Online Forex Brokers in Kenya are regulated by The Capital Markets Authority (CMA). Currently, there are only six Non-Dealing Forex Brokers in Kenya which are authorized by CMA & legal.

It is advised for forex traders to only trade with CMA authorized forex brokers for the safety of their funds. Trading with an unregulated broker is highly risky as you can lose your funds since you are not protected by law. In fact, trading with an unlicensed broker in Kenya is considered illegal.

Comparison of CMA Regulated Forex Brokers in Kenya

| Forex Broker | Regulation | EUR/USD Spread | Minimum Deposit | |

|---|---|---|---|---|

| FxPesa |

CMA,FCA

|

0 pips with Premiere Account

|

$5 for Executive Account

|

Visit Broker |

| HF Markets Kenya |

CySEC, CMA, FCA, FSCA

|

1.4 pips

|

$5

|

Visit Broker |

| Scope Markets |

CMA

|

0.2 pips with Silver account

|

$5

|

Visit Broker |

| Pepperstone Kenya |

ASIC, FCA, CMA, CySEC

|

0.8 pips

|

$200

|

Visit Broker |

| Exinity |

CMA, FSC, FSRA

|

0.0 pips

|

$20

|

Visit Broker |

| Admirals |

CMA, FSCA, ASIC, CySEC

|

0.8 pips

|

$25

|

Visit Broker |

| Exness |

CMA, FCA, CySEC

|

1.0 pips

|

$10

|

Visit Broker |

8 CMA Regulated Forex Brokers in Kenya

Below is the list of Best CMA Regulated Forex Brokers in Kenya:

- FxPesa – Overall Best Regulated Forex Broker in Kenya

- HF Markets Kenya – CMA Regulated Forex Broker with Low Spread

- Scope Markets Kenya – CMA Authorized Forex Broker with MPesa

- Pepperstone Kenya – Legal Forex Broker in Kenya with Raw Spread Account

- Exinity – ECN Type Forex Broker licensed with CMA

- Windsor Markets – CMA Regulated Forex Broker with Negative Balance Protection

- Admiral Markets – Low spread CMA regulated forex broker

- Exness – CMA regulated forex broker with .ke site

Now check the brief description of all the above-listed CMA regulated Forex brokers one by one. We have reviewed them using regulation, trading fees, deposit & withdrawal options, and customer support.

#1 FXPesa – Overall Best Regulated Forex Broker in Kenya

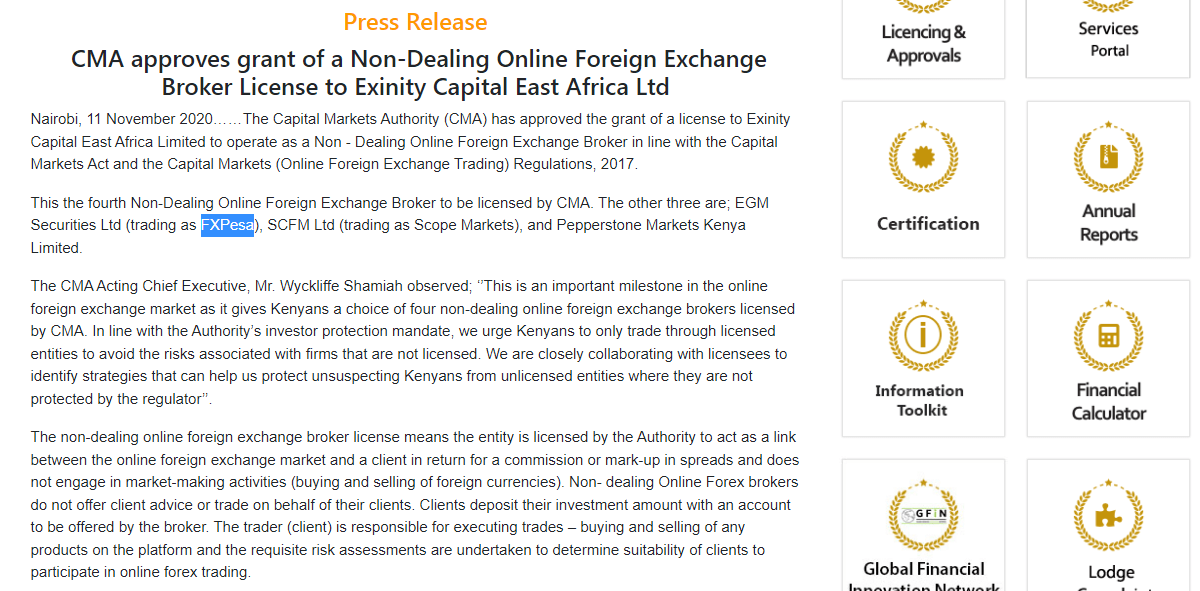

FXPesa Broker was founded in 2019 and it is the brand of EGM Securities which is licensed by the CMA under the company name EGM Securities Limited.

Their license number with the CMA is 107. The parent company of EGM Securities i.e. Equiti Limited Group is also licensed in the UK with FCA.

