FXTM is an online forex broker that offers the trading of currency pairs, and CFDs on metals, indices, precious metals, energies and others. They also accept traders based in Kenya.

FXTM was founded in 2011 as a foreign exchange and CFDs broker. FXTM is authorised in Kenya and by other Tier-1 and Tier-2 Forex regulators, such as the FCA in the UK and CySEC in Cyprus.

They accept local payment methods including deposits & withdrawals via MPesa. But they do not have KES base currency trading accounts.

We’ve reviewed FXTM’s trading conditions, fees, deposit and withdrawal options, and available trading instruments for Kenyan traders. We also cover the pros and cons of FXTM Kenya broker.

| FXTM Review Summary | |

|---|---|

| 🏢 Broker Name | Exinity Capital East Africa Ltd |

| 📅 Establishment Date | 2011 |

| 🌐 Website | www.forextime.com |

| 🏢 Address | Exinity Capital East Africa Ltd, West End Towers, Waiyaki Way, 6th Floor, P.O. Box 1896-00606, Nairobi, Republic of Kenya |

| 🏦 Minimum Deposit | $200 |

| ⚙️ Maximum Leverage | 1:400 |

| 📋 Regulation | CMA, FSC Mauritius, FCA, CySEC, FSCA, |

| 💻 Trading Platforms | FXTM MT4 and MT5 for PC, Mac, Web, Android, iOS and FXTM Trader for iOS and Android |

| Start Trading with FXTM | |

FXTM Pros

- FXTM is regulated in Kenya

- FXTM has negative balance protection

- You can make deposits to FXTM via Mobile Money in Kenya

- The customer care support of FXTM is good and available 24/5

FXTM Cons

- FXTM charges dormant account fees after 6 months of inactivity

- FXTM charges withdrawal fees on some payment methods

- FXTM customer support is not available 24/7

- FXTM does not have KES account currency

Is FXTM Safe for Traders?

FXTM is considered low risk for traders in Kenya because of their regulations by Top-Tier financial authorities including the CMA in Kenya.

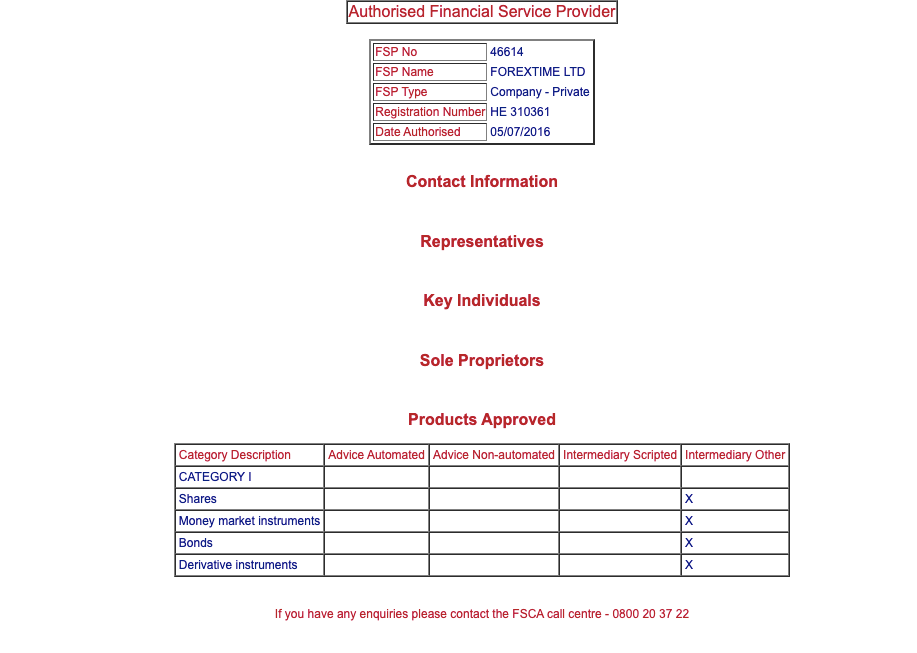

The details of the regulations and licenses for FXTM can be found below.

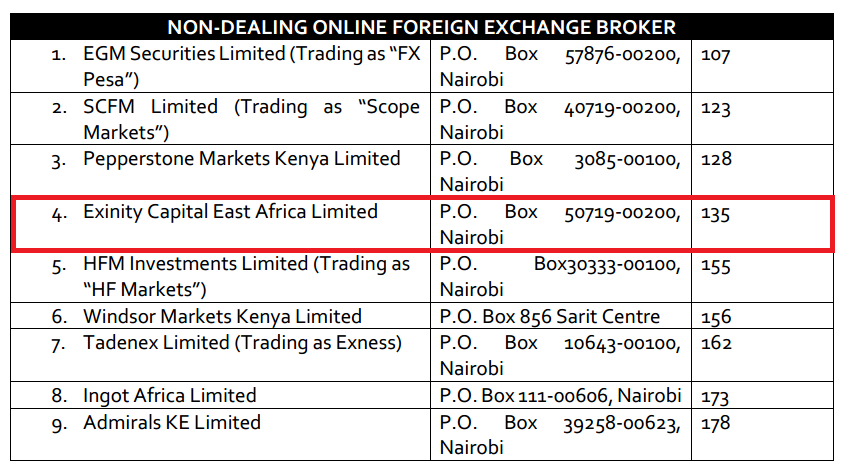

1) Capital Markets Authority (CMA) Kenya: The CMA has licensed FXTM as a non-dealing online foreign exchange broker under the name ‘Exinity Capital East Africa Ltd’ with CMA license number 135.

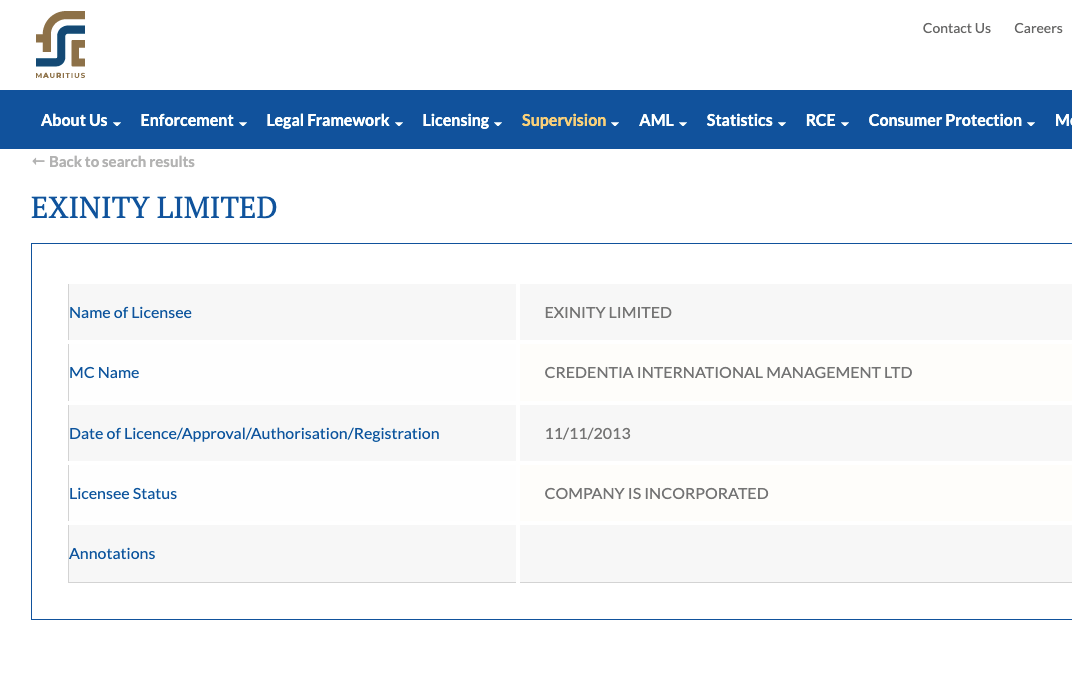

2) Financial Services Commission (FSC) Mauritius: FXTM is registered and regulated in Mauritius by the FSC in the Republic of Mauritius under the name Exinity Limited as an investment dealer with FSC license number C113012295.

