Forex trading is one of the most important financial markets all over the world. If you are thinking about signing up for an account with a forex broker to trade on the Kenyan market, then this post is for you.

You could register with one of the six Kenyan forex brokers that accept M-Pesa and credit your account instantly. Many foreign brokers that accept MPesa are unregulated or not safe.

We have listed only brokers that are regulated with Capital Markets Authority (CMA) in Kenya, or at least one Tier 1 regulator, with details on their trading fees, withdrawal time, platforms & more.

Comparison of Best Forex Brokers in Kenya that Accept MPesa

| Forex Broker | Regulation | Maximum Leverage | Minimum Deposit | |

|---|---|---|---|---|

| FxPesa |

CMA,FCA

|

1.400

|

$5 for Executive Account

|

Visit Broker |

| Exness |

FSCA, FCA, CySEC

|

1:2000

|

$1

|

Visit Broker |

| Scope Markets |

CMA

|

1:500

|

$50

|

Visit Broker |

| XM Forex Kenya |

CySEC, FSC Belize

|

1:888

|

$5

|

Visit Broker |

| FXTM |

FSCA, FCA, CySEC

|

1:2000

|

$50

|

Visit Broker |

| HF Markets |

CySEC, CMA, FCA, FSCA

|

1:400

|

$5

|

Visit Broker |

Best Forex Brokers in Kenya that Accept MPesa

Below is the list of Best Forex Brokers in Kenya accepting Mpesa:

- FxPesa – Best Forex broker for Trading with MPesa

- Exness -Forex Trading with MPesa at Low Fees

- Scope Markets Kenya – Regulated Forex Broker for MPesa

- XM Forex – MPesa Forex Broker with Zero Commission Accounts

- FXTM – CMA Regulated MPesa Forex Trading Platform

- HF Markets – Good MPesa Forex Broker

Here is a description of each and their trading application:

#1 FxPesa – Best Forex broker for Trading with MPesa

FxPesa is a local forex broker in Kenya registered as EGM Securities Limited and is one of the only 6 forex brokers that is regulated in Kenya under the CMA.

The company is also licensed by the Financial Conduct Authority (FCA), in the UK.

You can access the FxPesa trading platform on the web, MT4 trader and mobile applications on Android and iOS devices, from which you can trade Forex and CFDs on Indices, over 60 currencies pairs, Shares, Commodities, and they accept MPesa.

FxPesa offers traders two account types. The executive account requires a minimum deposit of $5 to start trading, has an average spread of 1.4 pips, with no commissions. While the Premiere account requires a minimum deposit of $100, has zero spreads, with a commission of $7.0. KES account is available in Kenya, meaning that Kenyan clients can make deposits and withdrawals with Mpesa without worrying about currency conversion and any associated fees.

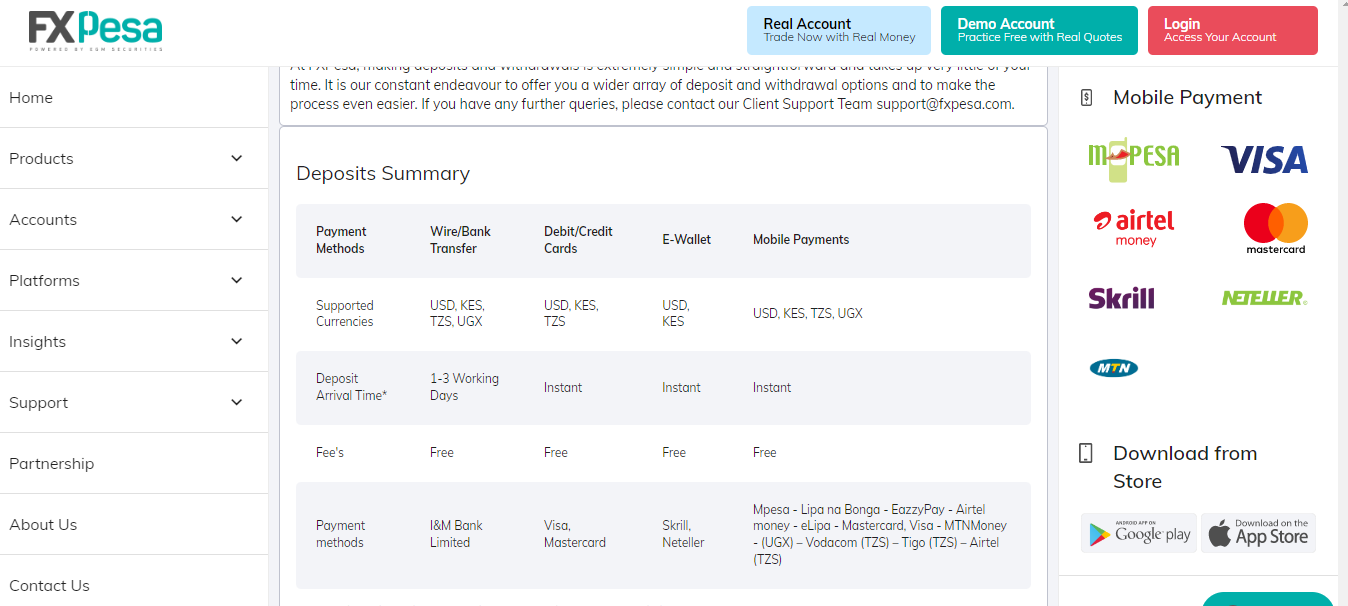

FxPesa offers free deposits to traders. While direct wire bank transfers take 1-3 days to credit to the trading account, payments through cards, e-wallets (Skrill, Neteller), and mobile money (MPesa) are credited instantly.

