Forex brokers provide the services you need to trade CFDs. In addition to these, they also partner with third-party companies to provide you with trading platforms. You can use these platforms as desktop software and web traders. Most traders prefer to check the markets using the desktop versions of software. They give a better view of present and current price movement.

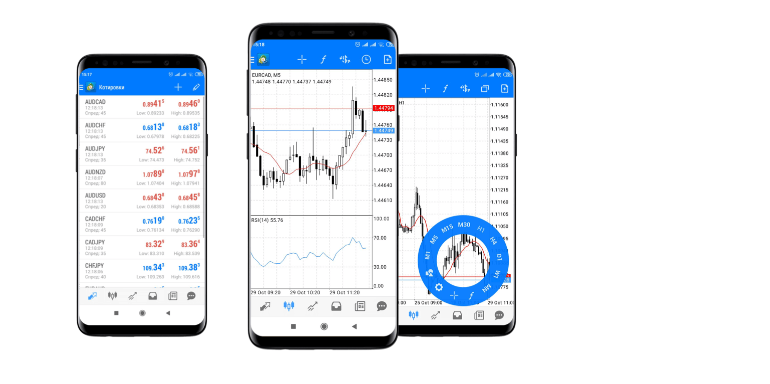

However, desktop trading software like MT4, MT5, cTrader, etc has a limitation. You cannot use them on the go. You will need a power source, internet, a workspace, etc. This is where forex trading apps come in. Most forex brokers have their platforms and third-party platforms available on mobile phones. Using forex trading apps is helpful for short analysis, quick opening, and closing of trades.

Note: It is advised that you should not trade via your Smartphone only. Trading requires research & analysis. You should only use the app as an added feature with the actual platform. A mobile device should only be used as a secondary device for checking your position on the go.

Comparison of Best Forex Trading Apps in Kenya

| Broker | CMA Regulated | Android App | Apple iOS App | Minimum Deposit | Visit |

|---|---|---|---|---|---|

| HF Markets MetaTrader App | Yes |

Yes

|

Yes

|

$5/700KES

|

Visit Broker |

| Exness | Yes |

Yes

|

Yes

|

$10/1156KES

|

Visit Broker |

| Pepperstone MT4 | Yes |

Yes

|

Yes

|

No minimum deposit

|

Visit Broker |

| FXTM MetaTrader | Yes |

Yes

|

Yes

|

$5

|

Visit Broker |

| Octa Trader | Yes |

Yes

|

Yes

|

$25

|

Visit Broker |

| XM Trading | Yes |

Yes

|

Yes

|

$5

|

Visit Broker |

List of Best Forex Trading apps in Kenya

- HF Markets MetaTrader App – Best Forex Trading App in Kenya

- Exness– CMA Regulated broker with MetaTrader App

- Pepperstone MT4 – Good Forex Trading App for Raw Spread

- FXTM MetaTrader – Reputable Forex Trading App

- Octa Trader – CopyTrading App

- XM Trading – Reputable Forex Broker App

Here is how we reviewed each forex trading app

#1 HF Markets MetaTrader App – Best Forex Trading App in Kenya

HF Markets is a CFD broker that offers its App to trade 53 Currency pairs, CFDs on 945 DMA Stocks, 54 Shares, 5 Commodities futures, 6 Metals, 4 Energies, 34 ETFs, 3 bonds, and 23 Indices.

Safety – HF Markets’ trading app is considered low risk because HF Markets is licensed by 3 Tier-1 & Tier-2 regulators; the FCA, FSCA & CySEC. Also by Dubai Financial Services Authority (DFSA) and Financial Services Authority (FSA) in Seychelles. Traders from Kenya are registered under HFM Investments Ltd (regulated with the Capital Markets Authority (CMA) of Kenya

Fees – Their CFD trading fees are considered low as per our comparison. Their average spread for majors like EURUSD is 1.4 pips with their Premium and Micro Accounts, and there is no extra commission per lot with these Accounts. HF Markets Zero Spread Account has spreads starting from 0.0 pips but also charges commissions on forex trades starting from $3 per side. HF Markets does not charge deposit or withdrawal fees.

Accounts – HF Markets offers six (5) types of trading accounts, with varying spreads, including an Islamic account, so you can choose the one that best suits your trading needs. They even have a Zero spreads account but require a minimum deposit of $200 for this account.