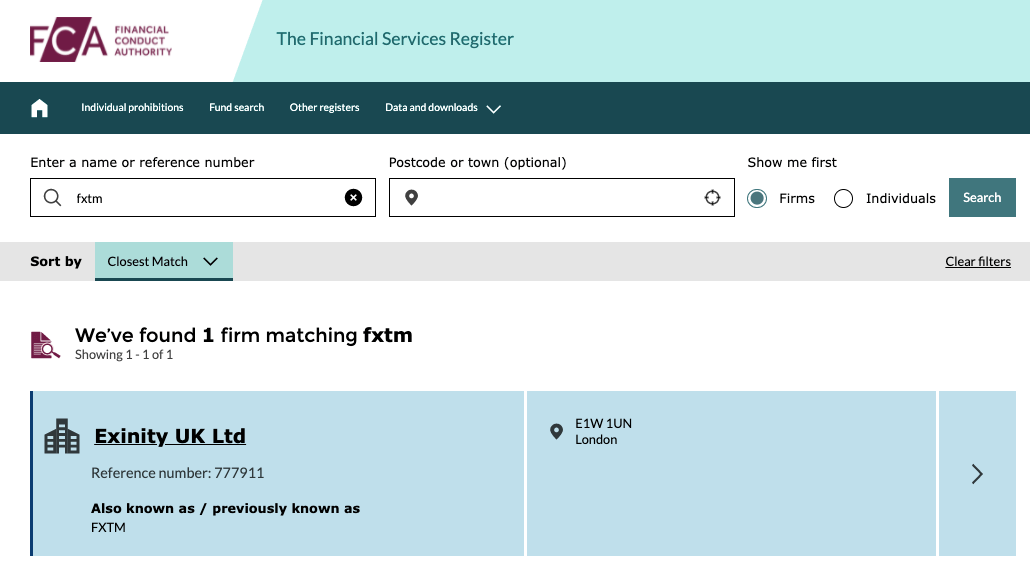

3) Financial Conduct Authority (FCA), United Kingdom: FXTM brand is also authorized by Tier-1 regulator in the UK by the FCA under their registration as Exinity UK Limited to offer financial services. They serve UK clients through this registration.

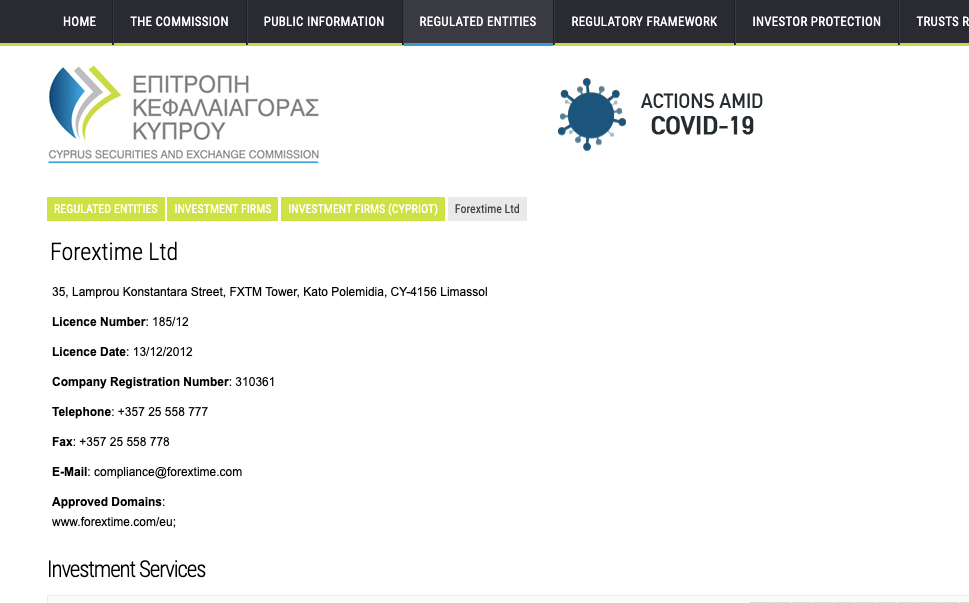

4) Cyprus Securities and Exchange Commission (CySEC): FXTM is licensed by the Tier-2 regulator, CySEC, through their registration in Cyprus as Forextime Ltd as an investment firm offering investment services. They serve European clients through this license.

5)Financial Sector Conduct Authority (FSCA), South Africa: The FXTM brand is also regulated in South Africa as ForexTime Ltd and licensed as a financial service provider. FSCA is a Tier-2 regulator.

FXTM Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| UK | £85,000 | Financial Conduct Authority (FCA) | Exinity UK Limited |

| EEA Countries/td> | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Forextime Ltd |

| South Africa | No Protection | Financial Sector Conduct Authority (FSCA) | ForexTime Ltd |

| Kenya | No Protection | Capital Markets Authority (CMA) | Exinity Capital East Africa Limited |

| Mauritius | No Protection | Financial Services Commission (FSC) | Exinity Limited |

If you are based in Kenya, FXTM will register you under their FSC license in Mauritius. Mauritius is an offshore region so regulations are not strict. There is no compensation scheme under this regulation and negative balance protection is not guaranteed.

Here is a statement from FXTM’s website about this. It’s not standard practice for us to correct negative balances, but this may be done on a discretionary basis. If there’s credit on your trading account, it may be deducted to cover the negative balance.

“It’s not standard practice for us to correct negative balances, but this may be done on a discretionary basis. If there’s credit on your trading account, it may be deducted to cover the negative balance.”

FXTM Leverage

FXTM offers both floating and fixed leverage for trading, depending on the type of account, currency pair, or instrument traded.

For FXTM floating leverage, the FXTM maximum leverage is 1:400 but the leverage will reduce as the notional value increases, that is, as the size of positions increases because it is variable leverage.

CFDs on stocks, commodities, and spot indices have fixed leverage on FXTM depending on trading instruments and account types.

With a leverage of 1:400, you can open a trade position worth 400 times the value of your savings. For example, if you deposit Ksh1,000, you can place a trade of Ksh400,000.

Note that the FXTM website may display a higher leverage sum, but all accounts in Kenya must have a maximum leverage of 1:400, based on CMA regulation.

Note that trading leveraged products involves risk and you could lose all your money. It is best to avoid trading CFDs unless you understand it and have experience. It is important not to use all the leverage available when trading, as this increases your risk of capital loss.

FXTM Account Types

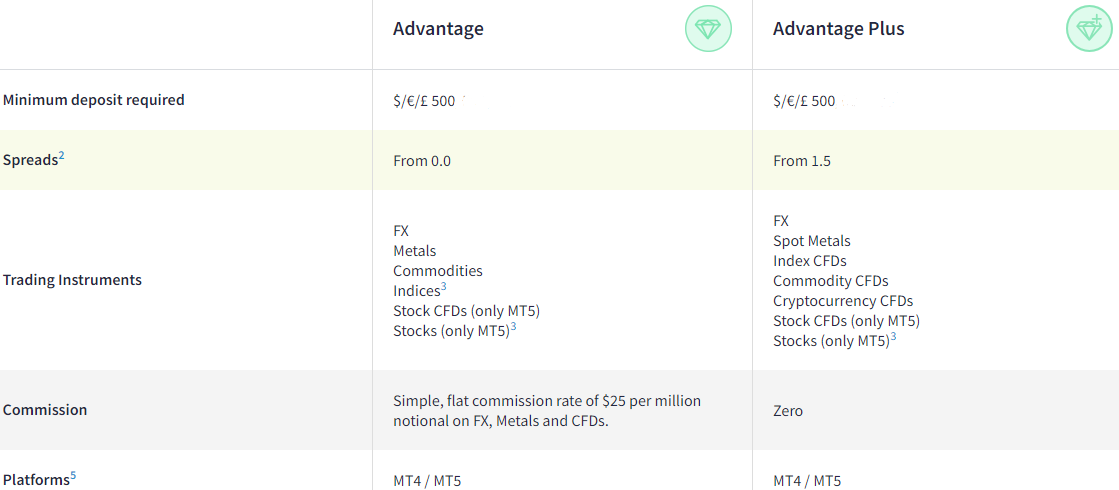

There are 3 main FXTM trading accounts you can choose from, the Advantage Stocks Account, the Advantage Account, and the Advantage Plus Account.

The Islamic Account is also available in all account types, and you can try the demo mode of all types of accounts.

Different FXTM account types determine the kinds of instruments you can trade, fees per trade, transaction size, deposit and withdrawal methods, and leverage.