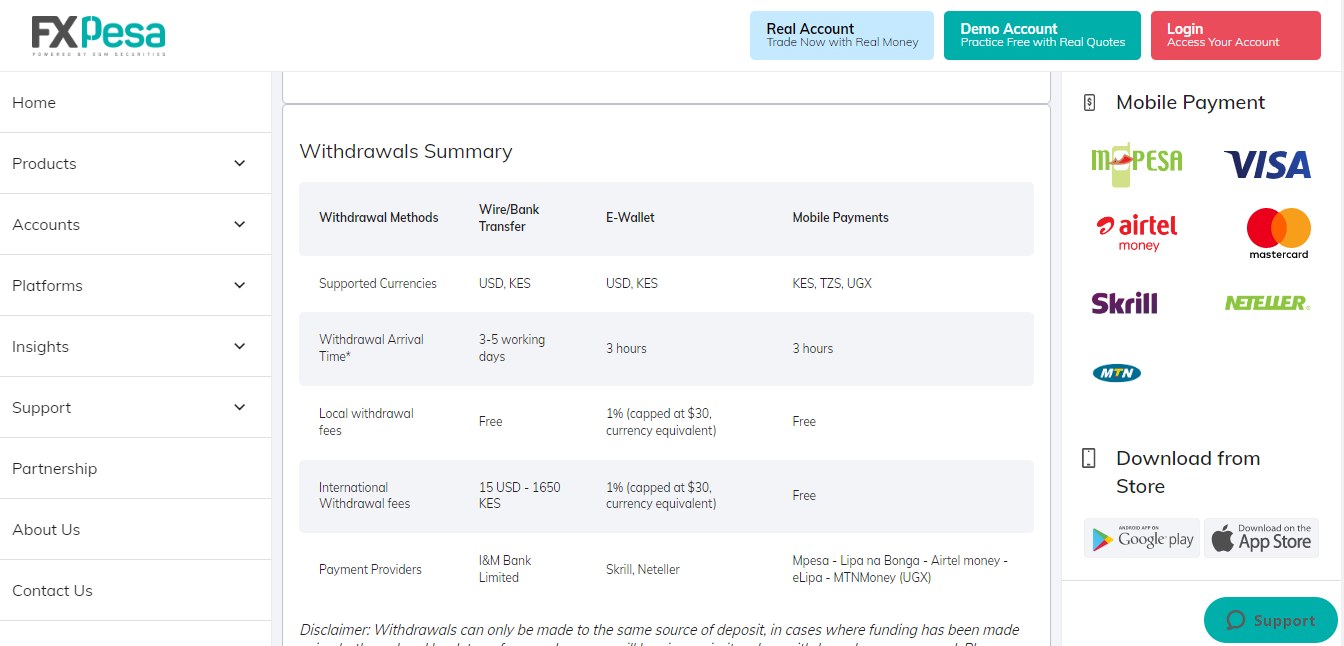

Withdrawals to Kenyan bank accounts are received within 1-3 days and have no fees. Withdrawals to e-wallets attract a 1% charge, which is capped at $30 and is received within 3 hours. Withdrawals to MPesa are received in 3 hours and are free of charge.

It is important to note that withdrawals are only sent to the same account from which the deposit was made and withdrawals initiated after 3:00 PM EST are processed the next day.

FxPesa has email and toll-free phone number support for traders in Kenya. Their 24/6 live chat responds in under 2 minutes and refers you to send an email if no representative is available.

FxPesa has Forex educational materials and news updates on its website insights section.

FxPesa Pros

- CMA regulation

- Fee structure is easy to understand

- Good customer support

- Offers KES account

FxPesa Cons

- High spreads

- Limited number of shares CFDs

#2 Exness -Forex Trading with MPesa at Low Fees

The Exness Group is a leading financial services provider founded in 2008 that offers trading in financial instruments and CFDs including stocks, currency pairs, cryptocurrencies, metals, energies, and indices.

Exness is licensed by 1 Tier 1 regulation – FCA & 1 Tier 2 Cyprus Securities and Exchange Commission (CySEC) and by the Financial Sector Conduct Authority (FSCA) in South Africa. This makes them safe to trade with.

Exness has MT4, MT5, and WebTerminal trading platforms, with mobile apps available on the App Store and Google Play Store.

Traders can choose either the standard account which has an average spread of 1.5 pips for currency pairs or a professional Zero account which has zero spreads but requires a minimum deposit of $500 with commissions starting at $0.1. Exness also offers Islamic accounts with zero spreads and swaps.

Offers deposits and withdrawals via MPesa. The minimum deposit is $10 and a maximum of $2,700 per transaction. The minimum withdrawal amount on Exness is $1 and a maximum of $1,000 via Rave or $4,800 via Duapay per transaction.

Exness charges zero deposit and withdrawal fees, no commissions, and withdrawals can only be made to the same source deposit was made from and can be initiated 24/7 from the platform.

Cards, mobile money, and e-wallet deposits are credited instantly while withdrawals to e-wallets are instant, it takes about 72 hours for card withdrawals to be credited. Deposits and withdrawals made with cryptocurrencies are executed in 72 hours.

Exness has support via email, phone number (no local phone in Kenya), and live chat. Their live chat virtual assistant starts by showing you some answers to frequently asked questions (FAQ) and you can request to be transferred to a live agent. Response time was under 5 minutes.

Exness Pros

- Top-tier regulation with the FCA

- Different account types with varying execution

- KES account is available for residents of Kenya

Exness Cons

- Not regulated in Kenya

- High fees especially with commissions

- No local mobile number

#3 Scope Markets Kenya – Regulated Forex Broker for MPesa

Scope Markets Kenya is a CMA regulated broker, that offers forex and CFDs trading on Futures Indices, Cash Indices, Commodities, and Shares. They also hold a license to trade in derivatives.

Scope Markets Kenya has two account types for traders, Gold, and Silver. Their trading platforms are MT5 on the web, iOS, and Android. Kenyan residents can choose between KES and USD as account base currency.