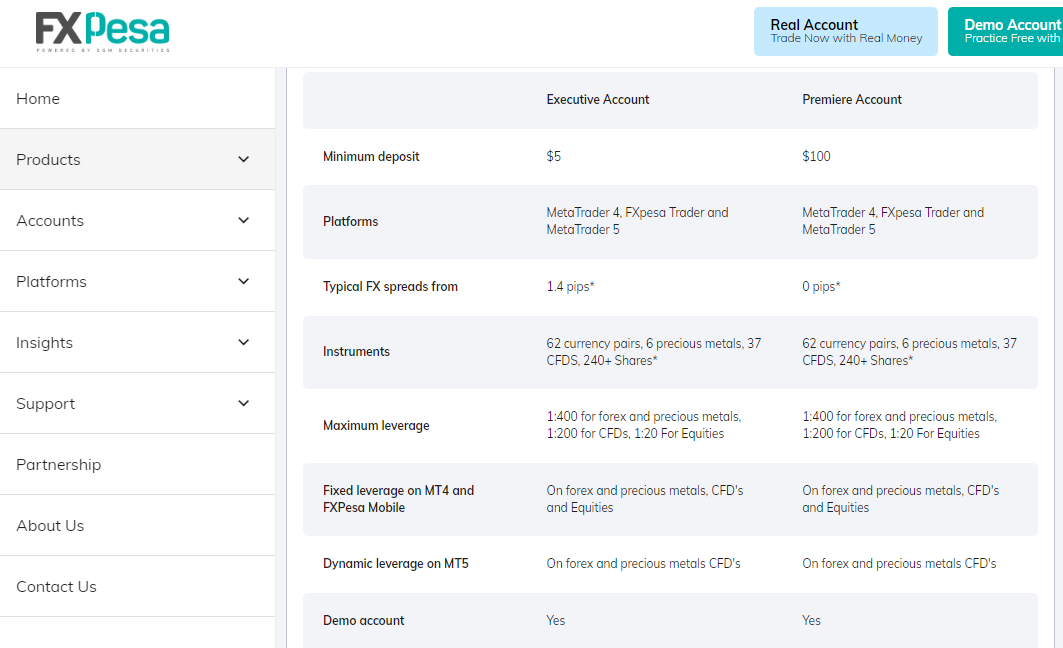

FXPesa has two trading account types; the Executive and Premiere accounts. The typical spread on FX majors for both accounts are:

| Currency Pair & CFD | Executive account (spread only account) | Premiere account (spread + $7/commission per lot) |

|---|---|---|

| EUR/USD | 1.4 pips | 0.0 pip |

| AUD/USD | 1.5 pips | 0.1 pip |

| USD/GBP | 2.2 pips | 0.2 pip |

| USD/JPY | 1.4 pips | 0.0 pip |

| XAU/USD | 0.32 pip | 0.1 8pip |

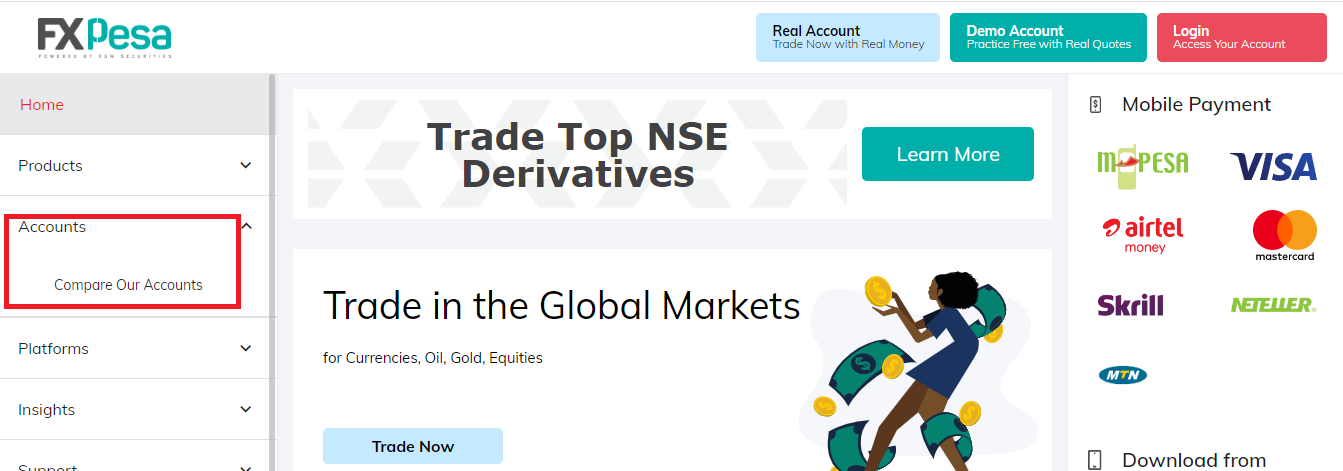

FXPesa offers trading on 62 currency pairs, CFDs on 6 precious metals, commodities, and 240+ shares as instruments.

The payment methods on FXPesa range from a local bank transfer, debit/credit cards, E-wallets, and mobile payments.

They accept payments via MPesa for deposits. Payments made via E-wallets, credit/debit cards, and mobile payment methods reflect instantly.

Deposit on FXPesa is free. There are no charges or commissions on deposits.

For withdrawals, the methods are the same as that of deposits. You can withdraw via Bank Transfer or MPesa, which are the most common methods. Withdrawals via Bank Transfer to a local bank account in Kenya are free but can take up to 3 days. For withdrawal with E-wallets and mobile payments including MPesa, the processing time is 3 hours.