HF Markets has negative balance protection that prevents you from losing more money than you have in your trading account.

Trading Application – In addition to the HFM App which is owned by HF Markets and available on mobile devices only (iOS & Android), HF Markets supports MT4 and MT5 web-based and desktop platforms as well as the mobile app versions (Android & iOS).

The mobile app has most of the tools you need to manage your trades on available CFD instruments from anywhere. While you can deposit and withdraw directly from this app, it does not fully cover the functionality of the HF Markets website.

Deposits & Withdrawals – You can deposit a maximum of $10,000 per transaction with debit cards like Visa and Mastercard and a minimum of $5. It takes about 10 minutes to reflect in your account.

HF Markets supports direct withdrawal to your Kenyan bank account and funds are received within 24 hours. This requires a minimum withdrawal amount of $10 equivalent in Kenyan Shillings. It takes 2 to 10 business days to receive funds if you want the money transferred to a dollar bank account, and some charges might apply by the correspondent and receiving bank.

Withdrawals can also be made to cards, the minimum withdrawal amount is $5.

Support – HF Markets offers customer support 24/5 via email and live chat on the website or mobile app. They also have local phone support in Kenya. Their support is good as per our tests.

Read our HF markets review for more.

#2 Exness – CMA Regulated broker with MetaTrader App

Exness is one of the low-cost beginner-friendly CFD brokers that accept traders based in Kenya. Financial instruments offered by Exness are 99 forex pairs and CFDs on 3 energies, 10 metals, 10 indices, 98 stocks, and 35 cryptocurrencies.

Safety – Exness was founded in 2008 and they are locally regulated by the CMA. They are also Licensed by the FSCA, FCA & CySEC. This makes them a low-risk and safe CFD broker for traders in Kenya.

Fees – The spread for the majority of CFD instruments is tight, with an average for majors like AUDUSD being 1.4 pips with Standard Account. Exness offers free deposits and withdrawals, with no commission on trades with Standard Account. They have low spread + commissions starting at $0.2 per side lot and up to $3.5 per side with Raw Spread and Zero Accounts.

Account – Exness offers 5 types of trading accounts with different features. They also have Raw Spread and Zero Spread Accounts with spreads starting from 0.0 pips. You can also apply for an Islamic Swap-free account on Exness.

Exness has negative balance protection that prevents you from losing more money than you have deposited into your account.

Trading Application – Exness is a MetaTrader-based CFD trading platform with MetaTrader 4 and 5, which provides standard and professional account types. The web trading platform is available, while the app is available for download from the App Store and Google Play Store.

You can run your custom scripts for automated trading on their MetaTrader platform. For a secure connection, Exness encrypts all communication between the server and trading platform with 128-bit keys.

The app has a Margin Calculator that easily determines your margin size, swap rates, and pip values before placing a trade. It also has a converter to help you calculate the currency’s exchange rate. A Calculator is also available on their website.

Exness has MT4 multiTerminal which allows you to manage multiple accounts, place new orders and allocate lots across various accounts simultaneously and monitor real-time positions.

Exness also has a proprietary trading mobile application ‘Exness Trader App’ which is available on iOS and Android devices.

Deposits & Withdrawals – Traders can instantly fund their accounts with online bank transfers in Nigeria at zero fees. The minimum deposit amount is $10 with a maximum of $45,000, while $3 is the minimum withdrawal amount and a maximum of $12,000 per transaction.

Support – Exness has 24/7 customer support via email and live chat, as well as a knowledge base FAQs section with information on how to navigate and use the website and app.

#3 Pepperstone MT4 – Good Forex Trading App for Raw Spread

Pepperstone does not have a proprietary mobile app. They support third-party trading apps that allow you to trade 60+ currency pairs, 20+ stock indices, 900+ stocks, 100+ ETF CFDs, 20+ commodities, and 3 currency indices.

Safety – Pepperstone is regulated with top-tier bodies like the FCA and ASIC. They also hold licenses with CtSEC, DFSA, and BaFin. Importantly, they are locally regulated with the CMA as Pepperstone Markets Kenya Limited. They are considered low risk for Kenyan traders.

Fees – Pepperstone charges spreads and swaps. They have a Standard Account and a Razor Spread Account. The average spread on the Standard Account is higher than that of the Razor Spread Account. Commissions are charged based on your account’s base currency. Dollar-based accounts pay $3.50 per standard lot as a commission on MT4/MT5. This fee applies to Razor Accounts only.