To help you choose the right account type, here is an overview of the 3 three accounts types offered by FXTM below:

1) Advantage Stocks Account: The FXTM Advantage Stocks Account is designed for traders who want to trade stock CFDs

FXTM Advantage Stocks users can trade shares CFDs only.

This account does not charge commission fees and spreads start from just 6 cents. Swap fees for overnight positions do not apply

FXTM Advantage Stocks Account has a minimum lot per trade requirement of 0.01. This account features fixed leverage, with maximum leverage of 1:1, and offers market execution of trades.

The Advantage Stocks Account requires a minimum deposit of $200 to begin trading. This account has negative balance protection, which means that you will not lose more than the money deposited. If a trade position is unsuccessful and you suffer a loss, any negative balance that accrues on your account will be reset to zero.

2) Advantage Account: FXTM’s Advantage Account is for more experienced traders who can trade through the MT4 and advanced MT5 trading platforms.

FXTM Advantage Account holders can trade a wide variety of financial instruments. Those instruments include Forex, metals, indices, stock CFDs, stock baskets, stocks, and FX indices.

Spreads on this account start from 0.0 while commission charges start from $0.40 to $2 (per side), and are based on a floating commission structure that varies based on trade volume. Swap fees apply for overnight positions.

FXTM Advantage Account has a minimum lot per trade requirement of 0.01. This account features floating leverage, with maximum leverage of 1:400, and offers market execution of trades.

The Advantage Account requires a minimum deposit of $200 to begin trading and also has negative balance protection.

3) Advantage Plus Account: The FXTM Advantage Plus Account is similar to the Advantage Account, the Major difference being that this account is commission-free. Advantage Plus Account-holders can trade through the popular MT4 and advanced MT5 platforms.

Tradeable instruments on this account are Forex, metals, indices, stock CFDs, stock baskets, stocks, and FX indices.

You trade on this account at spreads starting from 1.5 pips. There are no commission charges, but there are swap fees for overnight positions.

FXTM Advantage Plus Account has a minimum lot size of 0.01. It offers floating leverage, with maximum leverage of 1:400, and market execution of trades.

To start trading on the Advantage Plus Account, you’ll need a minimum deposit of $200 and you have negative balance protection as well.

4) Islamic Account: FXTM Islamic Account offers zero swaps in line with the sharia law of no-riba, which means that you won’t pay any fees/interest for maintaining a position overnight. This option is designed for Muslim traders. Islamic Account holders cannot engage in the trading of exotic FX pairs.

After registration, you will need to contact the support team to enable your account as Islamic. You will be required to provide a document that proves you are a Muslim. You can use your birth certificate or any other document that shows you are a Muslim.

FXTM Base Account Currency

Currently, the base currencies available on FXTM are Euros – EUR, United States Dollar – USD, Great Britain Pounds – GBP, and Nigerian Naira – NGN.

When you create an account, you are required to select one of the four account currencies on FXTM, which means that all trading, fees, deposits/withdrawals, and profits/losses will be shown in this currency and converted accordingly.

FXTM currently does not have Kenyan Shilling as base account currency but you can deposit money in KES, and your funds will be converted to the currency of your trading account.

FXTM Overall Fees

FXTM charges fees to traders based on the type of accounts they have. Details of the trading and non-trading fees on FXTM are shown below:

Trading fees

Spreads: Whenever you trade an instrument on the FXTM platform, the broker adds a markup to the ask price of the instrument. The markup which is the difference between the ask price and the bid price is referred to as spread, measured in pips.

FXTM uses a floating spreads system and its spreads on the Advantage Account and Advantage Plus Account start from 1.5 pips, while its Advantage Account spreads start from 0.0 pips. Typical spreads for major pairs on FXTM are shown in the table below:

| Instrument/Pair | Advantage Stocks Account | Advantage Account | Advantage Plus Account |

|---|---|---|---|

| EUR/USD | N/A | 0.0 pips | 2.1 pips |

| GBP/USD | N/A | 0.0 pips | 2.5 pips |

| EUR/GBP | N/A | 0.6 pips | 2.7 pips |

| XAU/USD | N/A | 9 pips | 36 pips |

2) Commission fees: FXTM offers commission-free trading for Advantage Stocks and Advantage Plus account holders, and charges commission on the Advantage Account starting from $0.40 to $2 per lot side opened. The commission charge is based on a floating structure and reduces as your size of trade increases.

Swap fees: Whenever you keep a trade position open past the market’s closing time, the trade rolls over to the next trading day and you incur overnight funding costs or rollover fees, also called swap fees.

FXTM charges swap fees on all account types for holding a trade position open overnight either long swap (buy option) or short swap (sell option).

Swap-free trading is allowed on FXTM Islamic Account for 7 days, after which, account holders pay daily fees.

For example, if you enable the swap-free option and then open EURUSD trade, it has no swap fees for the first 7 days. After 7 days, it has swap-free (Daily Fee), of about -$10.63 per lot.

If you close a trade and re-open it, the 7 days start counting afresh, and you pay zero swap fees.

Non-trading fees

Deposit and Withdrawal fees: FXTM does not charge deposit fees for funding your account but charges withdrawal fees of $1 for Mobile Money and card withdrawals attract a transaction fee of $3 per withdrawal.

Bitcoin withdrawal on FXTM has a 1% withdrawal fee. You can use Skrill to withdraw bitcoin from FXTM.

Account Inactivity charges: After six months with no trading activity on your account, you’ll be charged $5 monthly on any balance in your account.

However, if you have more than one account and at least one of those accounts is used to trade, then no fees will be charged. If your account balance is zero, no negative balance will accrue.

| Fee | Amount |

|---|---|

| Inactivity fee | $5 |

| Deposit fee | None |

| Withdrawal fee | None*(M-Pesa) |

*Withdrawals via credit cards (Visa, MasterCard, and Maestro) attracts a $3 fee. There are no charges if you use e-wallets except for Perfect Money which attracts 0.5% commission for withdrawals.

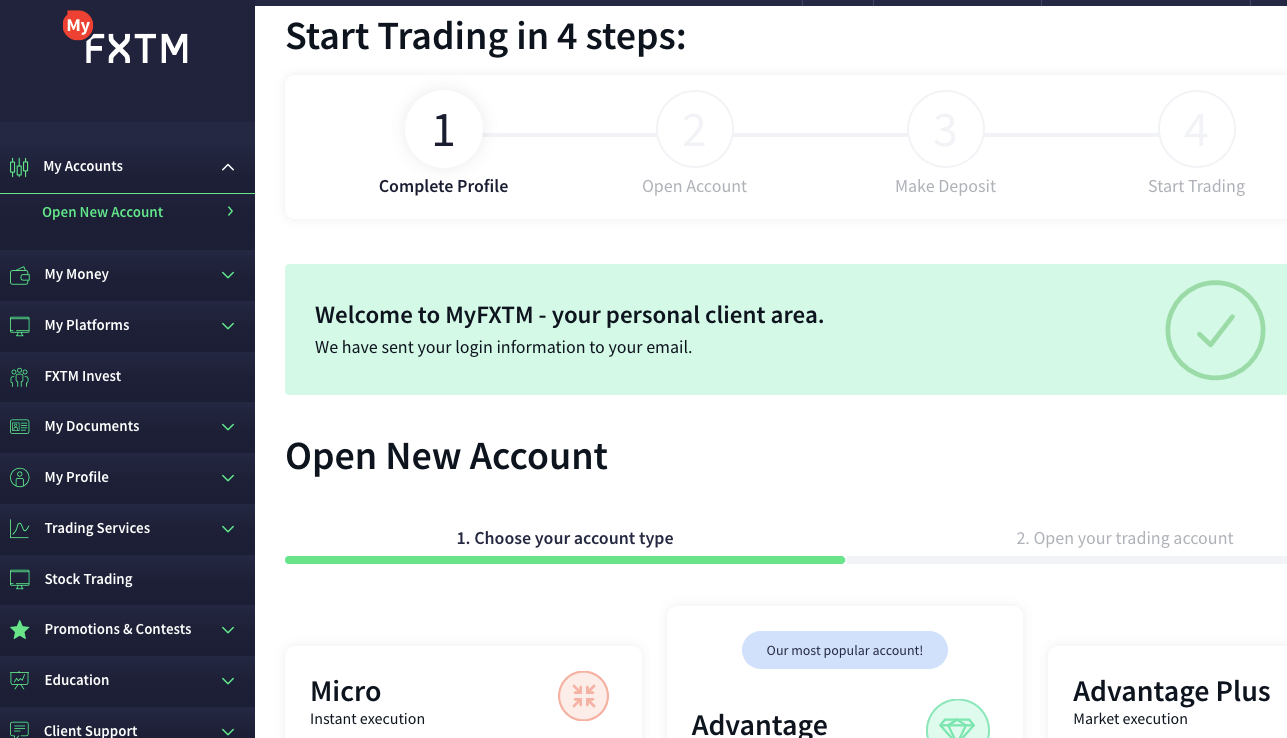

How to Open FXTM Account in Kenya

If you want to start trading on FXTM, you need to open an FXTM live account. You can open an FXTM account, by following the steps below:

Step 1: Visit FXTM’s website at www.forextime.com and click the OPEN ACCOUNT button in the red button at the top right corner of the page on desktop or the middle of the page on mobile.