Withdrawals on FXPesa via bank transfer in a Kenyan bank account and mobile payments are free.

The client support on FXPesa has Live Chat, Email, and Phone Number in Kenya. We found their support to be helpful in answering our queries.

#2 HF Markets Kenya – CMA Regulated Forex Broker with Low Spread

HotForex Kenya was authorized in 2021. They are a part of HotForex Markets Group which is well regulated with multiple regulators.

HotForex’s license number with the CMA is 155. HotForex operates under the company HFM Investments Kenya.

HotForex has 4 account types. The Micro, Premium, Zero, and HFCopy accounts.

| Currency pairs | Spread (Premium Account) |

|---|---|

| EUR/USD | 1.4 pips |

| EUR/GBP | 1.4 pips |

| GBP/USD | 1.6 pips |

| USD/CAD | 1.9 pips |

HotForex offers trading on 53 currency pairs and over 1000 CFDs on Commodities, Metals, Indices, Energies, and Bonds to clients in Kenya. The max. The leverage for forex is 1:400.

HotForex provides trading to clients through the MT4 and MT5 trading platforms. These platforms are available on the web, app, iOS, Android, and PC. They are also available on Google Play and Apple Store.

The minimum deposit on HotForex depends on the payment method you are using. The minimum deposit with Micro Account is $5. HotForex does not charge fees for deposits or withdrawals. You can deposit & withdraw funds via MPesa which has a minimum of Kes. 1000 for deposits & $10 for withdrawals. Or you can deposit via Dusupay which has Kes. 600 minimum deposit & $10 minimum withdrawals.

HotForex client support is available via email, live chat, and phone. They have a Kenyan phone number available for Kenyan clients. The live chat is also instant- just a few seconds wait time.

#3 Scope Markets Kenya – CMA Authorized Forex Broker with MPesa

This broker’s entity in Kenya is SCFM Limited while their trading name is Scope Markets Kenya. They were registered by the Kenyan CMA in 2019 and have an authorized license number 123.

SCFM has two account types, the gold and silver accounts. The FX spread on EURUSD is 1.1 pips and 0.2 pips for the silver and gold accounts respectively. There is no trading commission on the Silver account. However, there is a $3.5 commission per side for the gold account.

The minimum Kes deposit on Scope Market is 2000 or $20 in USD. Deposits can be made via Banks, MPesa, Credit and Debit cards, etc. Deposits and withdrawals are without charge.