Payment methods accepted are cards, e-wallets, MPesa, and direct bank transfers. The app has calculators for pips, margins, swaps, and profit.

Gold account charges a commission of $3.5 per side and 0.2 spread while silver charges spread only, starting at 1.1 pips for pairs like EURUSD.

There are no deposit or withdrawal fees on Scope Markets and all accounts are swap-free with maximum leverage of 1:400.

Deposits made via MPesa are credited instantly, while bank transfers take up to 24 hours. The minimum deposit amount is $100.

Withdrawals can be made at any time, those initiated after 6 PM GMT+3 are processed in the next business day. Withdrawals to MPesa are processed instantly with a minimum amount of $5 while withdrawals to bank accounts in Kenya take about 1-2 business days to be credited and the minimum amount is $1,500.

Scope Markets Kenya has an office in Nairobi, offers support via email, a local phone number, and live chat that responds within 2 minutes on weekdays.

Scope Markets Pros

- Good education

- Zero commission

- Well regulated

- Kenyan Shillings (KES) account is available.

Scope Markets Cons

- Minimum deposit is high

- Only one account is available

#4 XM Forex- MPesa Forex Broker with Zero Commission Accounts

XM is one of the biggest online Forex brokers offering CFDs trading on 1000+ financial instruments, including forex, commodities, indices, stocks, futures, energies, and metals on standard MT4 & MT5 based apps for all devices (web, android, and iOS).

XM is licensed by CySEC and Financial Services Commission (FSC), Belize, which makes them score moderate on trust and safety of funds for traders.

XM account types are Micro, Standard, Ultra Low, and Shares, with an option for an Islamic account. Traders can hold more than one account type.

All accounts have negative balance protection that prevents traders from losing more than the money in their trading account.

XM offer promotional loyalty deposit bonuses from time to time, up to $4,500, and a welcome bonus of $30 for new users.

There are no deposit or withdrawal fees. Only the Shares account has commission fees. Spread is 0.6 pips for Ultra-Low accounts and 1 pip for Micro and Standard.

If an account is inactive for six months, XM charges an inactivity fee of $5 monthly on the free balance. If there is no free balance, then no fee is charged.

The minimum deposit amount for Micro, Standard, and XM Ultra-Low accounts is $5, and $10,000 for Shares account.

You need to log in to your account to view the deposit methods. XM accepts MPesa, and you need to select the Mobile payment method in the deposit methods in the XM panel to see it. Deposits made via bank transfers and MPesa can take up to 5 days to be credited, while cards and e-wallet deposits are credited instantly.

Withdrawals to MPesa, e-wallets, bank accounts, and cards are processed within 24 hours. The minimum withdrawal amount is $5.

XM has email, international phone, and fast and responsive live chat support, which is available 24 hours Monday through Friday. They also have an educational section on their website for traders.

XM Pros

- Top-tier regulation with ASIC

- No order requotes

- No deposit/withdrawal fees

- Solid live chat support

XM Cons

- Limited shares CFDs

- No crypto CFDs

- Solid live chat support

- Does not offer KES account

#5 FXTM – CMA Regulated MPesa Forex Trading Platform

FXTM is a leading online forex broker in Kenya that is regulated under the CMA as Exinity Group. They are registered as ForexTime Limited in Cyprus and are well regulated by the CySEC, FCA and FSCA.

FXTM offers a range of financial products and CFDs on currencies, cryptocurrencies, shares, and commodities. FXTM trading platforms are available on Web traders, Android & iOS Apps, MT4 & MT5.

Trading accounts are categorized into Micro, Advantage, and Advantage plus. Also, offer demo accounts for new traders to learn.

Micro and Advantage plus accounts attract zero commission and spread fees from 1.5 pips, while the Advantage account has commission fees from $0.2 to $2 and ultra-tight spreads starting at 0.0 pips.

Zero deposit fees apply. While no withdrawal fees are charged on e-wallets like Skrill and bank transfers in Kenya, transfers to cards attract a fee of $3 per transaction and 2% is charged on the withdrawal to WebMoney accounts.

FXTM charges a monthly inactivity fee of $5, after six months of an account being inactive.

If you request to withdraw funds without any trading activity after the deposit, FXTM charges 3% of the money as a withdrawal fee, and withdrawals can only be made to the same source deposit was made from.

Profits from trading can be withdrawn to different accounts.

To start trading, a minimum deposit of $10 is required for Micro accounts, while Advantage and Advantage Plus Account require $500.

Withdrawals are processed within 1 day and funds are received in your bank account. And you need to have enough free margins on your account to cover your withdrawals.

Note that FXTM does not accept MPesa, and supports only USD accounts for clients in Kenya.

FXTM has email and phone number support, with a live chat assistant that answers basic questions and you can request to be transferred to a live agent, who typically responds in 1 minute on working days.

FXTM Pros

- Well regulated

- Good education content on their website

- Quick account opening

- Payments are processed quickly

FXTM Cons

- High trading fees

- No local support for Kenya-based traders.

- No KES account.

#6 HF Markets – Good MPesa Forex Broker

HF Markets is a well-regulated forex broker in Kenya that accepts MPesa, licensed by one Tier 1 regulator FCA, DFSA, FSCA, CMA, and Financial Services Authority (Seychelles).

HF Markets is a well-regulated forex broker in Kenya that accepts MPesa, licensed by one Tier 1 regulator FCA, DFSA, FSCA, CMA, and Financial Services Authority (Seychelles).

The company offers trading for 57 currency pairs (including majors & minors), CFDs on 56 shares, 7 crypto assets, commodities, indices, energies, and ETFs. They use the MT4 and MT5 web-based platforms, with mobile app versions (Android & iPhone).

Account types available with HF Markets are Premium, Zero, Micro, Auto, PAMM, and HFCopy. KES, USD are the available account base currencies for Kenyan traders.

Premium accounts are commission-free spread only, while there is a spread + $6 commission per 100,000 units (1 standard lot) with their Zero Account.