Account – As mentioned earlier, Razor Account and Standard Account are the two accounts offered by Pepperstone. The accounts do not have a stipulated minimum deposit. However, Pepperstone recommends a minimum deposit of $200. The Razor Account is ECN-type so the average spreads are low.

Trading Application – Pepperstone has MT4, MT5, and cTrader mobile trading apps. They are available on Android OS and iOS. You can download them on the Google Play store and the App store. You can use these apps after opening an account with Pepperstone. You will get access to advanced trading tools, indicators, and an economic calendar.

Deposits & Withdrawals – For funding and withdrawals, Pepperstone accepts M-Pesa, debit/credit cards (Visa and MasterCard), PayPal, and local bank transfers.

Support – For help and inquiries, pepperstone has good customer support. You can contact them via email, a phone call (local Kenyan number), and live chat.

#4 FXTM Trader App – Reputable Forex Trading App

FXTM Trader is a provider of financial trading services, offering over 2,500 trade instruments, including CFDs for 3 commodities, 1,288 shares, 829 CFDs stocks, 5 stock baskets, 5 metals, 17 indices, 6 FX indices, and 60 currency pairs.

Safety – The company is registered as ForexTime Limited in Cyprus and is well-regulated by CySEC, FCA, and FSCA. Which makes the broker score high on trust and is considered safe. Traders from Kenya are registered under their license in Kenya as Exinity Capital East Africa Limited.

Fees – Deposits are free of charge and the average spread fee is around 2.1 pips for major currency pairs on Micro accounts, which is relatively higher than most brokers. Advantage account holders are charged spreads from 0 pips plus a $0.40 to $2 commission per lot side opened on trades with Majors.

Account Features – FXTM offers 3 trading accounts as well as an Islamic Account option for Muslim traders. Different FXTM account types determine the kinds of instruments you can trade. The broker also offers negative balance protection on all account types.

Trading Application – FXTM supports MT4, MT5, and FXTM Trader which is owned by FXTM. The broker has multi-platform support, meaning you can trade on the web or use their mobile apps available on iOS and Android devices.

Deposit & Withdrawals – FXTM supports Nigerian traders to deposit and withdraw funds via their bank accounts in Kenya. They also support e-wallets like Skrill, Neteller, and M-Pesa.

Support – FXTM also offers a range of educational resources on their website, and 24/5 customer support via live chat, email, and Nigerian phone numbers. This includes personal account managers, who can assist and support you in your trading journey.

Read our FXTM review for more.

Types of Forex Trading Apps

There are two types of forex trading apps. Some forex brokers have both while some support just one type. Let us break them down:

1) Third-Party Trading Apps: These trading apps are developed by other companies for forex brokers. These companies allow CFD brokers to host their trading services on their trading apps. A prominent example is MetaTrader 4 and MetaTrader 5 mobile developed by MetaQuotes.

Another common third-party mobile trading app is cTrader mobile developed by Spotware Systems. These companies are not brokers. However, they partner with brokers globally so traders can use the app through their clients.

2) Proprietary Trading Apps: Proprietary trading apps are developed by forex brokers independently. This is not done in conjunction with third parties so the names of these trading apps vary from broker to broker.

For example, most brokers just name their apps after their companies just name it after their company (like FXTM Trader and Exness Trader App Station)). Because these apps are developed by brokers individually, their trading conditions and interface are never the same too.

Advantages of Using Forex Trading Apps

There are some pros that come with using forex trading apps. We look at a few in this section.

Ease: It is easier to trade forex with trading apps. In the past, traders needed an office and a desktop to analyze the market. To get key economic news, they have to read newspapers. In addition, access to industry experts was so difficult. They have to make a number of calls to get advice. A single proprietary trading app can perform all of these functions and much more.

Flexibility: Apart from the convenience that trading apps bring, they also offer flexibility. With mobile apps, you can trade on the go, analyze the market, and monitor your positions. You can do these while you are in a car, hanging out with friends, or taking a walk. This will not be possible if all that was available for trading are desktops

Disadvantages of Using Forex Trading Apps

Though forex trading apps are very useful, they also have some disadvantages. If you really want to be a proficient trader, you cannot use mobile apps alone. Here is why:

Size of the Screen: This is a major challenge with using mobile apps. They do not give a good view of past price movements, especially on higher timeframes. This experience is not so good. Many traders use up to two or more desktops to have a full view of the market. You cannot do this on mobile devices, not even a tablet.