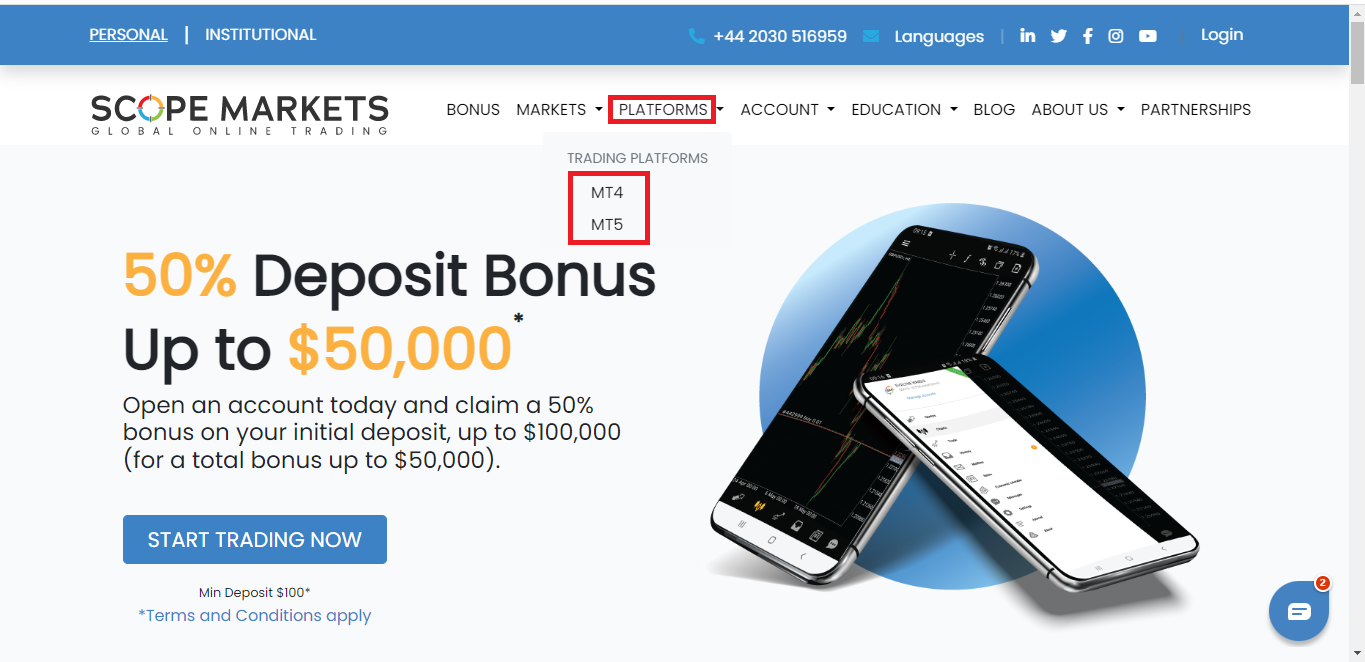

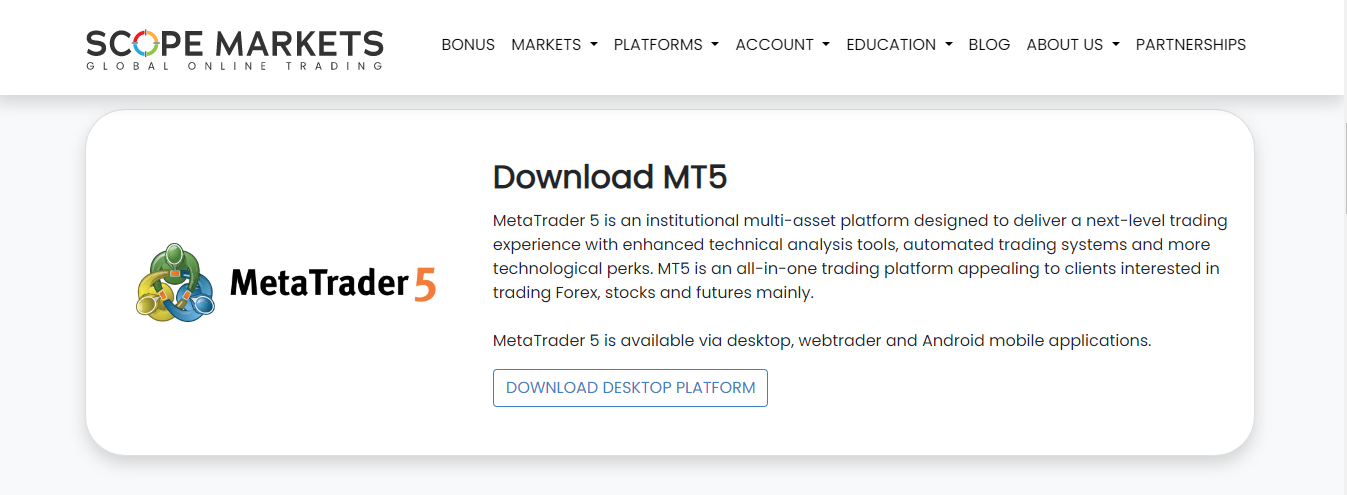

Scope Markets offer around 63 CFD Instruments to clients in Kenya. The trading platform offered by Scope Market is the MT4 and MT5 trader. They are available on MAC, Windows, iOS, Android, and the web.

Scope Market Kenya has email, live chat, and a local Kenyan number to call. The live chat is responsive when tried. Customer support is available for 24hrs every day and five days a week.

#4 Pepperstone Kenya – Legal Forex Broker in Kenya with Raw Spread Account

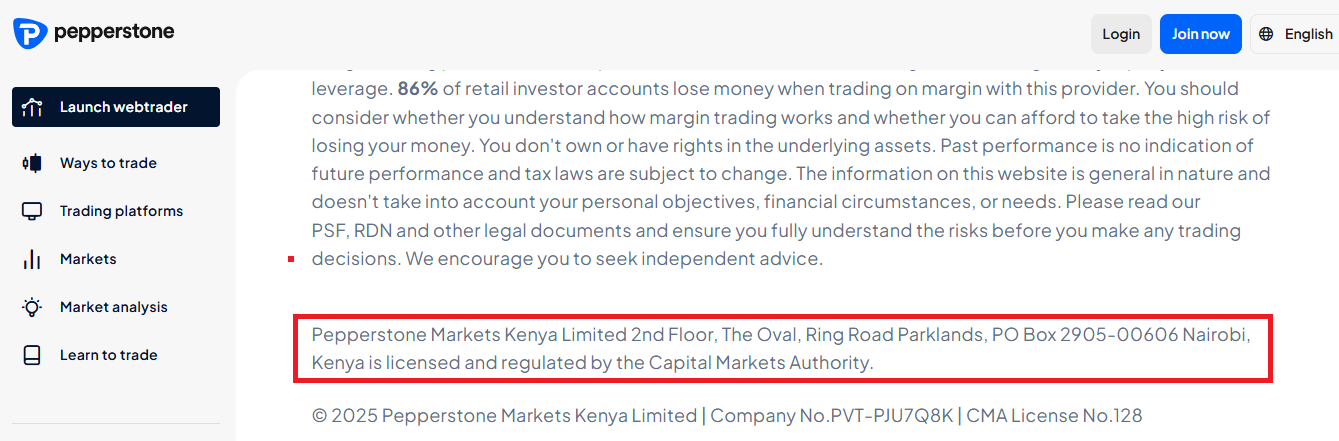

Pepperstone Group was established in 2010 in Australia. In Kenya, the company is operating under the name Pepperstone Markets Kenya limited. They are authorized by the Capital Markets Authority with license number 128.

Pepperstone offers two trading accounts; the Razor and Standard accounts. The spreads for both accounts are given below.

| Currency pair | Razor account (plus $7-8 commission per lot Roundturn) | Standard account |

|---|---|---|

| EURUSD | 0.09 pips | 1.09 pips |

| GBPUSD | 0.28 pips | 1.28 pips |

| USDCAD | 0.35 pips | 1.35 pips |

| Gold | 0.13 pips | 0.13 pips |

Pepperstone charges commission on its Razor account when trading and on its MT4, MT5 & cTrader platform.