HF Markets provides technologies like Trading Calculator, Economic Calendar, VPS Hosting Services, Auto Trading, etc. to make trading easy and friendly.

Traders can use robots like Expert Advisors (EAs) on HF Markets. They also have educational resources like courses, webinars, and video tutorials to help traders learn and understand the platform.

HF Markets fees are competitive with a Premium account, with no charges on deposits or withdrawals via MPesa.

Typical spreads for Premium, Micro and Auto accounts is 1.3 pips while it is 0.1 for Zero accounts.

The micro account requires a $5 minimum deposit for activation, $100 for Premium account, and $200 for Zero and Auto accounts.

While deposits through bank transfers are credited within 2-7 days, cards and mobile money (MPesa and WebMoney) deposits are credited instantly and it can take up to 10 minutes for e-wallets deposits to be credited.

Withdrawals through wire transfer require a minimum of $10 and $5 for cards. Both are processed within 2-10 business days. A minimum of $5 is required for mobile money and cryptocurrencies. While mobile money withdrawals are processed immediately, cryptocurrencies take about 2-10 business days with a 1% charge of the amount through bitpay.

HFMarkets offers 24 hours weekdays support via a phone helpline but does not have local phone support in Kenya. We didn’t experience a hold time of more than a minute anytime while connecting on their live chat, and email is fair & normally reply within 2 hours on. Overall support is good.

HF Markets Pros

- Tight spreads

- Fast execution

- No deposit/withdrawal fees

- Regulated in Kenya

- STP execution so no dealing desk

- KES account is available

HF Markets Cons

- Customer service is not 24/7

- Multiple accounts that might be difficult for beginners to grasp

What is MPesa

M-Pesa was launched by Vodafone and Safaricom in 2007. Since its launch in Kenya, M-Pesa has expanded to other African countries like Tanzania, Mozambique, DRC, Lesotho, Ghana, and Egypt. M-Pesa is a mobile-based money transfer service and a branchless banking service. In the financial year ending 31 March 2022, MPeas had read about 52.4 million active users.

M-Pesa also won the award for the most successful payment system in the developing world. M-Pesa is a mobile payment solution that allows users to use their app as an e-wallet. You can make deposits/withdrawals and pay for different services on the app. There are no fixed transaction costs with M-Pesa. The higher the size of your transaction, the more the transaction cost you will incur.

Finally, M-Pesa is safe because they are regulated in all the countries they operate. They are either regulated by

the Central Banks or a body that regulates financial service providers. M-Pesa supports different currencies (major and emerging). Funding via M-Pesa is not an exclusive process. Forex brokers in Kenya supports other payment methods as well.

However, M-Pesa keeps growing in popularity because it is easy to use. You only need to link your bank account to M-Pesa and then link your trading account to M-Pesa.

How to Open Forex Trading Account with M-Pesa?

1. Choose a Regulated Forex Broker: Is the broker regulated with CMA? The first step to opening a forex trading account is to pick a broker. It is important that you trade with well-regulated brokers. Currently, only 7 brokers are regulated by CMA. These include FXPesa, Scope Markets Kenya, FXTM, HF Markets, Windsor Brokers, Tradenex Limited, and PepperStone.

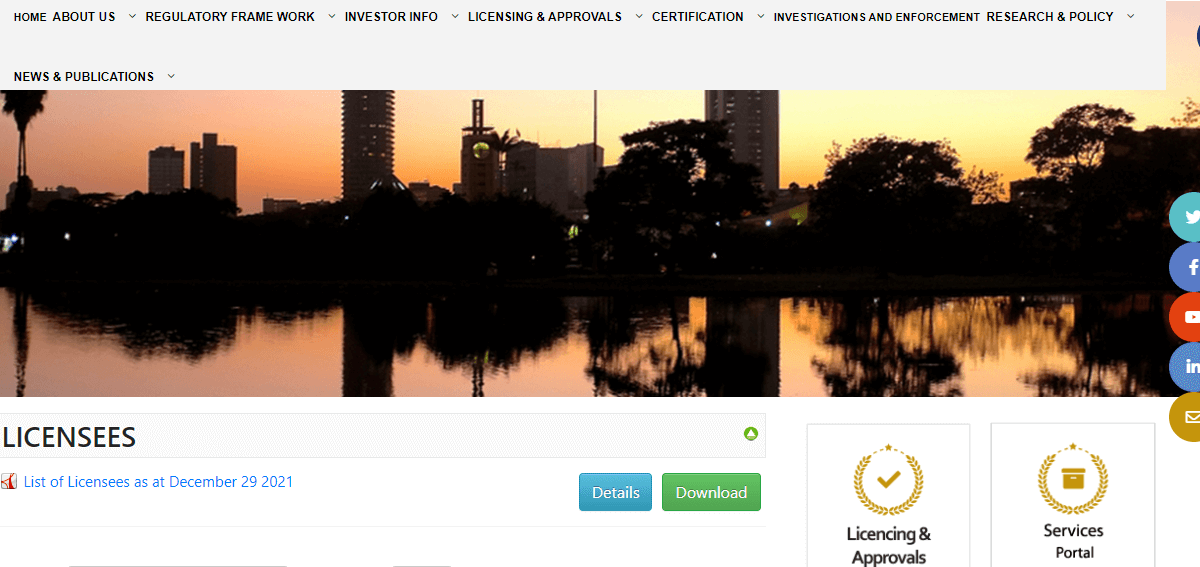

- You can verify registered brokers on the CMA website, by downloading the list of licenses. Next, you search for the broker’s name. It appears under the ‘Non-dealing Online Foreign Exchange Broker’ title.

Let’s take FxPesa for example.