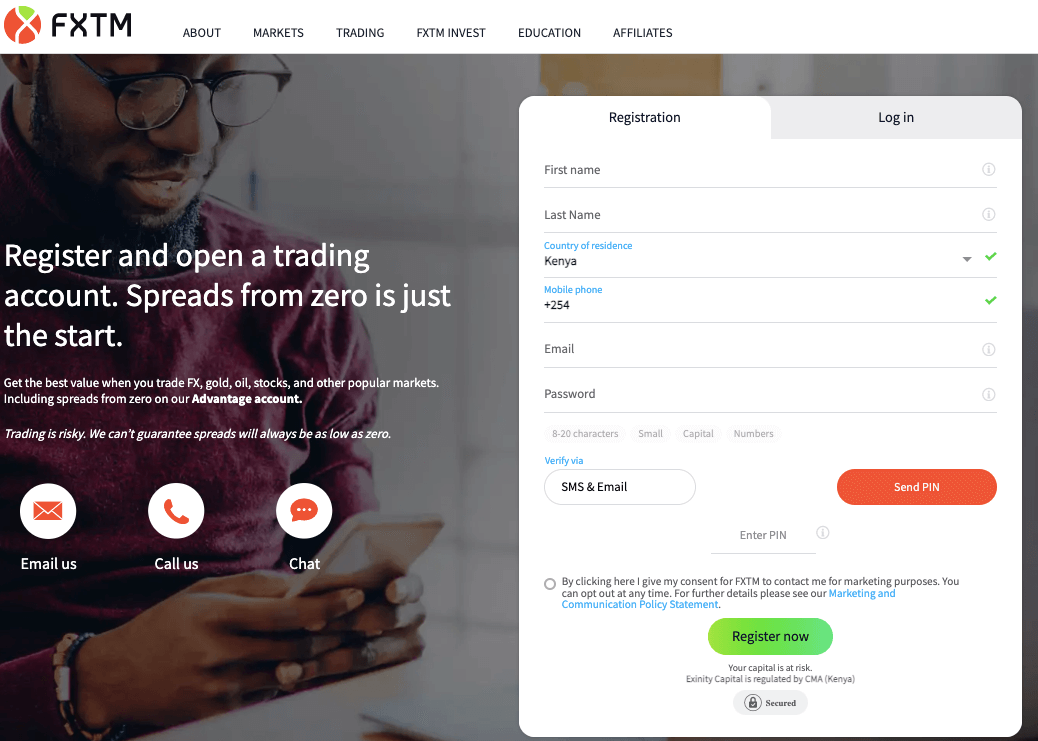

Step 2: Fill out the form that appears. You will need to provide your name, email address, phone number, and country, then create a password.

Once you do that, click on “SEND PIN” to receive a verification code via SMS or WhatsApp message to continue with the process. The PIN will also be sent to the email you provided.

Once you get the verification PIN, enter it, check the terms and agreement box and click on ‘Register now’ to continue.

Step 3: You will be taken to the client area/dashboard and required to choose an account type to proceed.

Scroll down below the account type you want and click on ‘Open Account’ to open either the Advantage Stocks, Advantage or Advantage Plus Account.

You can also choose to open an FXTM demo account at this point by clicking on ‘Try demo’.

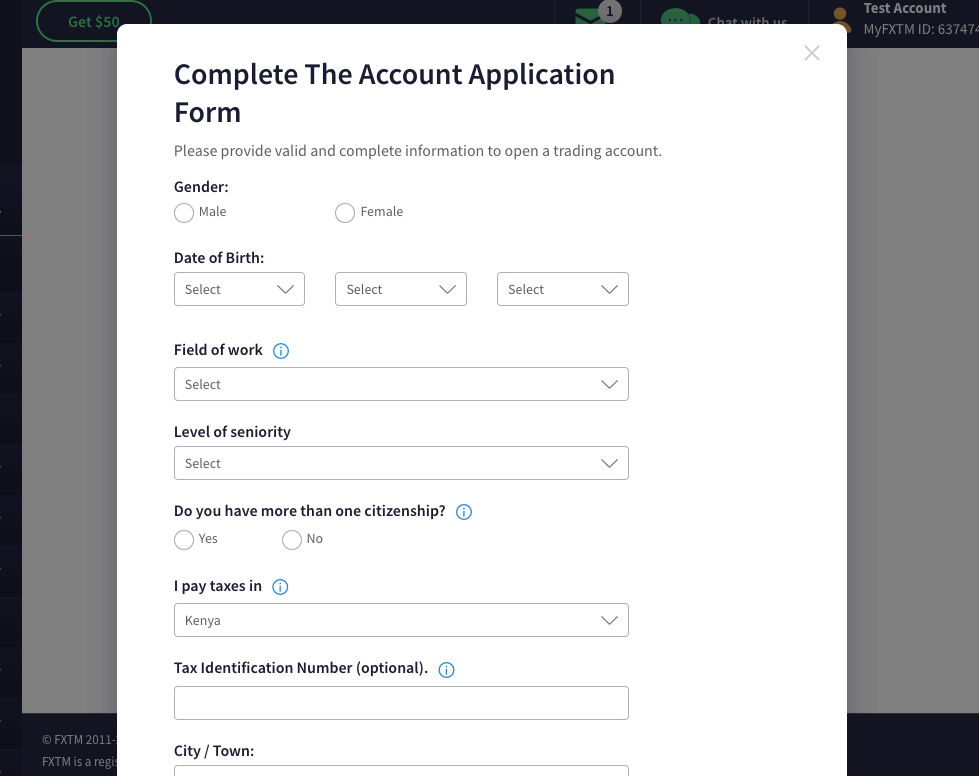

Step 4: After clicking ‘Open Account’, a form will appear for you to fill out to complete the Account Application process.

Your personal information will be required on this form, providing the information, check the box to show you have read and accepted the Terms and Conditions then click on the Submit at the end of the form.

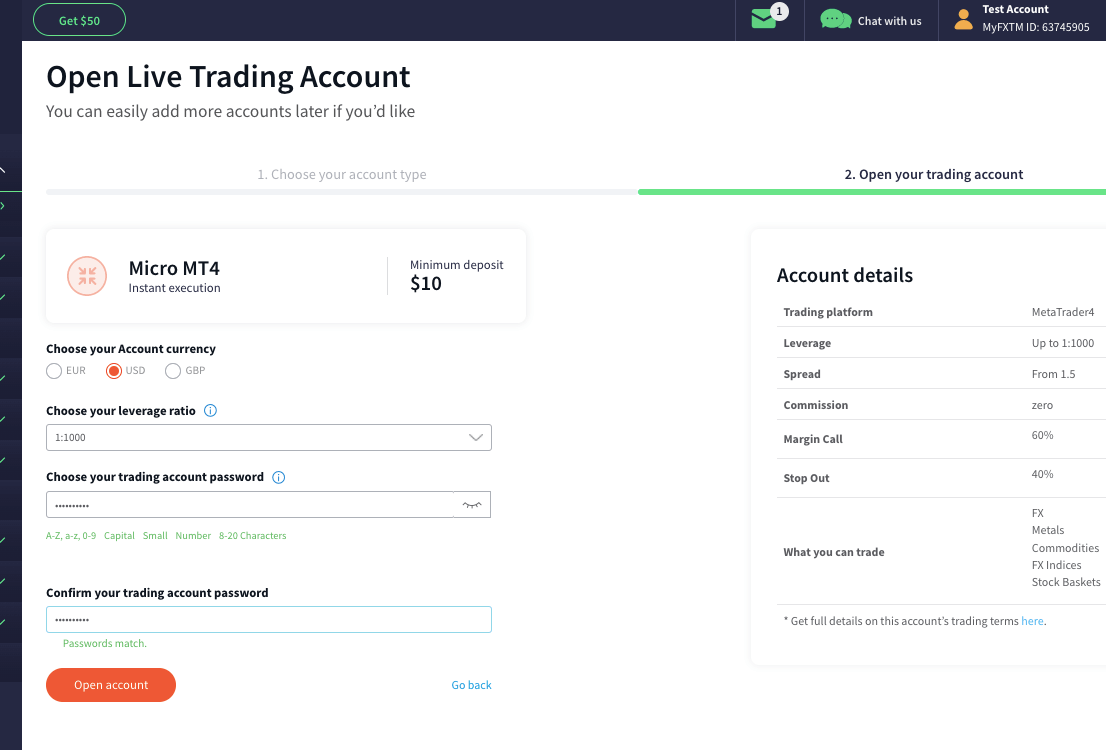

Step 5: After submitting your bio-data information, you will be required to choose your account currency, set a leverage limit and create a password for the trading account. You can choose either USD, EUR or GBP.