Deposits and withdrawals can be made on Pepperstone through these methods; Bank transfer, Visa, Mastercard, MPesa, and PayPal. Withdrawals made by banks usually take 3 to 5 working days as processing time.

Pepperstone requires a minimum account opening balance of $200. The account can be opened in USD or GBP as the base currency.

The trading platform on Pepperstone are; MT4, MT5, cTrader, and Social trading platforms. These platforms are available for PC, web, and mobile devices.

Pepperstone offers 62 currency pairs, CFDs on 600 plus U.S shares, 100 U.K equities, 200 Australian equities, commodities & indices. In total, the broker offers over 1200 CFD instruments to clients.

Pepperstone has three customer support options. The chatbox, email, and phone number. You can also visit them at their Kenya office. The replies on the chatbox are instant. However, it takes between 2 to 3 minutes to get a response from your transferred agent.

The phone lines are available 24hrs daily and only 5 days per week. For the email, it takes around 30 minutes for their email support to respond. However, it only acknowledged receipt of the complaint and not the issue.

#5 Exinity – ECN Type Forex Broker licensed with CMA

Exinity Capital East Africa is a company under which FXTM and Alpari International operate. This broker is registered with the Kenyan CMA with license number 135. In Kenya, Exinity group operates as ForexTime FXTM.

FXTM offers three account types to clients. They are the Micro, Advantage, and Advantage plus accounts.

The typical spread on FX majors on ForexTime begins from 1.5pips on the micro account, 0.0pip on the Advantage account, and 1.5pips on the Advantage Plus account. The Advantage account has a commission of 0.40c to $2 per lot.

The Micro and Advantage Plus accounts have zero charges/commissions. FXTM also charges an inactivity fee for a dormant account over a six months period.

FXTM uses the MT4 and MT5 trading platforms coupled with other trading tools. Deposits on FXTM are without charge, however, there are charges applied to withdrawals via some payment methods. The payment methods available at FXTM are; Wire/Bank transfer, E-wallets such as Skrill, Neteller, Perfect Money, etc. Deposits are processed instantly except in cases where there is a need for internal verification.

The customer support options on FXTM are quite much. However, we tested the live chat and email. Replies on the chatbox were instant. However, it only answered questions it was programmed to answer. It works more like a bot. The email we sent was answered in a few hours.

Requirements for a Forex Broker to be Licensed by the CMA

A broker cannot just begin to operate in Kenya under CMA license. There are essential requirements that must be met. These requirements ensure that forex brokers operate in line with the law that govern CFD trading in Kenya.

Here are some of the requirements:

Company governance: A CMA regulated broker in Kenya must have a governing board of directors and the company must be registered as a limited liability company in Kenya. The role of the board of directors is to oversee the operation of the broker.

Capitalization: The forex broker must meet a capital requirement of $500,000. That is about Ksh 64,380,000. This capital must be maintained all through the broker’s operations. They cannot go below it.

AML Compliance: AML means anti money laundering. The CMA requires all brokers comply with AML rules. Forex brokers are required to create policies to make sure their business is not used for money laundering. Procedures such as record keeping and customer identification is important. Transactions that look suspicious must be reported as well.

Personnel: CMA regulated brokers are must of necessity have the right personnel. Their team must consist of a management team with solid experience in forex trading. They must also have a minimum of three full time employees.

Insurance: Regulate brokers in Kenya must have insurance cover in case of losses. The insurance will also serve as guard against fraud.

Application fee: The CMA license is not free. Every broker who seeks to be regulated in Kenya must pay an application fee of $5000 (Ksh 645,000) to the CMA.

Who regulates forex brokers in Kenya?

In Kenya, the Capital Markets Authority (CMA) serves as the primary regulatory body for forex brokers. Established under the Capital Markets Act (Chapter 480 of the Laws of Kenya), the CMA oversees the entire capital markets ecosystem, including forex trading.

What are the benefits of trading with a CMA-regulated broker?

Choosing a CMA-regulated forex broker in Kenya comes with several key benefits that enhance your security, trust, and overall trading experience:

Increased protection:

1) Financial safeguards: CMA mandates that Client funds are segregated from the broker’s own funds, minimizing the risk of misappropriation in case of insolvency.

2) Compensation scheme: The CMA operates a compensation scheme that protects eligible clients against losses up to Ksh. 50,000 in case the broker becomes insolvent.

3) Dispute resolution: Access to fair and efficient dispute resolution mechanisms through the CMA, if issues arise with the broker.

Enhanced transparency and fairness:

1) Regulatory standards: CMA-regulated brokers must adhere to strict regulations and ethical practices in their dealings with clients.

2) Disclosure requirements: Clear and transparent information about trading conditions, fees, and risks must be provided to clients.

3) Market manipulation prevention: Regulations aim to prevent unfair practices like market manipulation and ensure a level playing field for all traders.

The History of CMA Forex Licensing

According to the Bank for International Settlements in 2019, retail forex trading accounted for 3% of all forex trading activities. The total amount traded is about $206 billion in that period. Retail forex trading is offered as CFDs and are traded over the counter (OTC). It is typically regulated by to statutory bodies in different countries.