To start trading with FxPesa, you need to open a live account on their website:

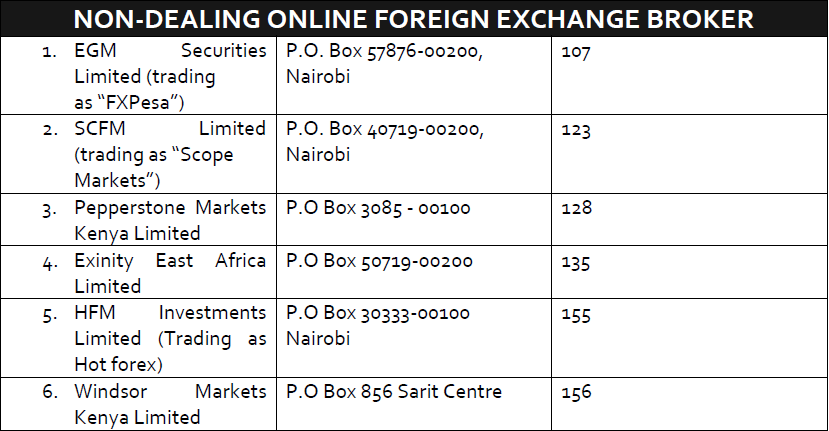

2. Signup with the Broker: This generally involves a straightforward process. We will break down the signup info into 3 processes.

a. You will be required to enter contact information including phone number, email, and full name. A 4 digits code will be sent to your phone, you will enter the code and continue.

b. Then fill in details on personal information, set a password, and choose an account type.

c. Next, you will be required to provide some information about your trading experience and to read and sign the legal declaration online.

3. Verify Your Account: A confirmation email will be sent to you, which will confirm that you have signed up with the broker. The email will also include the next steps which you need to follow.

And you will be required to verify your identity by uploading a government-issued ID and an address verification document like a water bill.

4. Account Approved: Afterwards, if your account opening is approved, you will receive an email with your login details and a link to download the app.

On the app, you can make deposits and start trading. You can deposit via Mobile money MPesa. Generally, the deposits are instant (a few minutes) at most of the brokers using this method.

How to Choose Forex Brokers in Kenya that Accept MPesa

Apart from CMA regulation, there are other important factors to consider when choosing a broker that accepts MPesa. We have covered how you can verify a broker’s CMA regulation in the previous section. Here, we will be looking at other factors. Putting all of these factors together is important for a wholesome trading experience. Here are some of them.

Tier-1 Regulations: The brokers in this review are regulated with the CMA. This is the local regulation and we have covered this. However, there are other top regulations that make trading low risk. Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Both regulators operate in the UK and Australia respectively. If your broker accepts MPesa and is regulated with the CMA, FCA, and ASIC, then they are low risk. In fact, you should check it for yourself.

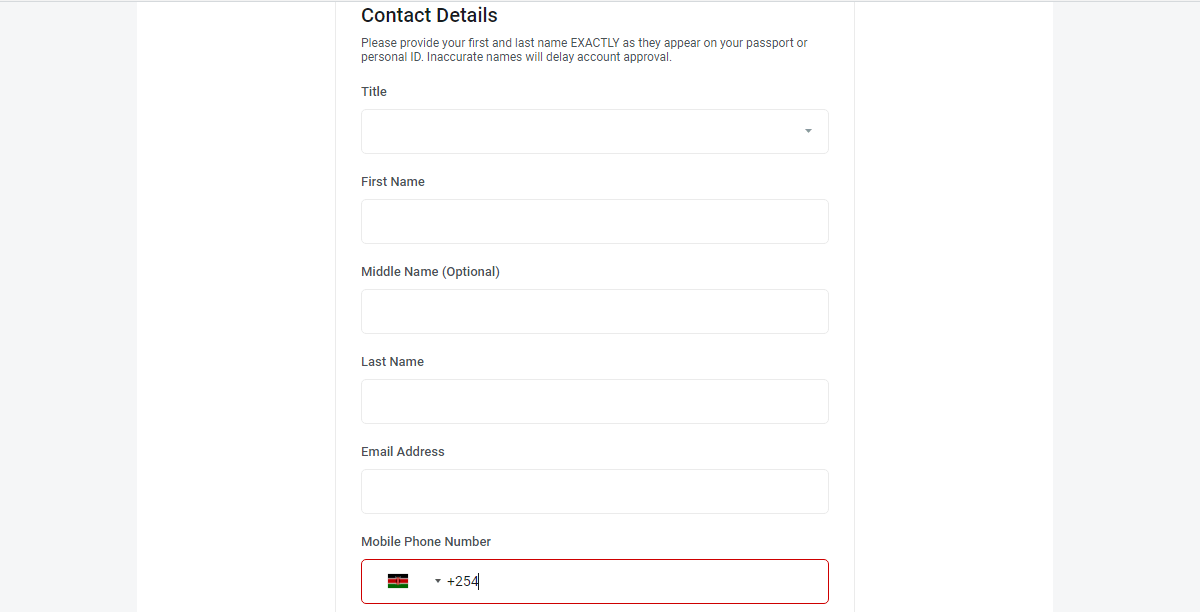

Here is a screenshot of Pepperstone’s regulation

As seen above, Pepperstone has top regulations with ASIC and the FCA. Therefore, you can consider them low-risk. Any broker with these top regulations is less risky.

Fees: Deposit/withdrawal charges are non-trading fees. However, there are other trading fees like spread, commissions, and swaps. Most brokers charge spread and swaps. Commissions might or might not be charged based on account type.