After creating a password, click on ‘Open account’ to proceed.

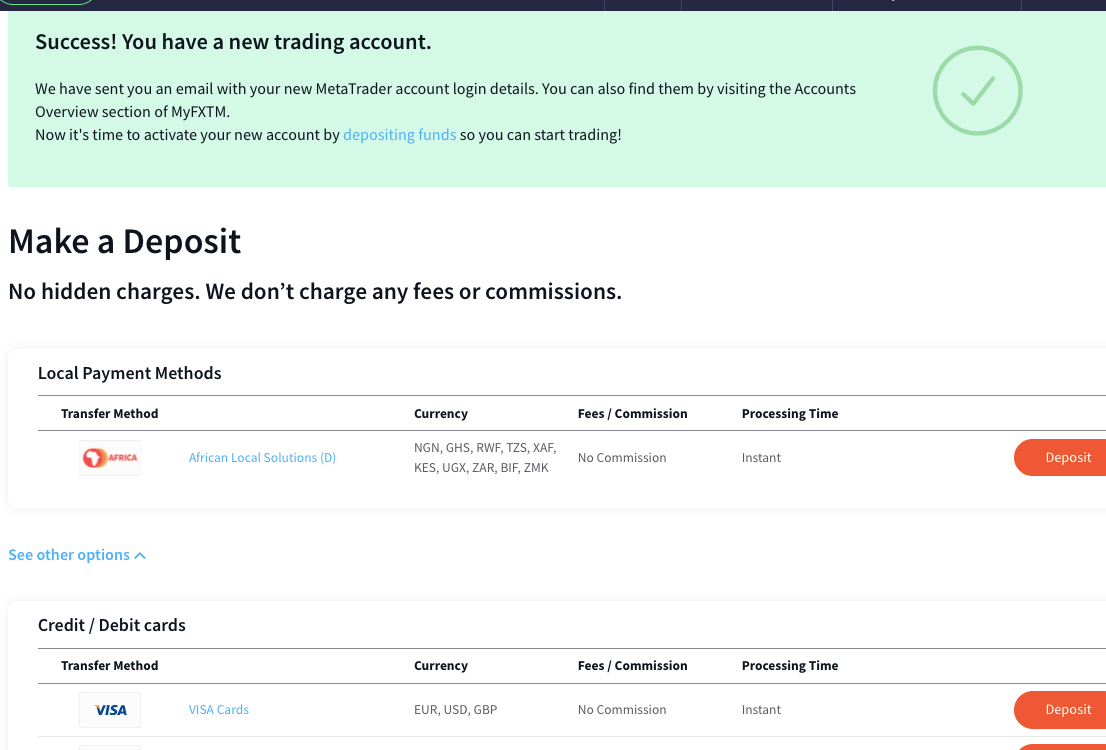

Step 6: After creating your account, you can make a deposit to your trading account and start trading.

FXTM Deposits & Withdrawals

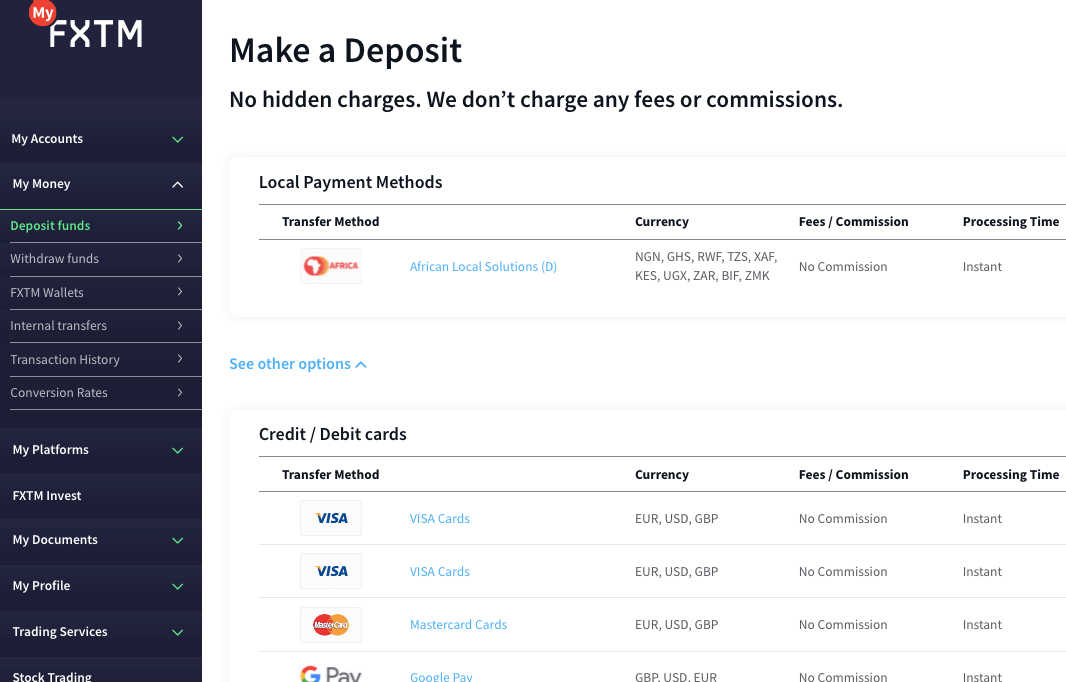

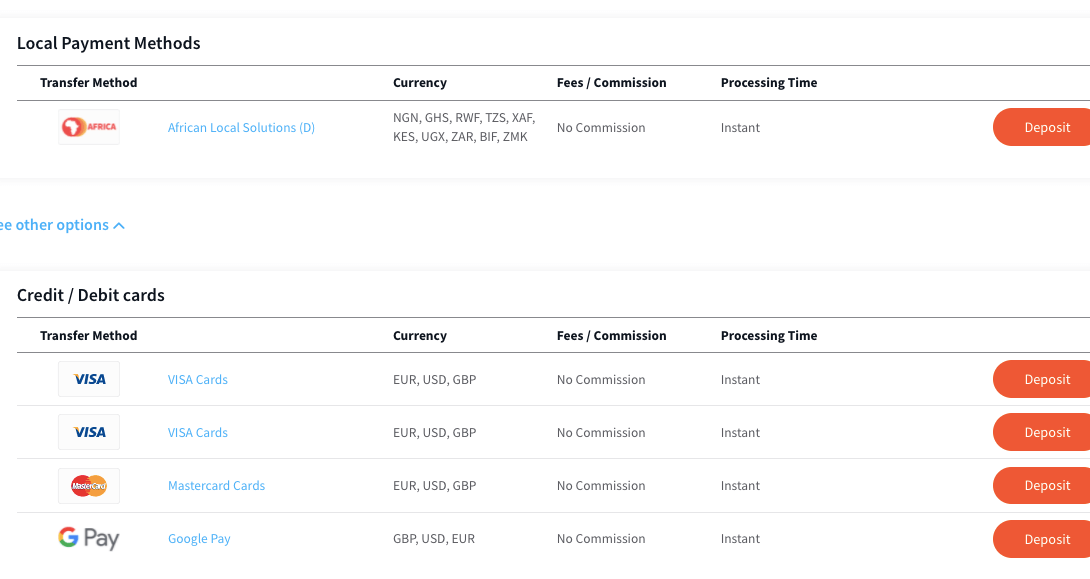

Payment methods supported by FXTM for deposits and withdrawals are bank transfers, e-wallets and cards. Here is the summary of the deposits and withdrawal options on FXTM in Kenya.