After South Africa, Kenya became one of the African countries that regulated retail forex trading. This happened in 2016 (almost a decade after South Africa). It was in 2016 that the CMA released a public draft about regulating CFD trading in the country. According to the draft, the reason for regulation was to protect traders registered with offshore brokers and to monitor all brokers operating in the market.

On 25th August 2017, the CMA passed its regulation on forex and CFD trading in Kenya after public discussions. This regulation protects the growing number of traders in Kenya. According to Tade Forex Kenya, forex trading volume in Kenya grew by 80% with up to 40,000 new traders added to the market.

How Does the CMA Protect You?

The CMA acts in the best interest of forex traders. As an authority over forex brokers, they make sure financial services providers are set up to reduce the risk traders are exposed to. In this section, we will be looking at the structures the FCA has put in place to protect you and your funds.

1) Leverage restriction: CMA regulated brokers have a leverage cap for CFDs. The maximum leverage for retail traders is 400:1 (currency pairs). There are leverage restrictions for commodities, indices, and stocks too. The restriction ensures that you do not abuse leverage. Leverage amplifies losses. Lower leverage ensures that traders are not exposed to damaging losses.

2) Segregation of funds: The segregation of funds involves forex brokers keeping clients’ money in a separate account. That is, your money and the brokers’ money are not in the same account. This has good implications for forex traders. The implication is that the creditors of brokers cannot lay claim to traders’ money in case of bankruptcy. Also, traders’ money will not be used for hedging trades with counterparties.

Traders’ money is kept with institutions in Kenya, separated from the brokers’ money.

3) No conflict of interest: The CMA does not allow flexibility with CFD brokers’ execution model. Any model with a conflict of interest is not allowed. That is, a broker should not stand to gain financially from the results of your trades except via normal trading fees. This means forex brokers in Kenya cannot have a dealing desk. This protects traders by ensuring that brokers cannot manipulate market prices for their own gain.

Pepperstone, Exintity, and EGM Securities are one of the brokers that are in compliance with this policy.

6) Risk Disclosure: Most traders are drawn to forex trading ignoring the risks. Even with all the restrictions put in place by top-tier regulatory bodies, more than 80% of forex traders lose their capital trading CFDs.

For the sake of transparency, all CMA regulated brokers are required to send a written risk disclosure to potential clients/traders. Traders must then proceed to read, sign, and date the risk disclosure statement. This process ensures that traders understand the risk that comes with CFD trading.

All forex brokers licensed in Kenya are required to have individual traders’ acknowledgement of the risk disclosure statement.

How to Sign-Up with a Regulated Forex Broker in Kenya

To register with a regulated forex broker in Kenya, prospective traders should carefully follow the steps listed below.

Step 1) The first and perhaps the most important step in signing up with a forex broker in Kenya is verifying the registration status of the said broker with the local Kenyan Capital Markets Authority CMA.

This action is necessary to check against the foreign unregulated online brokers who cajole Kenyans to trade with them from their safe haven. It is illegal to trade with an unregulated forex broker in Kenya.

Aside from being illegal, trading with an unregulated broker exposes you to scams and inappropriate business practices from unregulated brokers. This is because there are no rules guiding the behavior of unregulated brokers. Hence, they might steal your funds and you won’t have anybody to run to.

Hence, trading with a regulated broker grants you protection from theft and inappropriate business practices.

So how do you know a forex broker is regulated in Kenya? Every CMA-regulated forex broker in Kenya has a unique license number. This number is usually displayed on most brokers’ websites as more of a footnote.

To verify a broker’s registration, just check its registration status with the broker and confirm with what’s on the Kenyan Capital Markets Authority (CMA) website.

There are only six forex brokers who are regulated by the Kenyan CMA. Check the CMA website if your chosen broker is among the six. Go to the CMA’s List of Licensees, and check if the broker that you are choosing is in their list of authorized “Non-Dealing Online Foreign Exchange Brokers”.

It is important you check to confirm the registration status of the broker with the CMA as some brokers can fake the registration and license without them actually being licensed by the CMA.

In the case of FXPesa, both websites confirmed their registration.