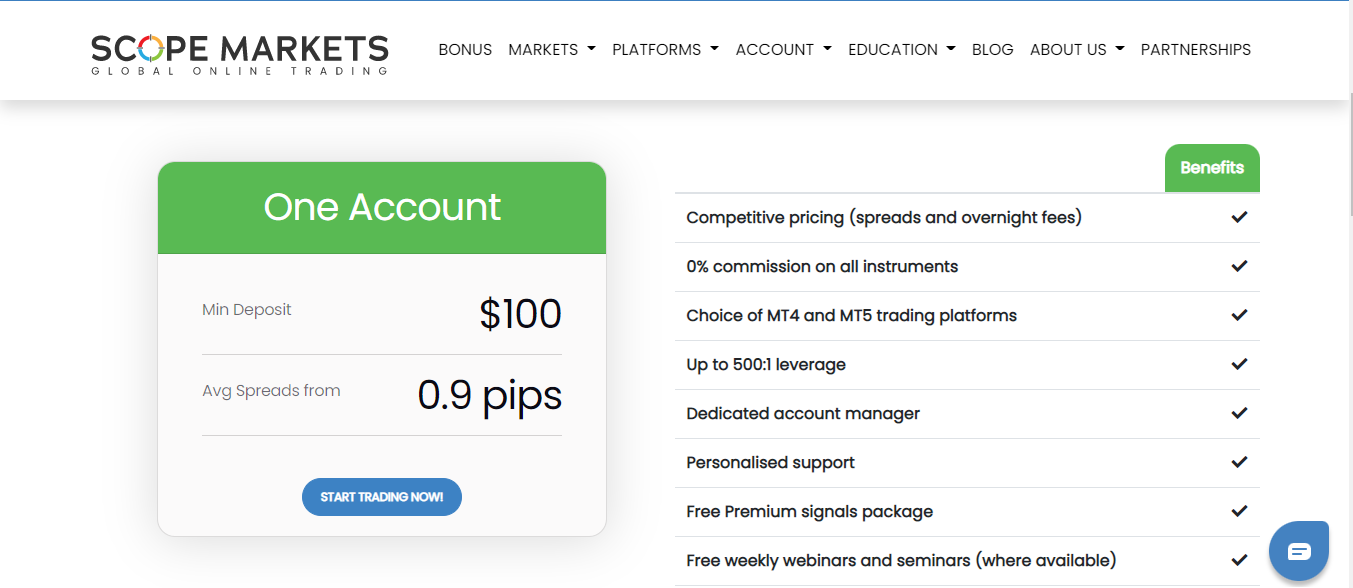

Trading fees affect your final profit or loss. Brokers charge them regardless of your trade result. This is why it is important you check if they are high or low. Here is how you can check for fees with Scope Markets (example broker).

You begin by going to their website and clicking on ‘ACCOUNT’. You will see a single dropdown that says ‘ONE ACCOUNT’ (highlighted yellow). Click it as shown below

When you click ‘ONE ACCOUNT’, you will see the characteristics of Scope Markets account and trading fees as shown below

From the image, you can see that the average spread for CFDs begins from 0.9 which is quite high. However, there are no extra commissions charged per standard lot. It is good to note that not all brokers have their fees summarised in a page like this. It might take a few more clicks but you will be able to find the fees easily once you get to their website.

Another important fee to pay attention to is your broker’s currency conversion fees. A major benefit of M-Pesa is that it allow you deposit and receive payment in KES. It is likely your broker does not have an account with KES as its base currency. When you fund your account in KES, it will be converted to US dollars or any other base currency that you choose.

Some forex brokers might charge a commission on this conversion which affects the final amount that reflects in your trading account. Always check with your broker to know of they charge conversion fees and how much it is.

Range of CFDs: It is no use if your broker accepts M-Pesa but does not have the instruments you want to trade. If you want to trade US stocks, for example, you need to be sure your broker has them. It should not be currency pairs only. Indices, commodities, and cryptocurrencies are other CFDs that should be offered by your preferred broker.

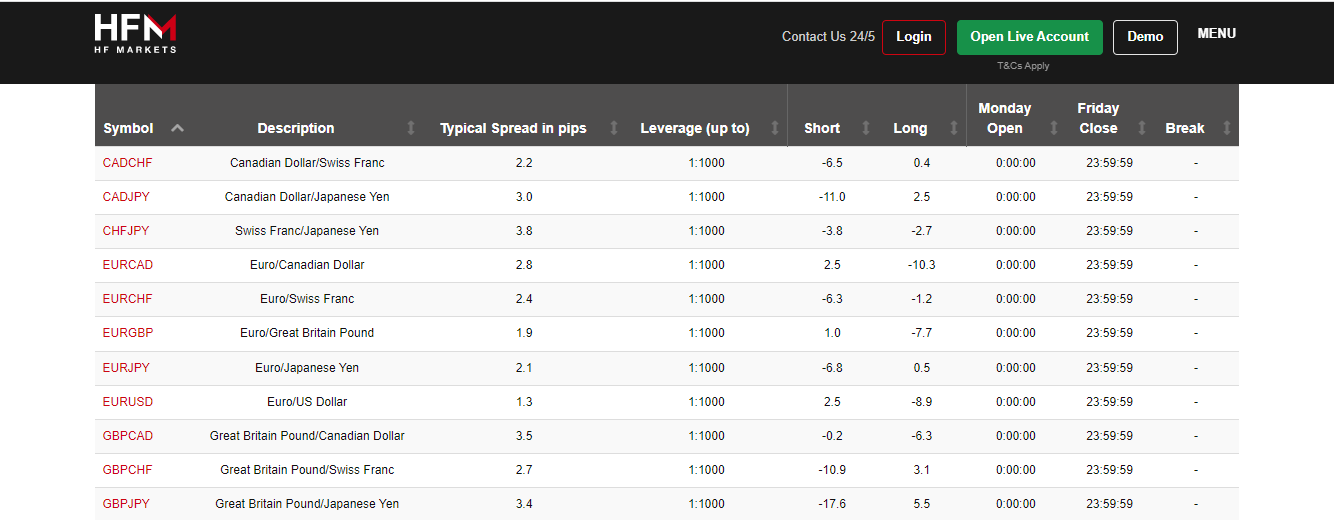

This is why you should check the trading instruments on your broker’s website. Let us take HF Markets for example, on their homepage, click on ‘PRODUCTS’.