Difficult to Focus: Mobile trading apps can lead to a lot of distractions. This could come from notifications from social media apps, a message, or a call. These interruptions are not good for traders and can affect long-term performance. Desktops do not have these issues.

Execution Speed: Forex trading apps have improved over the years. However, there could be risks of your app crashing when trading. In addition, mobile networks might not be very reliable. This affects execution speed and leads to latency.

Overtrading: Because it is easy to access charts on the go, mobile apps heighten the tendency to trade more. This in turn increases your chances of losing more money. To deal with this, you need to be disciplined and stick to your trading plan.

How to Choose the Best Forex Trading App in Kenya

Before choosing a forex trading app, there are a few things you should consider. The following questions should influence your decision-making.

1) Is the broker safe?

To consider a forex broker safe, you have to ensure they have a tier-1 license with the FCA (UK) and ASIC (Australia). Though not necessary, a tier-2 regulation with CySEC is good as well. After verifying these regulations, you can then proceed to verify the broker’s local license with the CMA in Kenya.

Even if your broker does not have a local license in Kenya, tier-1 regulations are good enough. They show a broker can be trusted and that they are low-risk.

2) What are the broker’s trading fees?

The next factor for picking a broker is their trading and non-trading costs.

Most brokers currently charge zero fees for withdrawals, deposits, and, while being competitive with the spread and swap rates.

For example, in a EUR/USD pair trade. Say the bid price is 1.1300 & the spread is 1.5 pips. This means that the trader would pay $1.5 for a 1 Mini Lot trade. If you hold the position overnight, then there will also be Holding charges i.e. Swap Fees.

Ensure there are no hidden fees, commission costs are affordable, and the spread is not too wide, before using a brokerage app.

3) What CFD instruments are available?

There is no industry standard for the number of CFDs a broker should have. Some have a wide range of instruments while some do not. However, the reason you should check the CFD offered by your broker is that all brokers do not have the same CFDs.

So if you want to trade Gold CFD for example, is it available? Can you trade it for lesser costs on multiple accounts? These are crucial factors you should consider.

You should choose a trading broker that offers a plethora of trading instruments, allowing you to trade currencies, stocks, and commodities.

4) Ease of use

If you wish to start trading on your mobile phone, you must check that the app is available on your phone platform: i.e. Web-based, Android, or iOS.

The next step is to download it and try using it, then see how long it takes to register and perform some micro-tasks on it. Alternatively, you can read the feedback of other users to help you decide.

When choosing a trading app, you want to find something that’s not only open, free, and powerful but also simple to use.

5. Other Features to Check on Trading Apps

There are a few other features that you should check in the app.

a. Ease of Funding/withdrawals: Funding and withdrawal should be easy. Your broker should support credit/debit cards and bank wire transfers. E-wallets such as PayPal, and Skrill should also be available. Finally, you should be able to deposit/withdraw in pounds without excessive charges.

b. Risk Management Tools: In unique situations, the market might execute your stop-loss order at an unfavorable price, leading to more losses. A guaranteed stop-loss order (GSLO) makes sure your stop-loss order is executed at your desired price. You should speak to your broker to know if they offer GSLO.

c. Is Customer Support Good or Bad: Your broker should be reachable via different means. Email, local mobile numbers, live chats, and instant messaging should be available. Quick response is the hallmark of good customer support so make sure to carry out a personal test.

d. Two Factor Auth: Does the platform support 2FA? This will provide added protection against hacking. Some forex brokers have 2FA for their accounts, and you should check this with the support of the broker that you intend to signup with.

e. Education: You want to choose a forex broker that allows you to learn. This is why education on trading apps should be key for you. The education content could be videos, written content, podcasts, or ebooks. Most of this content is usually on the broker’s websites. Few brokers like Capital.com have their educational content on their mobile app.

Is forex trading halal?

While it is haram to pay riba on trades, Some forex brokers offer swap-free accounts that are compliant with Islamic principles of no riba, these brokers offer accounts that eliminate overnight interest charges. some brokers in Kenya with Islamic accounts are Octa, HF Markets, XM and AvaTrade among others.

Highest leverage forex broker

Leverage in forex trading amplifies your potential profits and losses. While it can magnify your gains, it can also lead to significant losses if the market moves against you.