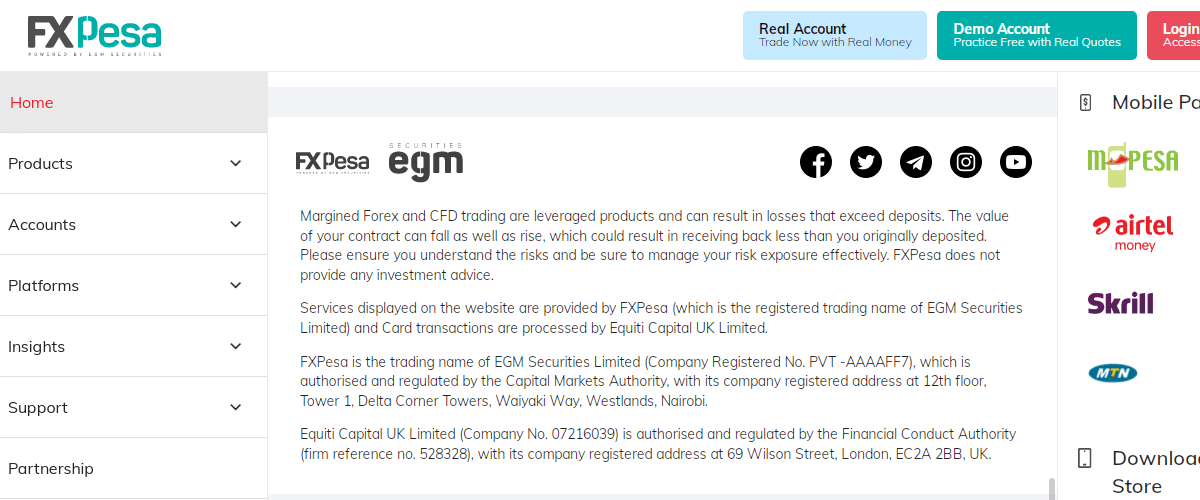

Step 2: Opening a trading account: In opening a trading account with FXPesa or any other Legal Forex Broker, you are expected to provide your contact details and further proof about your person (Know Your Customer KYC) verification and finally, the trading experience information.

The KYC verification includes providing a valid means of identification for the broker to determine your citizenship and so on.

Most forex brokers have different trading accounts for different categories of traders. It is important to read through the different features of these trading accounts before deciding to open one. These features include; spread, commission/fees, payment methods, base currency, etc.

Step 3: On completion of the KYC verification and furnishing the broker with information on your trading experience, you can now proceed to download the trading platform most suitable for you.

In choosing a trading platform, you must carefully read through the features of all platforms available before deciding on your choice.

Other Important Factors for CMA Regulated Brokers

Apart from CMA regulation, there are other trading conditions you should consider before choosing a CMA regulated broker. CMA regulation combined with good trading conditions gives you a complete trading experience. Here are other factors

Account type: Trading conditions vary by account. Some accounts have low spreads while some have higher spreads. Some brokers even offer just a single account so you do not have any choices. Another factor determined by account type is the commission. Most brokers with multiple accounts usually have an account that is commission-free. This is why it is important to check this factor so you can compare the account types and choose the one that fits you.

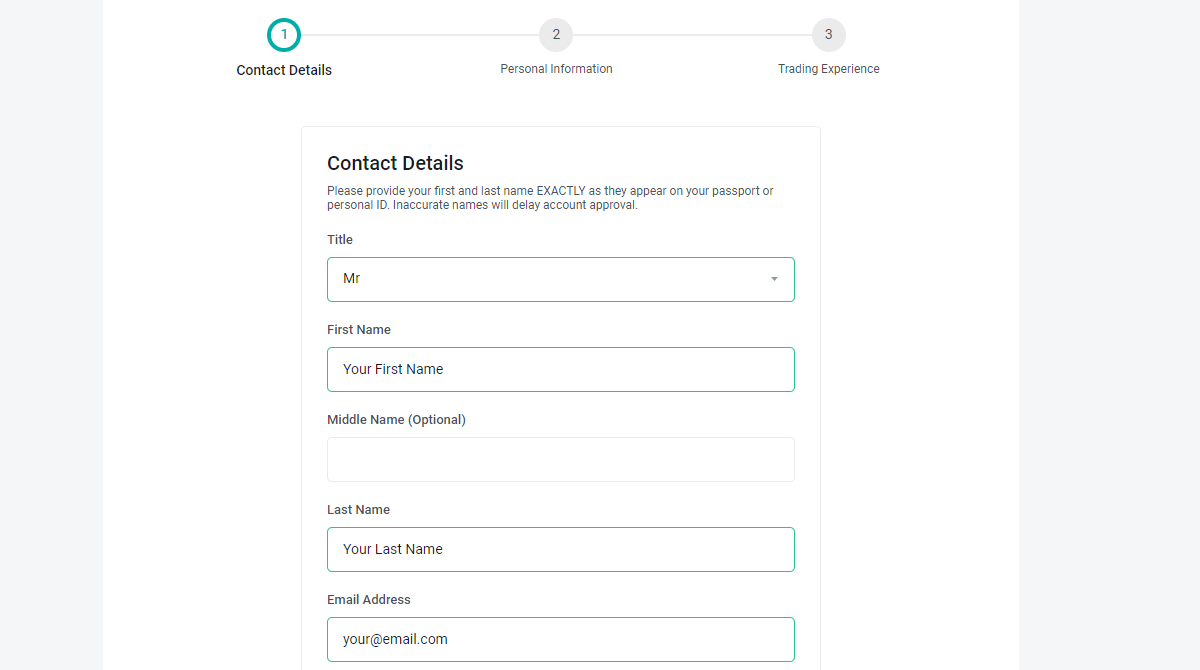

Here is an example of how to compare accounts with FxPesa. You begin from their homepage. On the left side of the page, click ‘Accounts’. You will see a dropdown with a single response that says ‘Compare Our Accounts’ (in the red box). Below is a visual illustration

When you click on ‘Compare Our Accounts’, you will find the table displayed below

From the image, you can see FXPesa has two account types (Executive and Premiere). Looking at the table, you can see the difference between the two accounts under typical spreads and minimum deposits. After comparing the accounts, you can choose anyone that fits your strategy and trading budget.

Trading Platforms: What you want to check here is the platform offered. Is it a proprietary platform developed by the broker? or a third-party platform like MT4, MT5, or cTrader?. Most forex brokers tend to have more advanced features on their proprietary platform so you should check.