As you can see, HF Markets have 8 instruments. There are currency pairs, ETFs, commodities, metals, energies, etc. If you click on any of the instrument classes, you will find more details about them. Leverage, swaps, trading hours, and spread. Here is an illustration below

Deposit/Withdrawals: Your broker should not have just MPesa alone. You should check how effective it is. How long does it take to deposit/withdraw via MPesa? Can you fund via local currency? How soon does payment reflect in your accounts? These are questions that determine how effective your broker is with MPesa. To answer these questions, you can send an email to your broker. Ensure that you make the relevant inquiries.

If you’d like to check yourself. Here is how you go about it (FxPesa is our example here). On FxPesa’s homepage, click on ‘Support’. You will see a dropdown with some options. Among the options, click on ‘Deposits and Withdrawals’ (in the red box)

As shown below, you can see that MPesa is available (under mobile payment) for funding your account. It is free and you can deposit in KES. Also, your money arrives in your trading account instantly.

If you scroll down to the withdrawals section, you will see the image below

Like deposits, MPesa is available for withdrawals, is free, and you can withdraw your money in KES. And it will take about 3 hours for the transaction to reflect in your account.

Platforms: Before choosing a broker that accepts M-Pesa, you should consider their trading platforms. Does the broker support MT4/MT5 which are the most common trading platforms?

Are there other third-party platforms like cTrader and TradingView with advanced technical tools?. Finally, you want to make sure that they have platforms that you can use on multiple devices and operating systems.

Customer Support: Good customer service is key. Using MPesa involves the movement of money. Unforeseen circumstances can lead to incomplete transactions. In this case, you want to be able to contact your broker and get swift responses. This is why you should test a broker’s support before signing up. It should not be because they accept MPesa alone.

Most brokers make their customer support accessible to non-clients. So you can test their email and live support to see how swiftly they respond. You also want to check if the responses you get are relevant to your inquiries. If the broker you are testing has an office in Kenya, you should ask if they receive customers there.

Also, you might want to know more about fees attached to funding/withdrawal via MPesa. For this, you can use your broker’s FAQ section. Inquiries about funding methods are one of the most popular questions clients ask CFD brokers in FAQs. You will find it useful as well. Below is a screenshot of deposit FAQs from Scope Markets’ website.

What are the benefits of using MPesa for forex trading in Kenya?

MPesa offers several benefits for forex trading in Kenya, making it a popular choice for many traders:

Convenience and accessibility:

1) Widely used: MPesa boasts widespread adoption in Kenya, making it readily available for deposits and withdrawals from forex platforms.

2) Mobile transactions: Deposits and withdrawals can be done conveniently through your mobile phone, eliminating the need for physical bank visits.

3) Fast and affordable: Transactions are typically processed quickly and often come with lower fees compared to traditional bank transfers.

4) Simple interface: MPesa’s user-friendly interface makes it easy to navigate and manage transactions, even for those unfamiliar with online banking.

Flexibility and control:

1) Small starting amounts: MPesa allows small deposits, facilitating participation in forex trading with minimal initial investment.

2) Regular top-ups: You can easily top up your trading account with additional funds from your MPesa balance as needed.

3) Trackable transactions: MPesa transactions provide a clear record of your deposits and withdrawals, aiding in financial management and tax compliance.

4) High transfer limit: MPesa has a high maximum transaction. This allows you deposit sizeable amount of money if you have to. MPesa’s transaction limit is 500,000 KES.

However, it’s crucial to remember that MPesa for forex trading also involves risks, such as market volatility and potential scams. Always choose a reputable broker, prioritize responsible trading practices, and manage your risk exposure carefully.

What are the cons of using MPesa for forex trading in Kenya?

1) Not widely available: MPesa is popular in Kenya and other areas in Africa. In fact, it is an acceptable payment method across 70% of the continent. However, there are geographical restriction to its availability globally. Only few countries in Africa accept MPesa as a payment method. This definitely limits the use of MPesa by a number of brokers that accept Kenyan traders.

2) Not enough brokers: If you have a strong preference for MPesa as payment method, then your options of forex brokers might be limited. Many forex brokers still prefer e-wallets like Skrill and PayPal. The use of M-Pesa is not widely available on forex platforms.

3) Transaction cap: MPesa has a transaction limit. Basically, there are two transaction limits that apply to you. There is the daily transaction limit and the limit per transaction. You cannot exceed Ksh500,000 transaction value per day and you cannot transact beyond KSh 250,000 per transaction.

If you are a high volume trader, these limits might affect your deposit or withdrawals.

4) Currency conversion fees: If your trading account is not KES-based, you might incur currency conversion fees. The fee might be charge by your broker or payment processor. This mean your KES deposit will be converted to USD (if that is your account’s base currency for example)

What Are the risk of using forex brokers with MPesa

Like other deposit and withdrawal methods, using MPesa with Forex Brokers also has some risks, and here are some of such risks:

1) Risk of Delayed Deposits: As a Forex trader, you need fast deposit methods, especially when you need to meet a margin call or quickly take advantage of a market trend you have observed. Mpesa does not offer that fast deposit process.

If you wish to fund your trading account using MPesa and your MPesa wallet balance is not up to the amount you need, to top up your MPesa balance, you need to physically take cash equivalent of the amount you want to deposit to an MPesa cash merchant who will then deposit the money into your wallet.

When the money is deposited into your wallet, you can use it to fund your brokerage trading account. This entire process is long and can put you at risk of losing out on market trends or having your open position(s) closed out due to lack of required margin.

2) Risk of Delayed Withdrawal Most brokers require that you withdraw your deposit with the same method you used to fund.

For example if you deposit 1,000 KES using MPesa and trade to bring your balance to 1,500 KES, you have to withdraw the 1,000 KES you initially deposited using MPesa, then you can use other methods to withdraw your profit.