FXTM Deposit Methods

Here is a summary of payment methods accepted by FXTM for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Online Bank Transfer | Yes (KES) | Free | 1-2 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (Skrill, Neteller, Mpesa) | Free | Instant |

FXTM Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on FXTM.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Online Bank Transfer | Yes (KES) | 1 USD | 48 hours |

| Cards | Yes | $3 per transaction | 24 hours |

| E-wallets | Yes (Skrill, Neteller, Mpesa) | Free | 1 business day, Instant for Mpesa |

What is FXTM Minimum deposit FXTM?

The minimum deposit on FXTM is $200 for Advantage and Advantage Plus Accounts.

While deposits via cards and Neteller require a minimum deposit of $5, local bank transfers require a minimum deposit of 20 KES, Skrill and Mpesa have no mandatory minimum deposit amount.

How do I Deposit Funds to FXTM in Kenya?

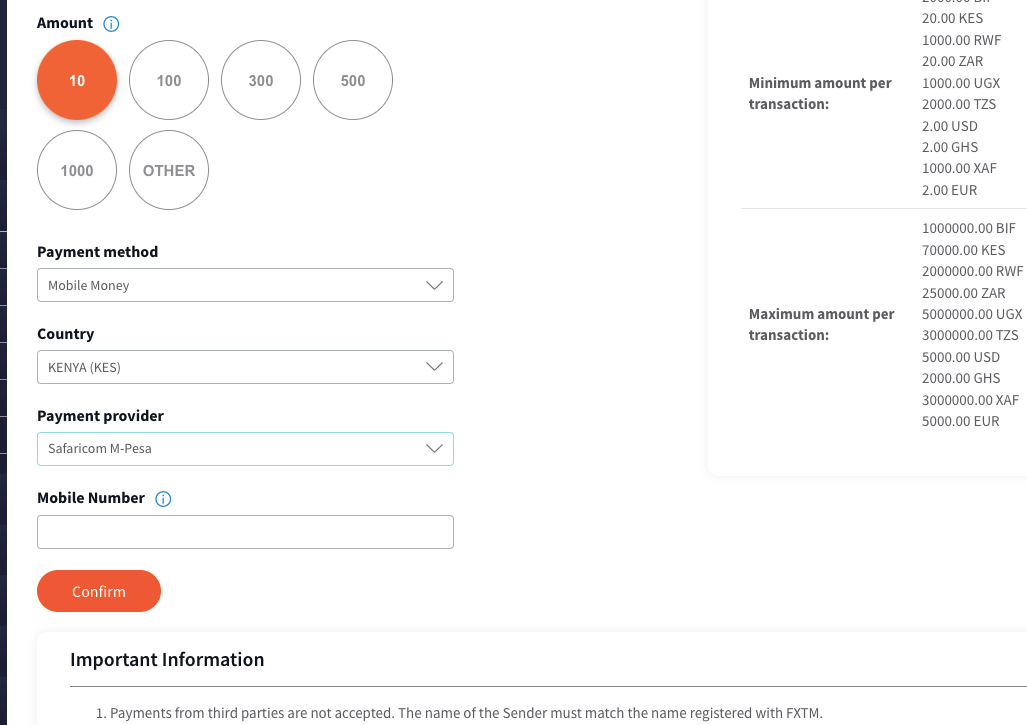

Follow the steps below to deposit funds into your FXTM Account:

Step 1: Log in to your FXTM account dashboard via the FXTM website or https://www.forextime.com/login.

Step 2: On your dashboard/client area, click on the ‘My Money’ tab on the left side menu and select ‘Deposit funds’.

Step 3: Select a payment method and click on the ‘Deposit’ button beside it.

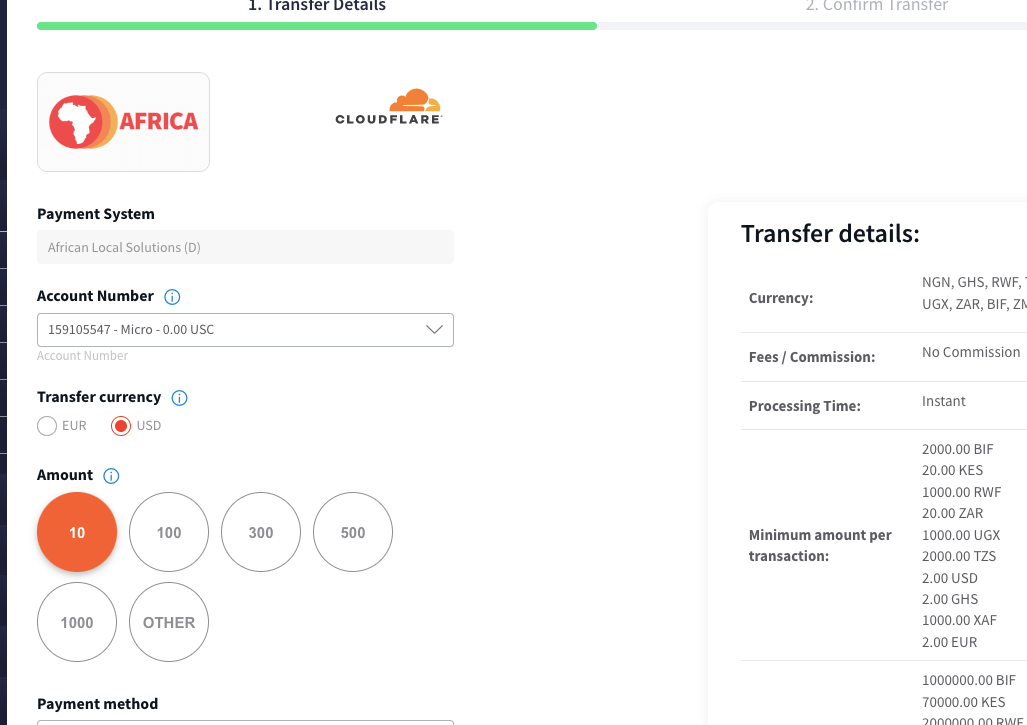

Step 4: If you select African Local Solutions, you will need to select your Trading Account Number and the transfer currency.

You will be required to select a deposit amount, you can also enter a custom amount on the ‘OTHER’ circle.

Next, select Mobile Money as the Payment Method and KENYA (KES) under country.

You will then select any of the 3 Kenyan Payment Providers supported (Safaricom M-Pesa, Airtel Money KE, and Equitel KE) on the platform and enter your mobile number.

After supplying this information, click on ‘Confirm’, which will take you to a page where you will confirm your deposit details, then click ‘Submit’ and follow the prompts to complete the deposit.

What is FXTM Minimum withdrawal?

The minimum withdrawal amount on FXTM is KES 20 for local bank transfers, $5 per transaction via cards and $1 via e-wallets which are processed within 24 hours or 1 business day.