In addition, you want to check if the platforms are available on desktops and mobile phones. This helps you combine the full view that the desktop offers with the on-the-go feature of mobile apps. Here is how to find trading platforms on your broker’s website. Since we have a number of them in this review, we will pick Scope Markets as our example.

On their homepage, click ‘PLATFORMS’

When you click ‘PLATFORMS’, you will discover that Scope Markets have MT4 and MT5 only. No proprietary platform. To know more about the platforms and download them, click on any of them. Here is what you see when you click ‘MT5’

Funding/Withdrawals: For Kenyan traders, you need to be able to deposit/withdraw your funds via local banks or credit/debit cards. This is the bare minimum. After these, you can consider if your broker supports e-wallets like Skrill and Neteller. If your broker also accepts M-Pesa, it is even better. M-Pesa is a very popular payment method in Kenya.

Beyond the payment methods, you should consider how fast funding/withdrawal is. Deposits should be processed quickly and reflected in your account instantly. Withdrawals should not be more than 3 business days. You can check this factor to make sure there is no delay in your transactions.

Customer Support: You want your forex broker to be reachable if you have any inquiries. Though FAQs are available, they might not have all the answers. So you need to check other support channels available. Emails and live chats are quite common. Some brokers also have a Kenyan mobile number.

What are the requirements for a forex broker to be licensed by the CMA?

Capital requirements: Generally, the requirements need to be met are fixed. First, a forex broker operating in Kenya must maintain a minimum capital requirement of Ksh 50 million. This is ensures that brokers have enough capital to sustain their operations. They also have to segregate client accounts. The forex broker’s money and trader’s money cannot mix.

Physical office: All CMA regulated brokers must set up physical offices in Kenya. Most CMA regulated brokers usually have their Kenyan address on their website. Here is an example from Pepperstone’s website:

As you can see from the image, they have an office in Nairobi.

Personnel:The top executives and directors of the firms must also be UK residents. Other key personnel must have sufficient expertise and experience in the financial sector.

KYC and AML Policies: Brokers are required to obtain know-your-client (KYC) data from their clients. Crucial questions must be asked to ensure that a client is ready to trade CFDs. Apart from names and address, documents that proof client identity and residence are also required.

Furthermore, client’s financial strength must also be strong enough to withstand losses common with CFD trading. There must also be a robust anti-money laundering (AML) policy.

Does the CMA have any power?

The Capital Market Authority (CMA) protects Kenyan traders with their authority. It advises forex traders, especially beginners to stay away from forex brokers that are not regulated in Kenya.

The power of the CMA is limited to Kenya only. It has no jurisdiction outside Kenya. Yet, some forex brokers with offshore regulations try to take on Kenyan traders without obtaining a CMA license. The CMA has regularly warned that these brokers be avoided because the CMA has no oversight over them.

For locally regulated brokers, the CMA closely monitors them to ensure they are in compliance. In a situation where a CMA regulated broker breaks the rules, the CMA can issue penalties, fines, and other enforcement measures.

For example, in October 2018, Kenyan authorities ordered Pesos Capital Markets Limited to stop operations. The firm was accused of acting as a fund manager and online forex dealer without the licenses required by the Capital Markets Act.

To protect the public, the CMA regularly issues notices and alerts warning about unlicensed entities and possible scams.

What is the future of forex regulation in Kenya?

The current regulation framework has worked so far, ensuring local traders are protected. However, more can be done. In the future, the CMA might come up with a compensation scheme for traders. The FCA and ASIC, and some regulatory bodies have a system of refunding traders’ money if their broker should go bankrupt. The CMA does not have one yet but you might see it in the future.

FAQs on CMA Regulated Forex Brokers in Kenya

Which forex brokers are regulated in Kenya?

There are six regulated and licensed forex brokers in Kenya. They are; Pepperstone, Scope Market Kenya, Exinity Group, EGM Securities Limited, HFM Investments Limited, and Windsor Markets.

Is Exness broker regulated by CMA?

Yes, Exness is regulated by the Capital Markets Authority (CMA) in Kenya as Tadenex Limited. They hold a non-dealing online foreign exchange broker license under license number 162. This means that Exness is authorized to offer forex trading services in Kenya under the supervision of the CMA.

Is Fxpesa regulated by CMA?

Yes, FxPesa is regulated by the Capital Markets Authority (CMA) in Kenya. They hold a non-dealing online foreign exchange broker license under license number 166. You can find this information on both the FxPesa website and the CMA’s list of licensed forex brokers.

Is online forex trading in Kenya legal?

Yes, trading forex online in Kenya is legal as long as you are trading with CMA authorized forex broker. There are only 6 authorized Non-dealing Online FX Brokers which are legal in Kenya.

How do I know if my forex broker is regulated?

You can find your broker’s regulation on their website. It is usually at the bottom of their pages. You can also find their legal documents that give more details about their regulations on their website too.

How to choose a legal forex broker in Kenya?

The first important thing to check is if the broker is actually authorized by CMA, which you can verify from CMA’s list of licenses.

You should then compare a forex broker’s fees (spread, commissions, swap, other charges), platforms, trading conditions, ease of withdrawals, and support. We look at these factors & more in our comparison.