In Kenya, The CMA (Capital Markets Authority) regulates the forex brokers so there is maximum leverage that the forex brokers must adhere to, which is 1:400. Most forex brokers offer high leverage outside Kenya, between 1:400 and 1:2,000 and some even offer 1:unlimited.

Some high-leverage forex brokers in Kenya that offer high leverage are HF Markets – 1:400, FXTM – 400, and XM Trading – 400. With a forex leverage of 1:400, this means that if you deposit Ksh1,000, you can control up to Ksh400,000 worth of trade value.

Low spread forex brokers

Spread in forex trading is the difference between the bid price and the ask price of a currency pair.

The bid price is the price at which you can sell a currency. Ask price is the price at which you can buy a currency.

For example, if you want to buy euros (EUR) using US dollars (USD). Your forex broker may quote you the following prices for the EUR/USD currency pair:

-Bid price: 1.1050

-Ask price: 1.1052

The spread in this case is 2 pips, which is the difference between the bid price and the ask price.

The spread is essentially the broker’s fee for facilitating your trade. While it is a revenue source for forex brokers, it is a charge to you, the trading. To reduce your trading costs, it is best to trade with a broker that charges low spreads.

Choosing the right low-spread forex broker depends on various factors, including your trading style, budget, and desired features. Here’s a breakdown to help you navigate the options:

Top Low-Spread Forex Brokers in Kenya:

1) HF Markets: Offers tight spreads starting from 0.0 pips with commission-based accounts like the HFM Zero Account and raw spreads from 0.6 pips with the Pro Account.

2) Exness: Known for its consistently low spreads starting around 0.6 pips with Exness Pro Account on major pairs like EURUSD and 0.0 with commission of $3.5 on the Exness Zero and Raw Spread Account.

3) Octa: Provides tight spreads (as low as 0.9 pips on EUR/USD) and commission-free trading on all instruments.

How Do Forex Trading Apps Make Money?

Trading apps do not generate money independent of forex brokers. Most of the fees you will pay will go to your broker. It does not matter if the app is proprietary or from a third-party.

Brokers make money from trading apps in multiple ways. However, we can simplify all of them into trading and non-trading fees. Trading fees are the money you pay to your broker for every trade you make. It does not matter if you won the trade or lost. You will pay these fees.

Spreads, commissions, and swaps are the main trading fees charged by brokers on trading apps. Spread is the difference between the buy and sell price of the CFDs you are trading. Swap is the fee you pay for holding your trades overnight while commissions are usually charged where spread is low.

If you are trading on MT4/MT5 on your mobile device, you will see the amount commission and swap you are charged per trade. Non-trading fees are not connected to trading. They include account inactivity fees (if you don’t place a trade for a certain period), currency conversion fees, etc.

Finally, not all brokers have the same fee structure for their trading apps. A broker may have a low spread account on MetaTrader or offer a commission-free package on their proprietary trading app. Furthermore, inactivity fee is not the same too. Some brokers charge it, some don’t.

So make sure you research your broker’s fee structure before signing up on their trading app.

Is there a difference between forex trading apps and software?

Anything application has to do with mobile phones or tablets. So it is not difficult to understand what forex trading apps are. They are designed and tailored for mobile phones so you can have a smooth experience when trading.

Forex trading software are quite different. They are designed for your laptops, PCs, and desktops. A major advantage software have over apps is the clear view you get. You can see price movements are use charting tools more conveniently with forex trading software.

In addition, you have a better user experience with the advanced trading tools on the software. Tools like backtesting and automated trading are easier to use on trading software because of the view. In summary, forex trading apps are built for convenience and are user friendly. You can be on the move and monitor your trades.

For trading software, you need to be settled with a work station or an office space even especially if you are a full time trader. You cannot carry desktops about. Though some laptops are light enough to carry, they are not as easy to use on the go like trading apps.

So which is better for you? The answer depends on you, your preference, and how you want to trade.

Trading features to look for when choosing a forex trading app

Here are some of the trading features you should check for in your mobile trading app:

1) Watchlists: Watchlists allow you to customize your favorite CFDs into a list so you can track them easily. There is a lot of CFDs in the market. Being able to narrow your focus on a few of them might be helpful.

2) 1-click trading: You don’t always have to use the popup feature when placing your order. 1-click trading allows you to place your order faster. However, some trading apps have terms and conditions connected to using this feature.

