FxPesa FAQs

How do I trade with FXPesa?

To trade with FXPesa, first open a live trading account on their website, then deposit funds in the trading account and you can start trading. We have given a step-by-step on how to register and deposit funds in this review. You can scroll up to see.

How does FXPesa make money?

Anytime you trade a financial instrument on FXPesa, the broker adds a markup to the ask(sell) price of the instrument. The difference between the ask (sell) and bid (buy) price is called spreads, measured in pips. The spreads go to the broker as income.

Another way the broker makes money is in commission fees charged on some account types every time you open and close a trade position.

What is the minimum deposit in FXPesa?

The FXPesa minimum deposit is $5 for deposits via cards. Deposits via local bank transfer require a minimum deposit of $50 or Ksh 8,000, e-wallets are $5 or Ksh 800 while mobile payments require a minimum deposit of Ksh 500.

Is FXPesa a good broker?

FXPesa is considered a good broker because they are regulated in Kenya by the Capital Markets Authority and in the UK by the Financial Conducut Authority. The broker also offers negative balance protection, does not charge dormant account fees and supports deposits and withdrawals via local banks in Kenya.

How long does FXPesa withdrawal take?

Withdrawals to mobile payments (MPesa, Airtel Money, MTN Money, and others) are instant or received within 24 hours, while It takes 1-2 for you to receive your money for withdrawals to e-wallets (Skrill & Neteller) and it takes about 1 to 5 working days to receive withdrawals made to local bank accounts.

Note: Your capital is at risk