If something happens (like SIM swap, or SIM block) and you lose access to your Safaricom SIM card, you cannot withdraw. And you need to first withdraw your deposit before you can withdraw your profit, so your money is stuck until the problem is rectified.

You are also likely to experience delayed withdrawal if Safaricom has a poor network at the time you wish to withdraw.

3) Being Scammed: MPesa users have been a constant target of cybercriminals and scammers.

These scammers can call you, or send you a message pretending to be a staff of Safaricom, claiming that they have detected a problem with your MPesa wallet and requesting sensitive information like MPesa PIN, ID card name and number, your last transaction (when, who it was to and how much), and when and how much was the last airtime you purchased using MPesa.

Once you give them this information, they will request that you switch your phone off for about 5 minutes.

During this time, they should have successfully swapped your phone number to a SIM card in their possession using the information you gave them.

Once they have control over your phone number, they can now see your transaction with your broker, and if you made any withdrawal from your trading account to MPesa, they can withdraw it using your PIN.

More woes to you, if you use the same PIN or a similar variant as your trading account password, as they can also use it to gain access to your trading account, log you out, and wipe out your balance.

Which forex brokers allow deposits and withdrawals via MPesa?

Here are some reputable forex brokers that allow you to make deposits and withdrawals via MPesa in Kenya:

1) FXPesa: A CMA regulated broker with office in Kenya, offers low fees and instant deposits/withdrawals in Mpesa.

2) Exness: A well-established broker with competitive spreads, diverse instruments, and reliable MPesa integration.

3) HF Markets: Offers tight spreads, multiple platforms including MetaTrader 4 and 5, and convenient MPesa transactions.

4) Pepperstone: Renowned for its low fees, Raw Spreads accounts, and user-friendly platform with seamless MPesa functionality.

How Secure is MPesa?

Mpesa prioritizes your safety as a customer. When you complete your registration, you have to complete your know-your-customer (KYC) verification. MPesa also assures your your security because you can only complete your registration through their many authorised agents. In fact, you cannot deposit your money if your registration is not complete.

Furthermore, there are also security measures around your transactions. When you try to send funds via MPesa, the company verifies it before it is sent. They ensure that your money goes to where you send it. They also check to make sure that the money is going to a legal source.

In Kenya, MPesa have carried out various studies to test whether their systems are really secured. The aim of this study was to ensure whether customer passwords and personal data are safe. It was also to ensure that they are implementing the right solution and innovation for data security.

In conclusion, no system is 100% secure. However, MPesa have a track record of protecting customer data and providing safe transactions.

How to Deposit Money via M-Pesa

1) Choose M-Pesa on your broker’s payment portal.

2) Select currency and the amount you want to deposit.

3) Proceed by clicking ‘Confirm Payment’

4) Enter your M-Pesa registered phone number. Ensure it begins with +254. That is the Kenyan country code.

5) Click ‘Pay’

6) You will receive USSD prompts on your mobile phone. Follow these prompts to complete your payment.

How to Withdraw Money via M-Pesa

We will be using FXPesa as an example for this section.

1) On your FXPesa’s dashboard, click withdrawal. You will find different withdrawal options including M-Pesa. Here is an image below:

2) Select the account from which you wish to withdraw

3) Specify the amount to be withdrawn

4) Submit your request

Can I link my M-Pesa account directly to my trading platform?

For normal bank transactions, you can link your M-Pesa account to your bank account. However, it is different when you want to fund your trading account. Instead of linking to a bank account, you will use your broker’s client portal to process your deposits and withdrawals. It is the portal that directs you to M-Pesa

Can I use M-Pesa to fund more than one forex trading account?

You should be able to fund more than one account with M-Pesa provided the accounts are with the same broker. The trading accounts should also e under your name. Since most brokers operate a return to source policy, you will also have to use M-Pesa to withdraw from these accounts.

Do all M-Pesa forex brokers offer demo accounts?

Yes, almost all reputable forex brokers that support M-Pesa deposits and withdrawals also offer demo accounts. This allows beginners to practice trading with virtual funds in a risk-free environment. You also get familiar with market conditions before trading with real money

FxPesa is one of the brokers we reviewed and they have a demo account.

Do all forex brokers support M-Pesa for deposits and withdrawals?

No, not all forex brokers support M-Pesa. It is a very popular method in places like Kenya, Tanzania and other parts of Africa. However, it is not as global as other common payment methods. This is one of the reasons international brokers do not support M-Pesa.

Best M-Pesa Accepting Forex Brokers in Kenya FAQs

Which MPesa Accepting Forex Brokers are regulated in Kenya?

FXPesa, Scope Markets, and HF Markets are the forex brokers that accept MPesa and are regulated in Kenya by the CMA.

Which MPesa Forex Broker has the lowest fees?

The Mpesa Forex Broker with the lowest fees in Kenya is HF Markets because their spreads on the Zero Account start from 0.1 pips for majors like EURUSD and the account has a commission of $6 round-turn or KSh. 660.

Is FxPesa a broker?

Yes, FXPesa is an online exchange broker. Their parent company is EGM Securities Limited.

How much minimum deposit is required for Forex Trading in Kenya via MPesa?

The minimum deposit depends on the forex broker that you are choosing. FXPesa has a minimum deposit of $5 or KES equivalent for deposit via MPesa. HF Markets has a minimum deposit of 700 KES via MPesa.

How do I start Forex Trading with MPesa in Kenya?

To start forex trading using MPesa in Kenya, first select a broker that accepts MPesa as deposit and withdrawal method, and is regulated by the Central Bank of Kenya.

FXPesa, HF Markets, and Scope Markets accept MPesa and are regulated by the Capital Markets Authority in Kenya.

After deciding which broker you want to use, check out the steps (above the FAQs) that take you through the process of creating an account and starting to trade forex.