Ensure you read and understand this conditions before agreeing to use 1-click trading.

Is there an official trading app for Forex

Forex trading does not have an official trading app. This is because the market has no central physical location. It is a decentralized market. Central banks, financial institutions, forex brokers, and large corporations make up the forex market.

Trading apps for forex are supplied by forex brokers. The app could be own by the broker or developed by a third-party company like MetaQuotes (MetaTrader 4 and MetaTrader 5 developer).

What are the risks of using forex trading apps?

Forex trading apps make on-the-go trading easy, but they also expose you to price volatility. The forex market is unpredictable, with prices changing quickly due to fundamental factors like news, geopolitical issues and economic releases. Traders using mobile apps need to be ready for sudden price changes that can hugely affect your loss or profit because of leverage.

In addition, unregulated mobile apps constitute a huge risk to you. This lack of regulatory oversight might allow forex brokers engage in unethical business practices such as price manipulation, stop hunting, or even denying withdrawal requests. It’s crucial for traders to do thorough research and sign up with mobile apps that are regulated with the Kenya’s Capital Markets Authority. Doing this will also protect you from clone firms.

Cybersecurity threats are also a source of major concern. Trading through mobile apps can expose you to hacking and malware risks. Unauthorized access to your account can result in stolen funds or worse. To mitigate these risks, make sure your password is strong, enable 2FA, and avoid logging into your trading accounts over insecure connections like public Wi-Fi.

Is there a difference between forex trading apps and forex trading platforms?

Forex trading apps and forex trading platforms allow you to trade the financial markets and grants you access to your broker’s system.

Though they perform the same function, they are significantly different. A major difference is that forex trading platforms run on computers while forex trading apps run on mobile devices. In addition, forex trading apps are limited in terms of features and tools required for thorough analysis. Forex trading platforms have these tools in abundance. This is why professional traders prefer trading platforms.

Can I download forex trading apps for free?

Most forex trading apps are free to download. Whether they are proprietary trading apps or third party trading apps like cTrader and the MetaTrader duo (MT4 and MT5).

This should not be confused with trading fees like spreads, commissions, and swaps. They will be on the app just as they are on desktop versions.

Can I open a trading account on a trading app?

Yes, you can open a live or demo account on forex trading apps. If you download MT4 or MT5 for example, you get a demo account from MetaQuotes.

You can switch to your broker’s demo or live account by searching for their server. However, it will likely be more straightforward on your forex broker’s trading app.

You can open a demo or live account directly on the trading app.

What is the most popular forex trading app?

MT4 and MT5 are the most popular forex trading apps. On the Google Play Store alone, MT4 and MT5 have over 20 million downloads between them.

On the Apple App Store, the figure is the same. Some proprietary trading apps also come close to this number. But none beats MT4/MT5 in terms of popularity.

Can I fund my trading account directly from the app?

Yes, with forex trading apps, you can fund your trading account on the go. Some forex brokers might not have all payment methods available on their trading apps. But you should still be able to fund your account with the methods supported.

Note that funding and withdrawals are not possible on third-party trading apps like MT4 and MT5.

Do forex trading apps and desktop platforms have the same tradeable instruments?

This depends on your forex broker and how they operate. If your broker only offers third party trading apps like MT4/MT5, the apps and the desktop platforms will have the same tradeable instruments.

With in-house apps and desktop platforms, brokers have more liberty. They develop the apps and platforms so they may distribute their CFDs differently. Some forex brokers do not even have an in-house desktop platform.

The best way to confirm the availability any CFD is to check your broker’s website. If you cannot confirm this way, use the customer care channels.

Is mobile trading safe?

Forex brokers do have security measures to protect traders that use their trading apps. The most common is the two-factor authentication. This makes sure no one can access your account without your permission.

In addition, some brokers add biometric verification to their security. But you can only use it if your phone has the function.

FAQs on Best Forex Trading Apps Kenya

Which is the best forex trading platform in Kenya?

Any trading platform with tier-1 regulation and CMA regulation is considered safe for Kenyans. You can then consider other factors like fees, trading software, customer support, etc before choosing a trading platform.

Which is the best trading app in Kenya?

HF Markets, Exness, FXTM, and Pepperstone have the best forex trading apps according to our review.

What app do most forex traders use?

MT4 and MT5 are the trading apps most traders use. But it is not uncommon to find traders using a broker’s proprietary trading app.