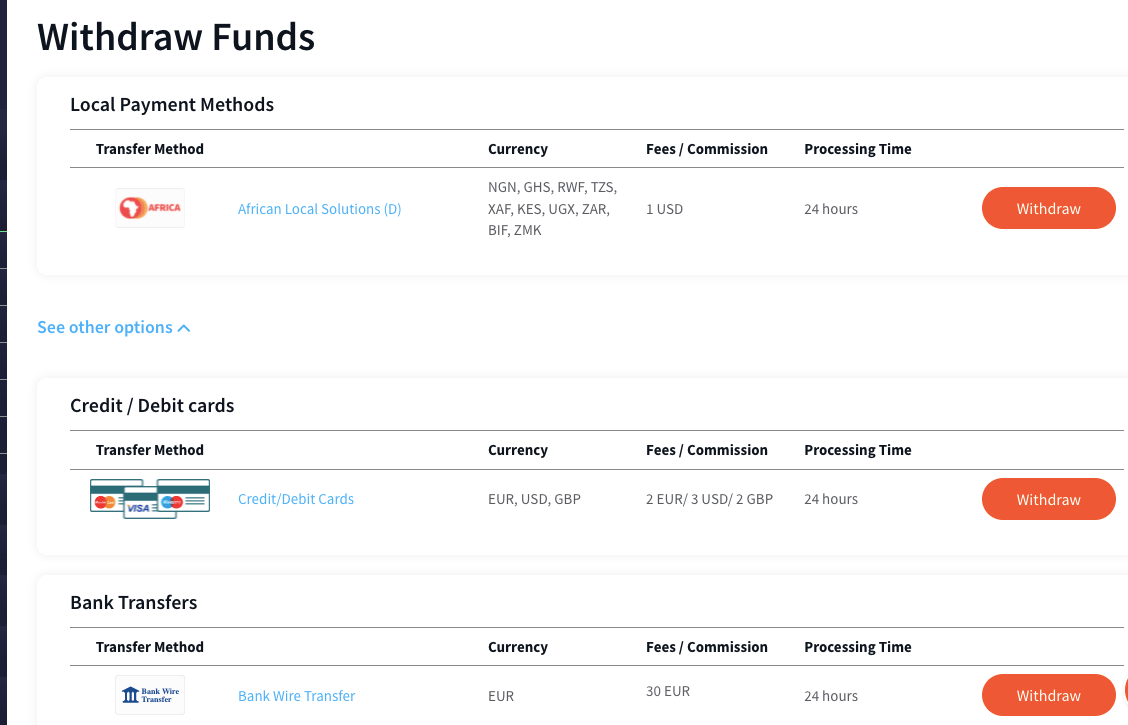

How to Withdraw Funds from FXTM in Kenya?

Follow the steps below to withdraw money from your FXTM Account:

Step 1: Log in to your FXTM account dashboard via www.forextime.com/login.

Step 2: Click on the ‘My Money’ tab on the left side menu and select ‘Withdraw funds’.

Step 3: Decide on a withdrawal method you want to use and click on the Withdraw button beside it then follow the prompts to complete your withdrawal.

Note that you cannot withdraw via any method except you have made deposits via that method.

Also, note that you need to get your account approved by uploading a valid ID card and proof of residence document before you can withdraw funds and access the full features on the platform.

FXTM Trading Instruments

You can trade any of the following numbers of CFD instruments with FXTM.

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 58 currency pairs on FXTM (19 majors, 22 minors, 17 exotics) |

| Commodities/Energies | Yes | 3 spot commodities on FXTM (Brent, Crude, Natural Gas) |

| Metals | Yes | 5 pairs of Spot Metals on FXTM (Gold and Silver paired to USD, EUR and GBP) |

| Indices | Yes | 13 spot indices on FXTM (AUS200, UK100, GER40, and others) |

| Stocks | Yes | 638 stocks on FXTM (US stocks) |

| Stock CFDs | Yes | 798 CFDs stocks on FXTM (CFDs US and European stocks) |

| Crypto CFDs | Yes | 11 CFDs cryptocurrencies on FXTM (BTC, DOGECOIN, RIPPLE, and others) |

FXTM Trading Platforms

FXTM supports the following trading platforms:

- MetaTrader 4 and MetaTrader 5: You can trade with MT4 and MT5 on the FXTM platform, both applications are compatible with the web, desktop platforms (Windows and Mac), and Android and iOS mobile devices

- FXTM Trader: FXTM offers a free mobile trading platform that can be downloaded from the Apple App Store or Google Play Store.

FXTM Kenya Execution Policy

Before going into FXTM’s best execution factors. We’d like to mention that the company takes all reasonable steps to make sure traders get the best possible results. In case of slippage, FXTM will give a re-quote under instant execution. If the trade is not under instant execution, it will be executed at the next available price.

FXTM’s best execution factors include price, cost, speed, the likelihood of execution, the likelihood of settlement, etc. Let us break them down.

The price given for any given CFD is obtained from third-party external sources. The prices are calculated by reference to the price of the relevant underlying asset. These prices are updated within as much as technological limits allow. The external sources are also reviewed daily to ensure that the prices provided are competitive. If any order can not be executed at your declared price, because of volatility, it will be executed at the first available price.

Costs include commissions and financing fees (swaps). When you open a position on some CFDs, you are charged a commission which could be a fixed amount or a percentage of the total value of the trade. These fees are not included in FXTM’s quoted price. They are charged from your brokerage account.

FXTM Kenya Education and Research

1)Top Guides: FXTM has two trading guides namely: forex trading for beginners and CFD trading for beginners. Both guides are in text form so be ready to do a lot of reading. There are also images to illustrate the texts.

Forex trading for beginners begins with defining forex and the forex market. It has six chapters as displayed below

The basics of trading like currency pairs, time zones, technical analysis, spreads, and other concepts are covered in detail.

CFD Trading for beginners deals with how to open/close positions and how the contract works. FXTM also went a great deal to explain the brief history of CFD brokers and trading concepts like margin and leverage. Combined with these are the details of FXTM’s CFD trading accounts and fees so you can compare easily.

2)Trading Videos: FXTM has a series of trading videos under their knowledge hub, covering three topics.

The first is forex basics which cover concepts that a beginner must be familiar with in detail. The second topic is technical analysis and has 8 videos. Trends, range, charting, and discipline are the core concepts discussed here. The final topic is trading basics with 15 videos. Here, you will learn about margin, leverage, order types, risk management, etc.

These videos are a good alternative if you do not want to read the trading guides.

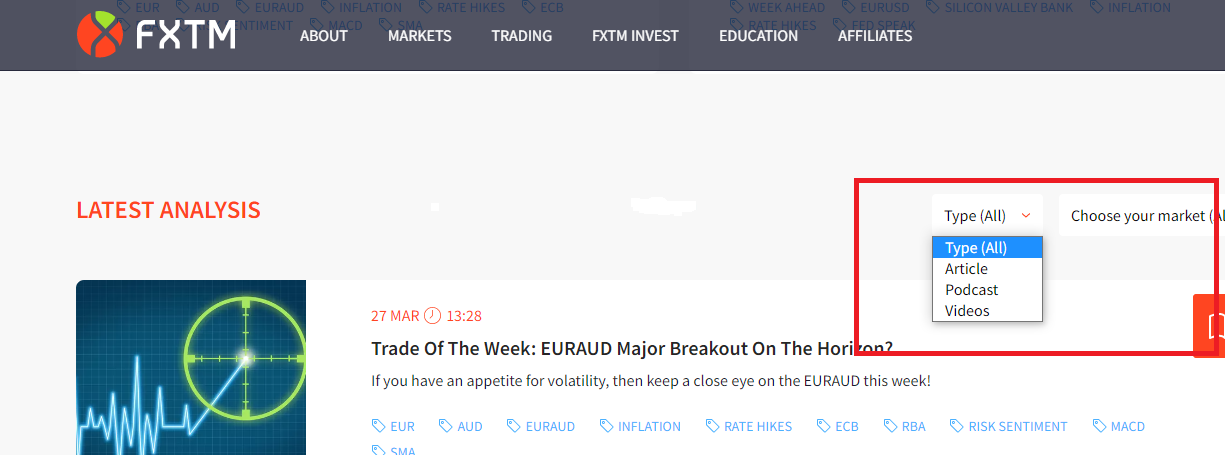

3)Daily Market Analysis: This section provides you with the latest news and insights. With the help of FXTM’s market analysts, you will get in-depth knowledge of price movements in the markets. The analysis covers popular currencies like GBP, USD, EUR, stocks, and more.

Furthermore, the analysis is not randomly joined together. There is a filter you can use to streamline your search to only needed information. The filter also allows you to choose the medium through which you get the information. Articles, Podcasts, and videos are the means available.

4)Ultimate Guide to Copy Trading: FXTM offers copy trading via FXTM Invest. If you are a newbie who knows nothing about copy trading, you can learn about it via FXTM’s ultimate guide. The guide is in text form and you can read it for free on FXTM’s website.

5) Forex Trading strategy: This is under the education section of FXTM. It covers forex trading strategies in an in-depth manner. You will learn what a trading strategy is, how to use it, and how to test it.

Finally, you will learn about 9 common trading strategies. Some of the strategies include: the London Hammer Trade, Daily Fibonacci Pivot Trade, and the Dual Stochastic Trade

6) Education Articles: You can have a good read with this article regardless of your experience level. The articles are not categorized by experience. However, there is an article for every level (beginner, intermediate, and advanced).

In addition, the articles are not arranged systematically so only read what you need.

7) Education Videos: If you want to watch short but comprehensive videos that help you learn faster, then you will find this section useful. The videos cover forex basics, trading basics, and technical analysis. There are 43 videos in total and they are about a minute and 30 seconds long.

8) E-books: FXTM has four e-books on forex trading that you can download and read. If you are a beginner, you will enjoy the first book titled The Road to Success: 50 Successful Traders’ Habit. The other books cover the Elliot Wave Theory, and Bearish/Bullish Japanese Candlesticks & Strategies.

FXTM Kenya Customer Service

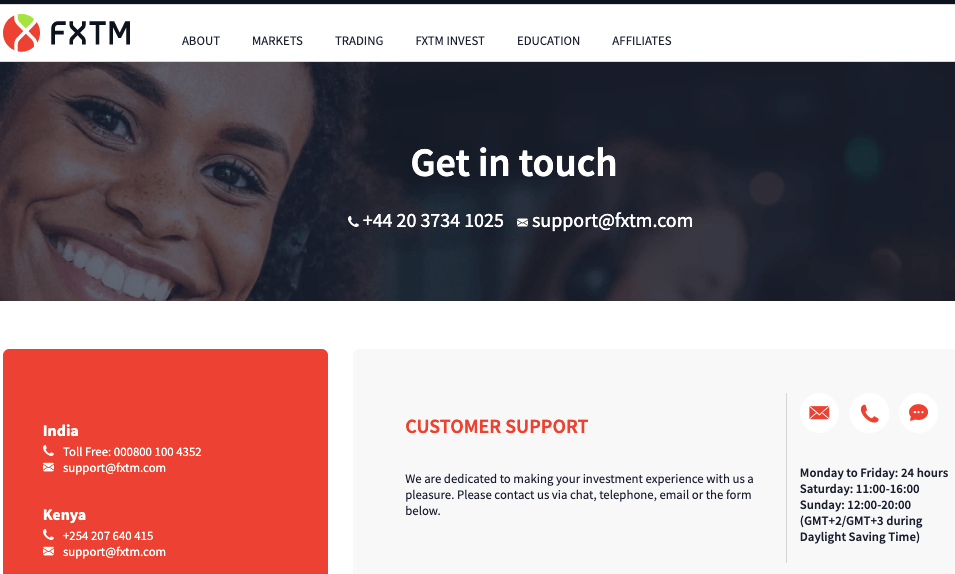

FXTM’s customer service is available to clients 24 hours a day, 5 days a week via the following channels:

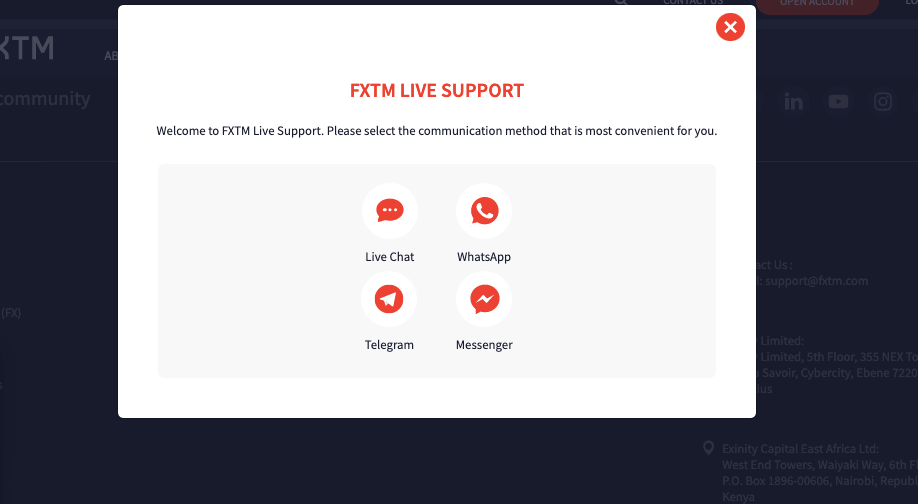

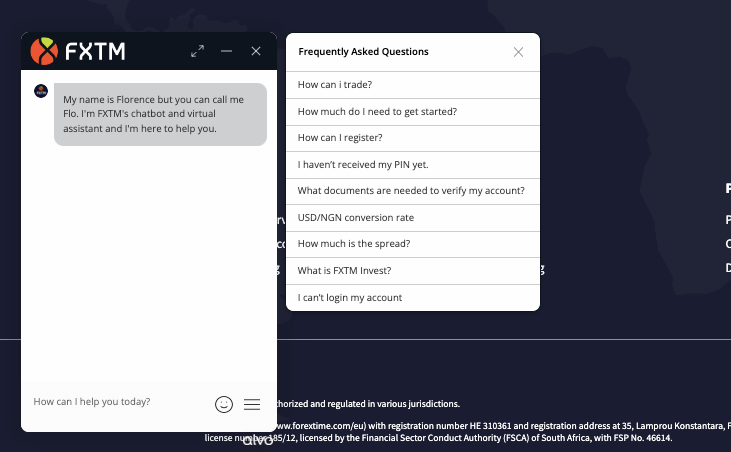

1) Live chat support: The FXTM live chat can be accessed through their website, it is available 24/5 and they respond fast within the said period. When our team tested it, the wait time was less than 2 minutes and the answers provided were relevant.

When you first click on the live support button, you will have to option to chat on WhatsApp, Telegram, Messenger, or live chat.

If you choose the live chat option, the FXTM chatbot will request your name and email address, then it will first respond to you by showing some FAQs. To transfer to a live agent, simply type chat agent in the chat and a customer care representative will respond and answer your questions.

2) Email support: The email support of FXTM is available for 24 hours from Monday to Friday. When you send them an email, you get an auto-generated reply confirming they have received your enquiry and will respond soon.

When our team tested it, we got feedback within a few hours and the answer was relevant. The email address of FXTM is [email protected].

3) Phone support: FXTM also offers international phone support that is available 24/5. FXTM phone number for support in Kenya is +254 207 640 415. The FXTM international number is +44 20 3734 1025.

FXTM Bonus

FXTM currently does not have any bonus offering for traders except the FXTM Referral Program that gives traders about $50 for referring your friend.

Referral Bonus: FXTM offers a $50 bonus under their Refer a Friend Program. Whenever you refer a friend to the platform and they signup and deposits the minimum required deposit within 7 days of clicking your unique referral link. The person you referred will also get a $50 referral bonus.

All bonuses offered on FXTM are subject to terms and conditions that you must meet. If you are eligible for the bonuses, you will need to accept the terms and conditions through your dashboard to participate.

Do we Recommend FXTM Kenya?

Yes, we do recommend FXTM. FXTM is considered a low-risk forex broker for traders based in Kenya as per our review because they are licensed in Kenya by the CMA and by other Tier-1 and Tier-2 financial regulators.

FXTM also have low fees with Advantage account, they accept local bank transfers for deposits & withdrawals in KSh, although they do not offer KES account currency. FXTM also has local support and offices in Kenya.

The spreads on the Advantage Account are higher, although no commissions are charged on the account, beginner traders who choose this account will pay higher overall fees.

The broker offers negative balance protection so you do not loose more money than you invest.

Overall, we recommend that you check their website to see more about them and probably chat with support and ask any questions you have to help you decide.

FXTM Kenya FAQs

Is FXTM a Legit broker for Kenyan traders?

FXTM is considered a legit Forex broker to trade with for Kenya based traders because the broker is regulated in Kenya by the Capital Markets Authority parent company Exinity Group are licensed by other Top-Tier financial regulators, like the FCA in the UK and FSCA in South Africa and they have a responsive online customer care support.

How much do I need to start FXTM?

You need a minimum deposit of 20 KES to start trading on FXTM Kenya for local bank transfers, $5 for cards, while Skrill and Mpesa have no mandatory minimum deposit amount.

Is FXTM regulated in Kenya?

Yes, FXTM is regulated in Kenya and Licensed by the CMA as a non-dealing online foreign exchange broker under the name ‘Exinity Capital East Africa Ltd’ with CMA license number 135.

How long is FXTM withdrawal?

All withdrawals on FTXM are processed within 24 hours or 1 -2 business days. Withdrawals to South African bank accounts are not supported on FXTM.

Is FXTM good for beginners?

Based on our research FXTM is good for beginners because they have demo accounts for you to try along with educational videos to help you build your trading.

FXTM also has negative balance protection, supports multiple platforms for trading. All of these features make FXTM good for beginners.

Note: Your capital is at risk